In his 2012 Shareholder Letter, Constellation Software President Mark Leonard explained why founder businesses and distressed assets make great acquisitions saying: Our favourite and most frequent acquisitions are the businesses that we buy from founders. When a founder invests the better part of a lifetime building a business, a long … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Simons, Fisher Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Are We Heading Into A Period Of 70’s Stagflation

During his recent interview with Tobias, Nicholas Pardini, Managing Partner at Davos Investment Group discussed 70’s stagflation. Here’s an excerpt from the interview: Tobias Carlisle: Is that new though? That hardcore money printing has been going on for more than 10 years now. You know that famous interactive brokers ad where they … Read More

Terry Smith: Investing In Stocks Is Not A Game Of Pass The Parcel To A Greater Fool

In his 2010 Fundsmith Shareholder Letter Terry Smith discussed why investing in stocks is a claim on a share of the cash flow produced by a business, not a sophisticated game of pass the parcel to greater fools saying: What we can say with a high degree of certainty is … Read More

One Stock Superinvestors Are Buying Or Holding (15)

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Positive Theory of Capital

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed The Positive Theory of Capital. Here’s an excerpt from the episode: Jake Taylor: All right, so the second thing to learn from this crazy [Winchester Mystery] house out in San Jose comes from this late … Read More

Prevent Your Portfolio From Blowing Up Using Micro Risk Parity

During his recent interview with Tobias, Nicholas Pardini, Managing Partner at Davos Investment Group discussed Micro Risk Parity. Here’s an excerpt from the interview: Nicholas Pardini: I mean, you can make money speculating on bonds going up or down the short term, if they go, say, negative, but I just think in terms … Read More

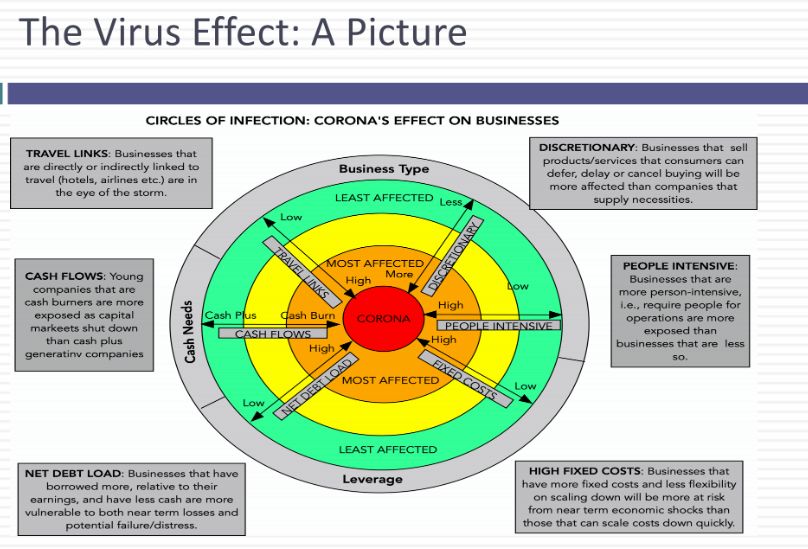

Aswath Damodaran: Now Is Not The Time For Investors To Go To The Dark Side!

Aswath Damodaran recently did a presentation at the 73rd CFA Institute Annual Virtual Conference in which he stressed the importance of going back to basics in terms of valuing companies during the current period of uncertainty saying: There is a simple way to think about how to approach valuation. Don’t … Read More

Joel Greenblatt: Top Buys, Top Sells (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

The Winchester Mystery House

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed The Winchester Mystery House. Here’s an excerpt from the episode: Jake Taylor: Yeah, I will. So the Winchester Mystery house is this … It’s a tourist attraction in San Jose. And it came about from … Read More

The Era Of Hard Choices

During his recent interview with Tobias, Nicholas Pardini, Managing Partner at Davos Investment Group discussed The Era Of Hard Choices. Here’s an excerpt from the interview: Nicholas Pardini: Okay. There are two main parts to what we do at Davos. The first is the platinum research business, which is an institutional research platform … Read More

Tom Gayner: The One Area Of Investing Were I Will Not Compromise

A couple of years ago Markel’s Tom Gayner did an interview with MOI Global in which he discussed a number of topics including the one area of investing were he will not compromise. Here’s an excerpt from the interview: MOI Global: You have stated that the businesses you seek should have … Read More

Carl Icahn: Top 10 Holdings (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Wes Gray – Investors Should Consider A Long-Short Value Investing Strategy

During his recent interview on the Excess Returns Podcast, Wes Gray was asked about his thoughts on value investing going forward. He discussed his views on a long only value strategy versus a long short value strategy. Here’s an excerpt from the interview: A few things I would say is … Read More

(Ep.69) The Acquirers Podcast: Nicholas Pardini – Davos Man, Tying Global Macro Trends Into Actionable Trades

In this episode of The Acquirer’s Podcast Tobias chats with Nicholas Pardini, Managing Partner at Davos Investment Group. During the interview Nicholas provided some great insights into: How Investors Can Capitalize On Future Macro Trends The Era Of Hard Choices Micro Risk Parity We May Be Headed Into A Period … Read More

Stock In Focus – TAM Stock Screener – Points International Ltd. (NASDAQ: PCOM)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Points International Ltd. (NASDAQ: PCOM). Points International Ltd is a … Read More

Ken French: How To Evaluate Your Investment Decisions

In his recent interview on the Rational Reminder Podcast, Ken French was asked how he evaluates his investment decisions. Here’s his response: When I think about the quality of the decisions I’ve made. I have spent most of my life studying empirical data and what I know is volatility, the … Read More

The State Of Value Address – Is Value A Value Trap?

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Tobias’ article titled – Is Value A Value Trap? Here’s an excerpt from the episode: Tobias Carlisle: All right. So I wrote it for … it’s up on the acquirers multiple website. I’ll link to … Read More

This Week’s Best Investing Articles, Research, Podcasts 5/29/2020

Here’s a list of this week’s best investing reads: Last Dance Lessons: Top Investors Weigh in on Key Takeaways from the 90s Bulls (YouTube) Bubble Behavior During a Depression (A Wealth of Common Sense) What We Leave Behind (Scott Galloway) Under Pressure (The Reformed Broker) 10 Reasons Why Stocks are More Dangerous than Sports … Read More

Howard Marks: Understanding The Market Cycle Tells Investors What’s Likely To Happen Next

In his recent Real Vision interview Howard Marks discussed how understanding the market cycle can tell investors what’s likely to happen next. Here’s an excerpt from the interview: I think the the key to understanding the business cycle is… and the market cycle is that you know most behavior is … Read More