In his latest earnings call on Wednesday Bill Ackman discussed the reasons why Pershing Square is selling its stake in Berkshire Hathaway. Here’s an excerpt from the call: Bill Ackman With that when why don’t we talk about Berkshire? And Ryan, why don’t you update our investors on investment in … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Rogers, Miller Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

As Long As You’re Not A Forced Seller, You’re Going To Do Fine

During his recent interview with Tobias, Moses Kagan, Co-Founder & Partner at Adaptive Realty discussed As Long As You’re Not A Forced Seller (Of Real Estate), You’re Going To Do Fine. Here’s an excerpt from the interview: Moses Kagan: Again, this doesn’t apply to some random place, but if you’re in a great … Read More

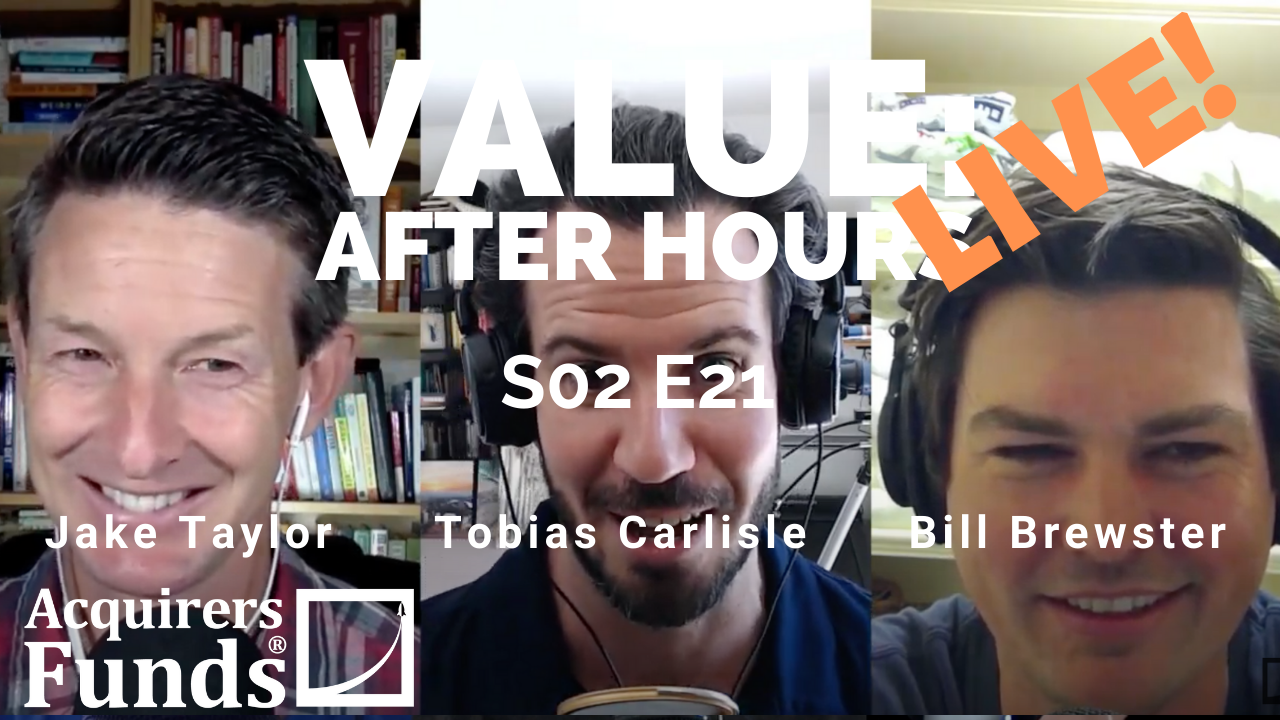

VALUE: After Hours (S02 E21): Is Value a Value Trap, Winchester Mystery House, Cash n’ Carry

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Is Value A Value Trap? The Winchester Mystery House Cash n’ Carry Frédéric Bastiat – The Parable Of The Broken Window Eugen von Böhm-Bawerk – The Positive Theory of Capital The Power Of Network Effects … Read More

Rich Pzena: Value Stocks Recover Stronger After Periods Of Volatility

Pzena Investment Management recently released an article titled Volatility, Wide Spreads, and Value Stock Returns which illustrates how value stocks recover stronger following periods of volatility like we’ve had this year. Here’s an excerpt from that article: Daily volatility of the average stock at the end of March was as … Read More

One Stock Superinvestors Are Buying Or Holding (14)

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Aswath Damodaran: How To Value Companies During Covid-19

Here’s an interview with Aswath Damodaran with Forbes India in which he discusses how to value companies during times of uncertainty, like we have with Covid-19. Here’s an excerpt from the interview: Q. How do we value companies if we don’t know what cashflows are going to be like, what … Read More

You’re Confused Right Now? You’re Not Alone

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed You’re Confused Right Now? You’re Not Alone. Here’s an excerpt from the episode: Bill Brewster: Yeah, no doubt. Well, good. I’m going to get into more of it. Because, I’m going to talk about how … Read More

Successfully Invest In Hyperlocal Real Estate Using One Simple Equation

During his recent interview with Tobias, Moses Kagan, Co-Founder & Partner at Adaptive Realty discussed Successfully Investing In Hyperlocal Real Estate Using One Simple Equation. Here’s an excerpt from the interview: Tobias Carlisle: Right. Just to return to you, let’s talk about the neighborhoods. You describe it in your brochure as being … Read More

Peter Bernstein: The Riskiest Moment In Investing Is When You’re Right!

Here’s a great interview with Peter Bernstein, author of Against The Gods – The Remarkable Story Of Risk, speaking with Jason Zweig in which he discusses managing risk and surviving as an investor. Here’s an excerpt from the interview: Understanding that we do not know the future is such a … Read More

Baumol’s Cost Disease

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Baumol’s Cost Disease. Here’s an excerpt from the episode: Jake Taylor: I’m not going there. This 1960s economist named William Baumol. He came up with this idea that you start with this thought that imagine … Read More

David Abrams: Top Buys, Top Sells (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Invest In Real Estate Like A Smart Family Would Own Real Estate

During his recent interview with Tobias, Moses Kagan, Co-Founder & Partner at Adaptive Realty discussed Investing In Real Estate Like A Smart Family Would Own Real Estate. Here’s an excerpt from the interview: Moses Kagan: Adaptive is a real estate private equity firm just like thepropertybuyingcompany. A tiny one in the grand … Read More

(Ep.68) The Acquirers Podcast: Moses Kagan – Boutique Re, How Moses Kagan Built A Boutique Property Empire

In this episode of The Acquirer’s Podcast Tobias chats with Moses Kagan, Co-Founder & Partner at Adaptive Realty, a company that buys, renovates and manages apartment buildings in Los Angeles. During the interview Moses provided some great insights into: Invest In Real Estate Like A Smart Family Would Own Real … Read More

Joel Greenblatt: Top 10 Holdings (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

This Week’s Best Investing Articles, Research, Podcasts 5/22/2020

Here’s a list of this week’s best investing reads: The Three Sides of Risk (Collaborative Fund) Mental Models For a Pandemic (Farnam Street) Netflix: Cooked? (behindthebalancesheet) Inequality Everywhere You Look (A Wealth of Common Sense) How Sectors are Driving Value and Growth (The Irrelevant Investor) Three things you can’t do in this world (The Reformed … Read More

Is (Systematic) Value Investing Dead?

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Cliff Asness’ recent article titled – Is (Systematic) Value Investing Dead? Here’s an excerpt from the episode: Tobias Carlisle: Yeah, I saw Cliff Asness had a third bite at the value cherry, Is (Systematic) Value Investing … Read More

Stock In Focus – TAM Stock Screener – Kimball International Inc (NASDAQ: KBAL)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Kimball International Inc (NASDAQ: KBAL). Kimball International Inc is a furniture … Read More

Philip Carret: Trend Versus Cycle Stocks

In Philip Carret’s book – The Art of Speculation, he provides some great insights into how to identify the difference between a ‘trend’ stock and a ‘cycle’ stock. Here’s an excerpt from the book: For many years cigarette consumption in the United States has increased year after year almost without … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Burry, Miller Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More