Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Reads 7/26/2019

Here’s a list of this week’s best investing reads: The Optimal Portfolio (A Wealth of Common Sense) Pershing Square up 45% in the first half of 2019 as Bill Ackman win streak continues (CNBC) Financial Twitter Loses a Source of Humility and Wisdom, but Good Voices Remain (Jason Zweig) Playing the Odds (csinvesting) … Read More

Steven Romick – Top 10 Holdings Q1 2019

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Walter Schloss: It’s An Irrational World, So You Can’t Always Do Things Logically

Here’s an excerpt from a 1989 article featuring Walter Schloss titled – Searching for Value. In the article Schloss provides some great insights into the difficulty of investing logically in an irrational world: A value-minded investor. Schloss views his business as rational—finding securities that are objectively undervalued compared to their … Read More

Investors Can Bundle Multiple Trend Strategies To Smooth Out Returns And Reduce Volatility

https://www.youtube.com/watch?v=pEX-UlEfEBU?start=3272 In his recent interview with Tobias, Adam Butler, CIO of ReSolve Asset Management discusses how investors can bundle multiple trend strategies to smooth out earnings and reduce volatility over time. Here’s an excerpt from the interview: Tobias Carlisle: So then how do you then work out how much you … Read More

Warren Buffett: How Investors Lose Millions – If It [The Stock Price] Ever Gets Back There, I’ll Buy It!

Here’s a great excerpt from a CNBC interview with features Warren Buffett, Bill Gates, and Charlie Munger. During the interview Buffett illustrates how investors miss out on great opportunities because they stay anchored on a stock’s previously lower price, instead of focusing on the current price, which may still represent … Read More

Investors Can Develop An “All Weather” Risk Parity Portfolio That Will Outperform

This content is restricted to registered paid users who are logged in. Click here to register or log in.

Joel Greenblatt: Selling: Know When To Hold ‘Em, Know When To Fold ‘Em

Here’s a great excerpt from Joel Greenblatt’s book – You Can Be A Stock Market Genius, on when is the right time to sell a stock, saying: This is probably as good a time as any to discuss the other half of the investment equation—when to sell. The bad news … Read More

Why Do Investors, That Are Given Proven Strategies That Work, Still Underperform

https://www.youtube.com/watch?v=pEX-UlEfEBU?start=1452 In his recent interview with Tobias, Adam Butler, CIO of ReSolve Asset Management discusses why investors that are given proven strategies that work, still underperform. Here’s an excerpt from the interview: Adam Butler: Absolutely. And I just love the story of … Oh, what was his name? Greenblatt, right? … Read More

(Ep.20) The Acquirers Podcast: Adam Butler – Adaptive Assets, The Philosophy Of Robust Quant

Summary In this episode of The Acquirer’s Podcast Tobias chats with Adam Butler, CIO of ReSolve Asset Management. Adam has developed a number of adaptive strategies that are designed to strive in changing environments and he is the author of Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good … Read More

TAM Stock Screener – Stocks Appearing in Pzena, Greenblatt, Dalio Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Reads 7/19/2019

Here’s a list of this week’s best investing reads: Paradigm Shifts (Ray Dalio) Value Is Dead, Long Live Value (OSAM) Joel Greenblatt – Keynote Presentation: Ben Graham VI (CFA Institiute) Trends That May End With The Baby Boomers (A Wealth of Common Sense) How I invest my own money (The Reformed Broker) … Read More

Daily Journal Corp (Charles Munger) – Top 10 Holdings Q2 2019

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Investors Can Find Some Of The Best Opportunities In The Smallest Listed Companies

https://www.youtube.com/watch?v=CLqepjONgtk?start=2669 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses how investors can find some of the best opportunities in the smallest listed companies. Here’s an excerpt from the interview: Tobias Carlisle: So, tell us a little bit about Indequity, … Read More

Joel Greenblatt: Here’s Why A Concentrated Portfolio Makes Sense

Here’s a great excerpt from Joel Greenblatt’s interview on Masters in Business in which he provides a great example of why a concentrated portfolio makes sense, saying: GREENBLATT: Right, well Warren Buffett has a good response to that as well. You know he says listen let’s say you sold out … Read More

The One Reason Mean Reversion Is So Powerful – This Too Shall Pass!

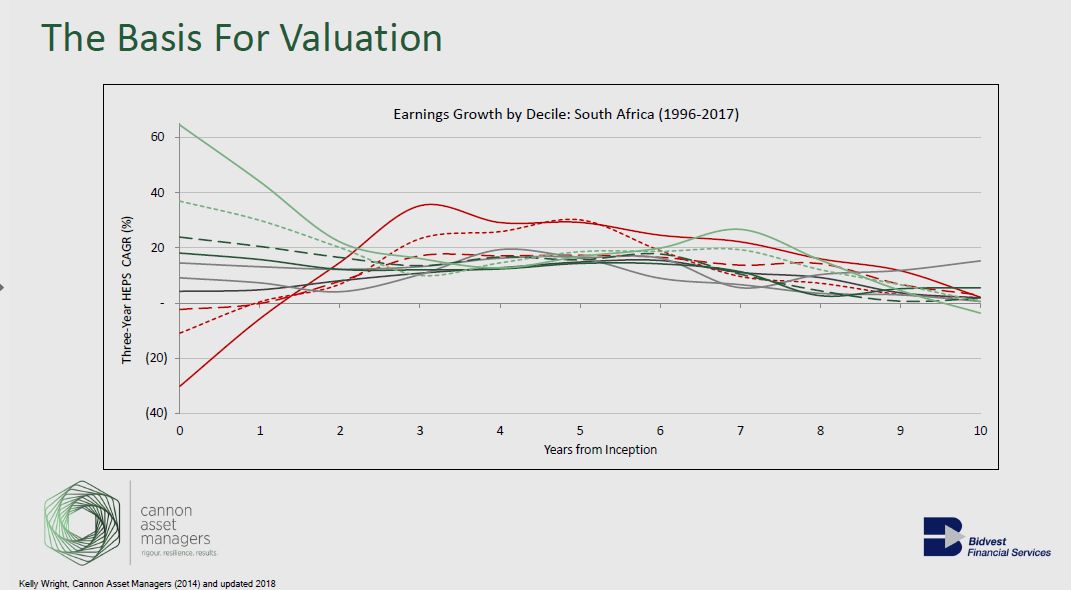

https://www.youtube.com/watch?v=CLqepjONgtk?start=2896 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses why mean reversion is such an important factor in investing. Here’s an excerpt from the interview: Tobias Carlisle: And, some of that marketing collateral you sent through to me, just … Read More

Michael Burry: The Best Way For Investors To Minimize Risk Is…

Here’s a great excerpt from Michael Burry’s 2001 Scion Capital Shareholder Letter in which he discusses the best way for investors to minimize risk saying: Although an outsider might think the goal of prevailing modern investment practice to be one of mediocrity, there in fact remains much more competition to … Read More

What Are The Four Attributes Necessary To Create A Successful ‘SuperDogs’ Portfolio

https://www.youtube.com/watch?v=CLqepjONgtk?start=454 During his recent interview with Tobias, Adrian Saville, CEO and founder of Cannon Asset Managers in South Africa, discusses the four attributes necessary to create a successful ‘SuperDogs’ portfolio. Here’s an excerpt from the interview: Adrian Saville: Sure, so the first attribute is to look for value in an … Read More

(Ep.19) The Acquirers Podcast: Adrian Saville – SuperDogs, Deep Value Investing In South Africa

Summary In this episode of The Acquirer’s Podcast Tobias chats with Adrian Saville, who is the CEO and founder of Cannon Asset Managers in South Africa. Since the mid-1990’s Adrian has been running portfolios full of unloved but good businesses which have returned an average of 19.8%. During the interview he … Read More

TAM Stock Screener – Stocks Appearing in Dalio, Griffin, Cohen Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More