One of the shareholder letters we really look forward to reading is the one from Horizon Kinetics. In their recently released Q2 2018 letter Horizon Kinetics provides some interesting research and commentary on the performance of passive investing over the past 20 years. The results may surprise many investors saying: … Read More

Which Are The Best Shareholder Letters For Investors To Read

We’re currently in the midst of companies releasing their Q2 2018 shareholder letters. During these times one of the questions we often get asked is, which are the best shareholder letters for investors to read? Some of the letters we recommend investors read include: Warren Buffett – Berkshire Hathaway Howard … Read More

Dan Loeb: Growth Stocks Are Now Value Stocks

One of the investors we follow closely here at The Acquirer’s Multiple is Dan Loeb, CEO at Third Point Management. In his latest Q2 2018 shareholder letter Loeb makes the point that he’s now including ‘growth’ stocks into his portfolio in addition to ‘traditional’ value based stocks saying: “The value-based … Read More

Jesse Livermore: How I Once Missed A $1,000,000 Profit Through Impatience And Careless Timing

One of our favorite investing books here at The Acquirer’s Multiple is – How To Trade Stocks by Jesse Livermore. There’s one passage in particular in which Livermore recounts the story of how he missed out on a $1,000,000 profit through impatience and careless market timing. Here’s an excerpt from that … Read More

Bill Miller: No One Knows What The Market Is Going To Do Over Any Time Horizon Short Enough To Be Of Interest To The Typical Investor

One of the investors we like to follow closely here at The Acquirer’s Multiple is Bill Miller, Chairman and Chief Investment Office of Miller Value Partners. In his latest Q2 2018 shareholder letter Miller provides some great insights on market forecasts, and market forecasters saying: “Portfolio managers often write a “market … Read More

Prem Watsa: Even Great Investors Have To Understand Their Limitations

Here is a an example of what makes Prem Watsa a great investor. We were recently reading though the 1990 Fairfax Annual Report when we came across a couple of gems from Chairman Watsa. He is speaking about the mistake he made in the company’s investment banking business, and understanding … Read More

This Week’s Best Investing Reads 07/20/2018

Here is a list of this week’s best investing reads: Pareto [Awesome Chart Every Investor Should See] (The Irrelevant Investor) Tech stocks contributed 98% of the S&P 500’s 2018 gain (The Reformed Broker) Mindsets: Optimism vs. Complacency vs. Pessimism (Collaborative Fund) Gold in $US to be at $0.00 in 2020; TREASURE CHEST!; Breaking Biases (csinvesting) Stock Analysis … Read More

TAM Stock Screener – Undervalued Louisiana-Pacific Corporation (NYSE: LPX)

One of the cheapest stocks in our Large Cap 1000 Stock Screener is Louisiana-Pacific Corporation (NYSE: LPX). Louisiana-Pacific Corporation (Louisiana-Pacific), together with its subsidiaries, manufactures building products primarily for use in new home construction, repair and remodeling, and outdoor structures, as well as light industrial and commercial construction applications. It operates through … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Griffin, Cohen Portfolios

One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

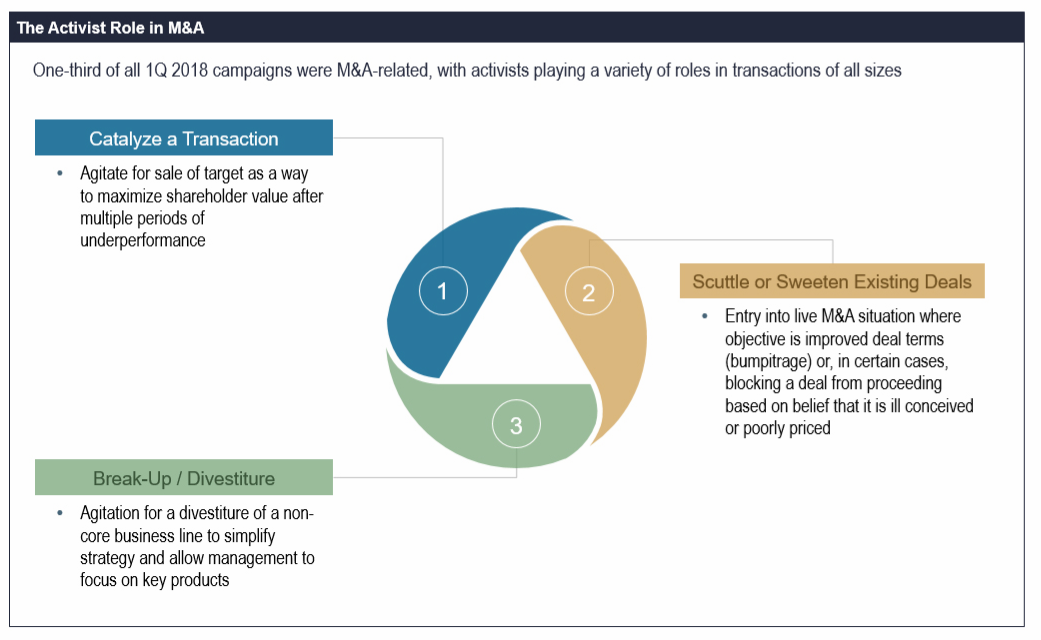

How Activist Investing Is Changing

There’s been a lot of discussion about activist investing in the past couple of weeks and how it’s changing. Here’s a great short video at The Financial Times illustrating how activist investing has changed saying: “Last year more than $62bn was deployed by activist investors on their campaigns, double the … Read More

OSAM: Here’s Why Value Factors Will Continue To Provide An Edge For Long Term Value Investors

One of the firms that we like to follow closely here at The Acquirer’s Multiple is O’Shaughnessy Asset Management (OSAM), which is run by Jim and Patrick O’Shaughnessy and their team. OSAM recently released it Q218 Shareholder letter which provides some great insights on the future of value investing and why OSAM … Read More

Bill Nygren’s Oakmark Funds Says Inactivity In Investing Remains The Optimal Strategy

One of the investor’s we follow closely here at The Acquirer’s Multiple is Bill Nygren. Nygren has been a manager of the Oakmark Select Fund since 1996, Oakmark Fund since 2000 and the Oakmark Global Select Fund since 2006. He is also the Chief Investment Officer for U.S. Equities at … Read More

Mario Gabelli: We’ll Use The Same Guiding Principles To Avoid Over-Paying For A Company’s Intrinsic Value And Lose Less During Market Manias

One of the investors we follow closely here at The Acquirer’s Multiple is Mario Gabelli, Founder, Chairman and CEO of GAMCO Investors, Inc. Gabelli recently did a Q&A session with some folks at Reddit which provided some great value investing insights. Here’s an except from the thread on Reddit: Hello Reddit! … Read More

Sequoia Fund: A Great Value Investing Mindset Creates A Substainable Advantage

One of the value investing firms that we follow closely here at The Acquirer’s Multiple is Ruane, Cunniff & Goldfarb (RCG), the investment adviser best known for managing the Sequoia Fund. RCG recently released its Q2 2018 Investor Letter. For the second quarter of 2018, Sequoia Fund generated a total return … Read More

Mason Hawkins: Real Value Investing Has A Humility Not Present In Today’s More Popular Method Of Heavily Weighing The Qualitative Factors Of The Business And Minimizing The Importance Of Valuation

One of the value investors we like to follow closely here at The Acquirer’s Multiple is Mason Hawkins, Chairman and Chief Executive Officer at Longleaf Partners (Longleaf). Last week Longleaf released its Q218 Shareholder Letter which contains a number of warnings for today’s investors saying: “Managers who say convincingly today that … Read More

This Week’s Best Investing Reads 07/13/2018

Here is a list of this week’s best investing reads: Some Considerations For Investing Globally (A Wealth of Common Sense) 50 Years of Financial History in Ten Minutes–The Yield Curve Comes Alive (csinvesting) Looking For Value In All The Wrong Places (The Felder Report) Amazon as a Value Stock? Believe It (Bloomberg) … Read More

TAM Stock Screener – Undervalued Thor Industries Inc (NYSE: THO)

One of the cheapest stocks in our Large Cap 1000 Stock Screener is Thor Industries Inc (NYSE: THO). Thor Industries Inc (Thor) is an American manufacturer of recreational vehicles through its subsidiaries. The company mainly sells vehicles in the United States and Canada. The company has two reporting segments: towable recreational vehicles … Read More

TAM Stock Screener – Stocks Appearing in Dalio, Greenblatt, Grantham Portfolios

One of the new weekly additions here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

Nassim Taleb: Economists Don’t Predict Better Than Cab Drivers. Typically A Little Worse, Often!

Here’s a great interview with Nassim Taleb and Bob Shiller hosted by Nick Paumgarten at The New Yorker Summit. The panel is discussing economics, economists, and their role in finance. Taleb is asked the following question: Paumgarten: Is Economics Even A Science? And here is his Taleb’s response: Taleb: No, no, … Read More