As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is PulteGroup, Inc. (NYSE: PHM). PulteGroup Inc is one of the … Read More

Wu Wei Investing

In their recent episode of the VALUE: After Hours Podcast, Jake Taylor, Mike Mitchell, and Tobias Carlisle discussed Wu Wei Investing. Here’s an excerpt from the episode: Jake: Oh, yeah, let’s do it. Yeah, let’s get deep in some Eastern philosophy to close out the hour. This concept of Wu … Read More

Daniel Kahneman: The One Question That Most Investors Can’t Answer

In his book – Thinking Fast And Slow, Daniel Kahneman says there is one question that most investors can’t answer in order to be successful. Here’s an excerpt from the book: Why do investors, both amateur and professional, stubbornly believe that they can do better than the market, contrary to … Read More

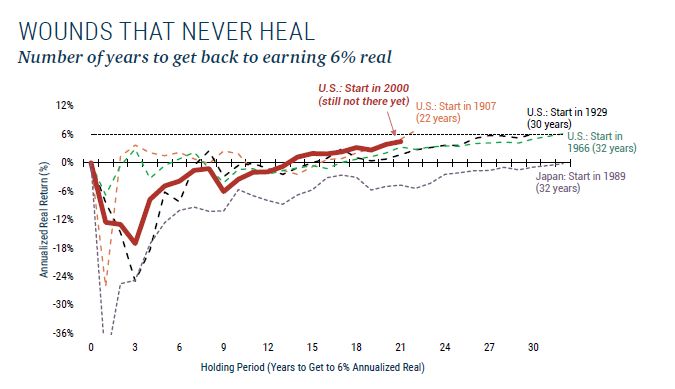

GMO: It Takes Decades To Recover When The Bubble Bursts

In their latest insight titled – Wounds That Never Heal, GMO provides some great research that shows just how long it takes to recover when the bubble bursts. Here’s an excerpt from the insight: WOUNDS THAT NEVER HEAL Why so focused on bubbles? The damage they inflict can last decades. … Read More

Bill Ackman: Investors Should Own Businesses With Real Pricing Power

In his latest interview with Interactive Investor, Bill Ackman recommends investors own businesses with real pricing power. Here’s an excerpt from the interview: You want to own businesses that have pricing power. If inflation turns out to be a lot more durable than temporary. I think inflation expectation has changed … Read More

This Acquirers Multiple Stock Appearing In Dalio, Ainslie, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Future Of Work Is Hybrid

In their recent episode of the VALUE: After Hours Podcast, Jake Taylor, Mike Mitchell, and Tobias Carlisle discussed The Future of Work Is Hybrid. Here’s an excerpt from the episode: Mike: Then, sprinkle on top of that, this work from home dynamic, it’s really fascinating to me, and I have … Read More

Burton Malkiel: The Nonsense Of Relying On Very High Long-Term Growth Rates

In his book – A Random Walk Down Wall Street, Burton Malkiel discusses the nonsense of relying on very high long-term growth rates. Here’s an excerpt from the book: The catch (and doesn’t there always have to be at least one, if not twenty-two?) is that dividend growth does not … Read More

Warren Buffett: How To Deal With Financial Shenanigans

In the book – Talent, Strategy, Risk: How Investors and Boards Are Redefining TSR, there’s a couple of great quotes by Warren Buffett on how to deal with financial shenanigans. Here’s an excerpt from the book: Whether people deviate from ethical behavior through bad intention or bad practices, you must put … Read More

Bill Nygren: Chasing Short Term Profits At The Expense Of Stakeholders

In his latest Q3 2021 Market Commentary, Bill Nygren discusses the problem with companies chasing short-term profits at the expense of stakeholders. Here’s an excerpt from the commentary: We believe that if stakeholders are mistreated, neither profits nor value can be maximized. CEOs can increase the next quarter’s or the … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

John Malone’s Compensation Philosophy

In their recent episode of the VALUE: After Hours Podcast, Jake Taylor, Mike Mitchell, and Tobias Carlisle discussed John Malone’s Compensation Philosophy. Here’s an excerpt from the episode: Mike: I have this Malone philosophy of compensation. It’s probably more relevant to me than the Berkshire theory of compensation. Tobias: What’s … Read More

Terry Smith: How To Ensure Share BuyBacks Add Value For Shareholders

In his book, Investing For Growth, Terry Smith discusses how to ensure share buybacks add value for shareholders. Here’s an excerpt from the book: Simply by executing a share buyback rather than paying out dividends, companies can inflate their earnings per share (EPS) and are almost universally seen to have … Read More

Weitz: Build A Portfolio Where Each Position Is Significant Enough To Matter, Yet None Can Individually Make Or Break Your Results

In their latest Q3 2021 Market Commentary, Weitz Investment says build a portfolio where each position is significant enough to matter, yet none can individually make or break your results. Here’s an excerpt from the commentary: The portfolio is focused and well-aligned with our vision for successful large-cap investing. We … Read More

David Einhorn: Make Sensible Investments In Companies Based On Earnings, Cashflows, And Assets, And Not On Top Line Story Stocks

In his recent interview with CNBC, David Einhorn recommended investors make sensible investments in companies based on their earnings, cashflows, and assets, and not in top line story stocks. Here’s an excerpt from the interview: By the way I think that growth is just a generally… is a component of … Read More

One Stock Superinvestors Are Buying

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Munger’s View On Inflation

In their recent episode of the VALUE: After Hours Podcast, Jake Taylor, Mike Mitchell, and Tobias Carlisle discussed Munger’s View On Inflation. Here’s an excerpt from the episode: Jake: Okay, well, this is against my better judgment. But I was just listening on my walk this morning, listening to the … Read More

Michael Burry: Look For Value Stocks That Have Been Going Sideways For Some Time

In this discussion on the Silicon Investor Forum, Michael Burry says he looks for value stocks that have been going sideways for quite some time. Here’s an excerpt from the discussion: Burry: Paul, I have concerns about OLS. In purchasing a value stock, I usually look for one that has … Read More

David Tepper: There Are No Great Asset Classes Right Now!

In his latest interview on CNBC, David Tepper says there are no great asset classes right now. Here’s an excerpt from the interview: I don’t think there’s any great asset classes right now. There’s people on your show talk about the risk of inflation and the question is what the … Read More

Joel Greenblatt Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More