https://www.youtube.com/watch?v=uBK3h0n2qPQ?start=1290 During his recent interview with Tobias, Peter Rabover, who is the Portfolio Manager at Artko Capital LP, discusses how investor biases can cause you to miss some of the best opportunities. Here’s an excerpt from the interview: Tobias Carlisle: So let’s talk a little bit about how you identify … Read More

Bruce Greenwald: The 3 Attributes That Make a Truly Great Investor

We’ve just been reading through the Winter 2009 issue of the Graham and Doddsville Newsletter which includes a great passage by Bruce Greenwald on the three attributes that make a truly great investor saying: Bruce Greenwald: There are three things that Buffett is good at—and if anyone is good at … Read More

How Can Investors Find Opportunities In The Small & Micro-Cap Universe

https://www.youtube.com/watch?v=uBK3h0n2qPQ?start=409 During his recent interview with Tobias, Peter Rabover, who is the Portfolio Manager at Artko Capital LP, discusses how investors can find opportunities in the small & micro-cap universe saying: Tobias Carlisle: When you’re looking at your opportunity set, I see in your presentation you divided into, you’ve got … Read More

Micro-Cap Investing Is Like Quasi Private Equity Investing Which Provides Significant ‘Early’ Investment Opportunities

https://www.youtube.com/watch?v=uBK3h0n2qPQ?start=2584 During his recent interview with Tobias, Peter Rabover, who is the Portfolio Manager at Artko Capital LP, discusses how micro-cap investing is like quasi private equity investing and how that provides significant ‘early’ investment opportunities. Here’s an excerpt from the interview: Tobias Carlisle: So, you said before you … … Read More

Mohnish Pabrai: Great Stock Selection Starts With Rejecting New Investment Opportunities For The Flimsiest Possible Reasons

Here’s a great interview with Mohnish Pabrai and The London Business School. During the interview Pabrai discusses his stock selection process, which he says starts with getting rid of new investment opportunities for the flimsiest possible reason. Here’s an excerpt from the interview: Mohnish Pabrai: I’ll give it a shot … Read More

(Ep.16) The Acquirers Podcast: Peter Rabover – Russian Bear, Concentrated Microcaps And Special Situations

Summary In this episode of The Acquirer’s Podcast Tobias chats with Peter Rabover, who is the Portfolio Manager at Artko Capital LP. Peter invests in small/micro cap companies and special situations within a concentrated portfolio. He provided some great insights into: – Why I Have A Bear In The Background … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Simpson, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 6/21/2019

Here’s a list of this week’s best investing reads: When Everything That Counts Can’t Be Counted (The Reformed Broker) ‘You Better Be Careful And Keep Your Eyes Open’ (The Felder Report) Why Do We Need Inflation? (A Wealth of Common Sense) While Studying Bonds, Why Credit Rating Analysts Should Keep an Eye on the … Read More

David Einhorn: Q1 2019 Top 10 Holdings

This content is restricted to registered paid users who are logged in. Click here to register or log in.

What Can Investors Learn From Buffett’s Pivot On Airlines As An Investment

https://www.youtube.com/watch?v=kkW9Zg6Hs8Y?start=2998 During his recent interview with Tobias, Bill Brewster who runs Sullimar Capital Group says, investors can learn a lot from Warren Buffett’s pivot on airlines as an investment. Here’s an excerpt from the interview: Tobias Carlisle: That’s where I spend my time. Let’s talk about airlines a little bit, … Read More

Seth Klarman Protégé – David Abrams – Investors Need To Use A Multi-Path Approach To Business Valuation And Analysis

We’ve just been listening to a great interview with Seth Klarman’s protégé David Abrams on the Value Investing With Legends podcast in which Abrams discusses why investors need to use a multi-path approach to business valuation and analysis. Here’s an extract from the interview: David Abrams: The first question we … Read More

If There’s A Wall Street Analyst Hammering A Company, Investors Really Need To Know Why Before Taking The Other Side

https://www.youtube.com/watch?v=kkW9Zg6Hs8Y?start=2616 During his recent interview with Tobias, Bill Brewster who runs Sullimar Capital Group says, if there’s a Wall Street analyst hammering a company, investors really need to know why, before taking the other side. Here’s an excerpt from the interview: Tobias Carlisle: Well, let’s change gears again. I don’t … Read More

Nassim Taleb – Just Because An Investor Makes Money Doesn’t Mean They’re Good

Here’s a great extract from Nassim Taleb’s book – Fooled By Randomness in which he illustrates how some investors are perceived as being ‘great’, when in actual fact they simply started investing at the best possible moment. But as time moves on it becomes apparent that their ‘strategies’ are flawed. … Read More

Phil Fisher’s Scuttlebutt Can Still Be Used To Find Great Opportunities Today

https://www.youtube.com/watch?v=kkW9Zg6Hs8Y?start=2086 During his recent interview with Tobias, Bill Brewster, who runs Sullimar Capital Group demonstrates how Phil Fisher’s scuttlebutt can still be used to find great opportunities today. Here’s an excerpt from the interview: Tobias Carlisle: Let’s talk about Ubiquiti. What’s the story there and how did you find it? … Read More

(Ep.15) The Acquirers Podcast: Bill Brewster – Brewster’s Millions, A Masterclass In Business Analysis

Summary In this episode of The Acquirer’s Podcast Tobias chats with Bill Brewster, who runs Sullimar Capital Group. During the interview Bill provided some great business analysis into a number of companies including AB InBev, GE, Netflix, and Ubiquiti. He also discusses: – How He Went From The Flooring Business … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Ainslie, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 6/14/2019

Here’s a list of this week’s best investing reads: Howard Marks Memo – This Time It’s Different (Oaktree Capital) When Does the Stock Market Go Up? (A Wealth of Common Sense) Meatless Future or Vegan Delusions? The Beyond Meat Valuation (Aswath Damodaran) This Is One Of The Worst Risk/Reward Setups In History (Felder … Read More

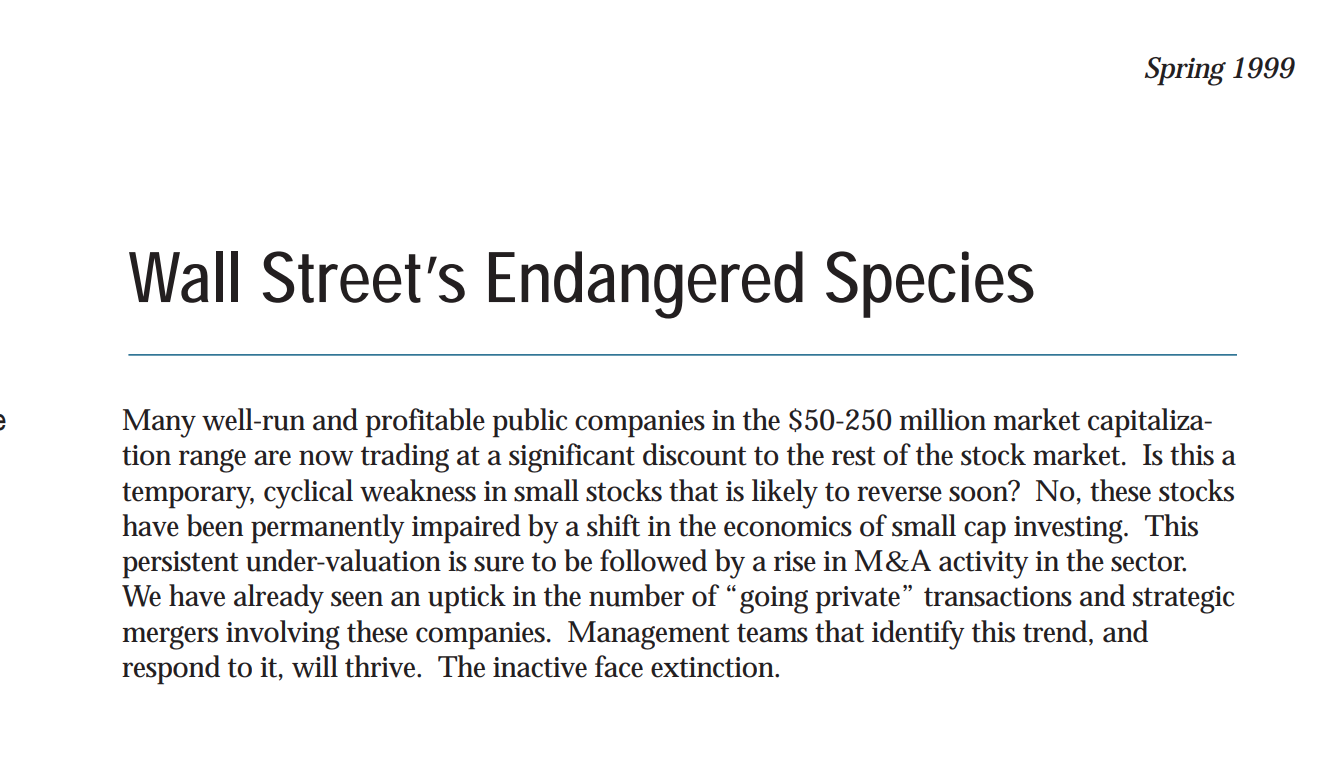

Wall Street’s Endangered Species

Twenty years ago in the spring of 1999, Piper Jaffray’s Daniel J. Donoghue, Michael R. Murphy and Mark Buckley*, produced a research report called Wall Street’s Endangered Species (the link is broken) that was hugely influential on my investment process. The thesis of the paper was that there were a … Read More

Joel Greenblatt – Top 10 Holdings Q12019

This content is restricted to registered paid users who are logged in. Click here to register or log in.

What Are The 20 Best And Worst Countries To Invest In According To The Human Freedom Index

https://www.youtube.com/watch?v=sec51fFMSPQ?start=2457 During her recent interview with Tobias, Perth Tolle who is the Founder of Life + Liberty Indexes discusses some of the best and worst countries to invest in according to the ‘human freedom index’. Here’s an excerpt from the interview: Tobias Carlisle: You may be not allowed to say … Read More