Here’s a list of this week’s best investing reads:

Paradigm Shifts (Ray Dalio)

Value Is Dead, Long Live Value (OSAM)

Joel Greenblatt – Keynote Presentation: Ben Graham VI (CFA Institiute)

Trends That May End With The Baby Boomers (A Wealth of Common Sense)

How I invest my own money (The Reformed Broker)

Opposite of Conventional Wisdom (The Irrelevant Investor)

Don’t Neglect the Forgotten (csinvesting)

Ten Hundred Words of Crypto: Bit Money, A Person-to-Person Computer Money Thing (Collaborative Fund)

Why You Should Read Thomas Sowell (Fundoo Professor)

The Only Thing the Smart Money Is Smart About (Jason Zweig)

The Many Flavors Of Value Investing In 2019 (Seeking Alpha)

These Simple Tips Can Make You a Better Investor (Vitaliy Katsenelson)

BANG: Why The Gold Miners Have Only Just Begun To Shine (The Felder Report)

Value Investing and Concentration (Alpha Architect)

Ackman’s London-Listed Pershing Square Gets Its Own Activist (Bloomberg)

How I Spotted A Fraud (Before It Was Too Late) (Forbes)

The Agony of Hope Postponed, by a Value Investor (WSJ)

Value Investing: Is It Dead? (Validea)

Most of the World’s Companies Are Duds, Stock Picker Says (Yahoo)

Two Big Lessons from History (Safal Niveshak)

How low interest rates and big tech make value investing a nightmare (Financial Post)

When Should You Use Graham Number in Stock Valuation? (Value Stock Guide)

Losing Dollars vs. Losing Percentages (Of Dollars and Data)

A Tale of Two Dividend Cuts (Miller Value Partners)

Market-Beating Value Investors: The Next Generation (WealthTrack)

Will Active ETFs Save Active Management? (Pragmatic Capitalism)

Smoke And Mirrors (Demonetized)

Is economic growth a delusion? (The Evidence-Based Investor)

The Investors High (Your Brain on Stocks)

Warren Buffett’s favorite business is a little chocolate maker with an 8000% return (Markets Insider)

Passively Irrational? (Albert Bridge Capital)

Solomon on Money (Humble Dollar)

How to Spot a Unicorn (Investment Innovation Institute)

Does investing in emerging markets still make sense? (FT)

The Cricket World Cup, Outcome Bias and Outrageous Fortune (Or How A Wicked Deflection Can Change Everything) (Behavioural Investment)

The Wisdom of Crowdsourced Bloggers (bps and pieces)

This week’s best investing research reads:

Is The Stock Market In A Bubble? (UPFINA)

ESG: What Is Under The Hood? (FactorResearch)

Integrating Alternative Data (Also Known as ESG Data) in Investment Decision Making (papers.ssrn)

Why Predicting Economic Downturns is Difficult (Price Action Lab)

US Dollar vs Global Currencies (ValuePlays)

Finding Growth in a Low-Growth World (Advisor Perspectives)

A Century of Factor Premia and Timing Evidence – What you need to know – Part I (Mark Rzepczynski)

What is Dollar-Cost Averaging? (Betterment)

This week’s best investing podcasts:

Episode 9 – Mario Gabelli (The World According to Boyar)

Jane McGonigal – How Games Make Life Better – EP.138 (Investors Field Guide)

TIP251: Macro Themes – Summer 2019 w/ Luke Gromen (The Investors Podcast)

Shielded Alpha (Animal Spirits)

Jean-Marie Eveillard: Taking a Top-Down Approach to Value Investing (Value Investing With Legends)

Episode #165: Chris Mayer, “I Do Think The Biggest Challenge…Is Keeping It, Holding On To It” (Meb Faber)

Ep 133: Joining As Sibling Partners To Launch A Joint Advisory And Accounting Firm, With Danna Jacobs (FA Success)

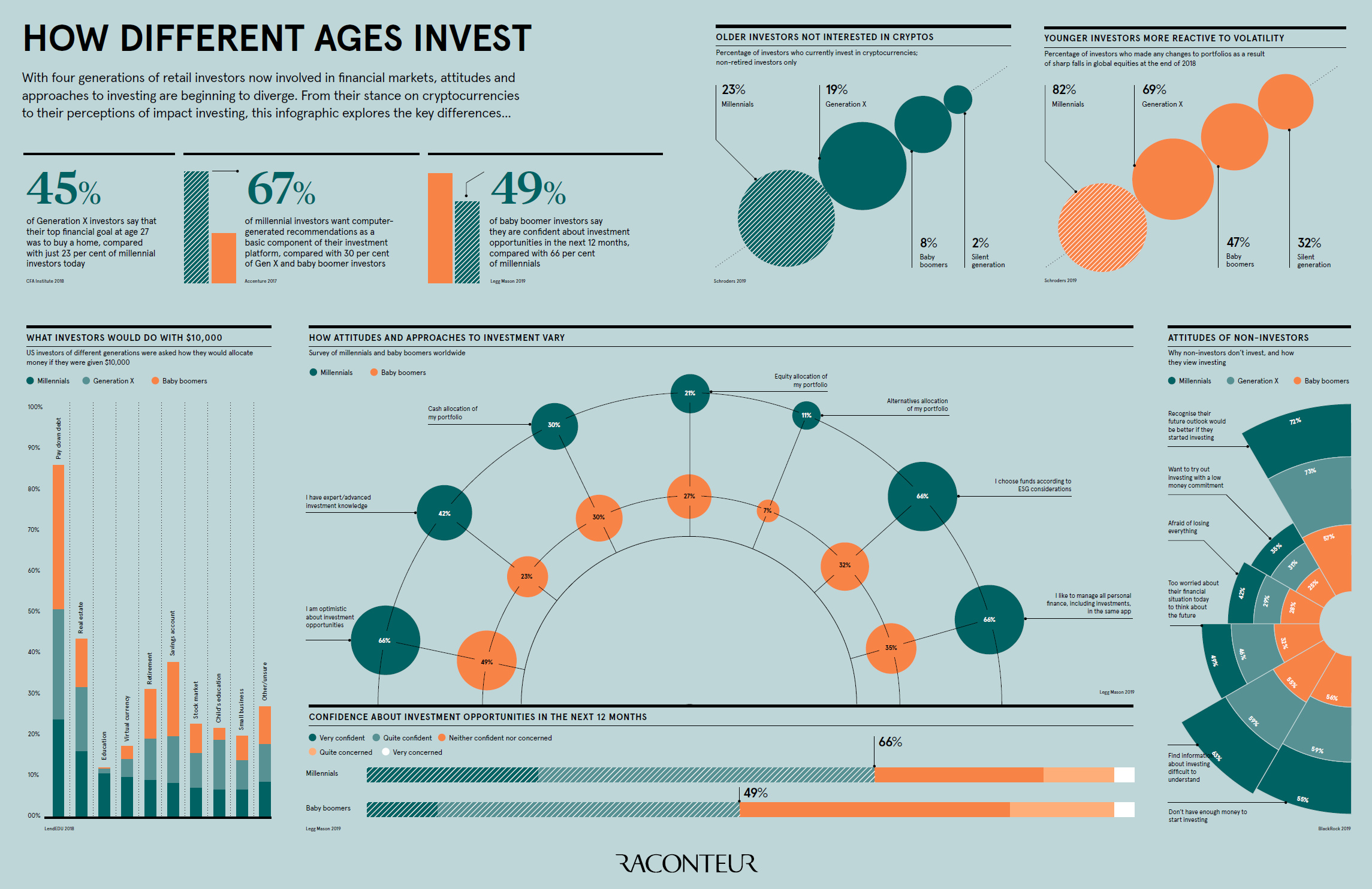

This Week’s Best Investing Infographic:

How Different Generations Think About Investing (Visual Capitalist)

(Source: Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: