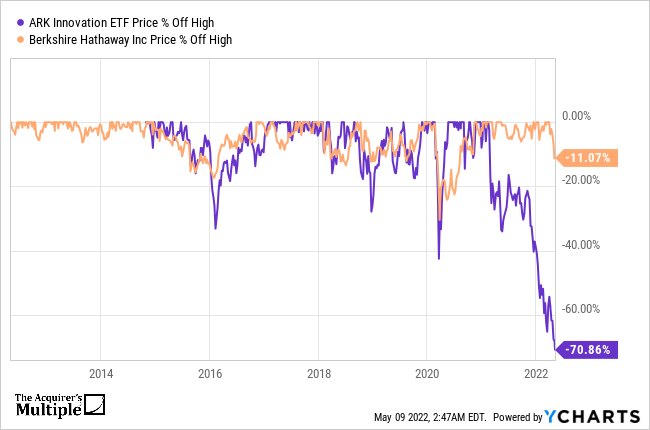

As part of a new weekly feature here at the Acquirer’s Multiple we’ll be providing some of our favorite charts of the week from @ycharts. This week we’ll take a look at a ‘head to head’ between Cathie Wood vs Warren Buffett over the last 10 years. Current Share Price … Read More

Warren Buffett: Cash Is Like Oxygen, If It Disappears For A Few Minutes It’s All Over

During his recent Berkshire Hathaway Annual Meeting, Warren Buffett explains why he always holds cash. Here’s an excerpt from the meeting: Buffett: Going back to Q2 is we will always have a lot of cash on hand. And when I say cash I don’t mean commercial paper. When 2008 and … Read More

Warren Buffett: Looking Back, We Have Bought At Some Really Dumb Times

In his latest Berkshire Hathaway Annual Meeting, Warren Buffett discusses how looking back, they have bought during some really dumb times. Here’s an excerpt from the meeting: Buffett: The interesting thing is you know obviously we haven’t the faintest idea what the stock market is going to do when it … Read More

Warren Buffett: I’ve Gotten Dumber But I’ve Gotten Wiser

In his recent interview with Charlie Rose, Warren Buffett explains why he’s gotten dumber but wiser. Here’s an excerpt from the interview: Buffett: I’ve gotten dumber but I’ve gotten wiser. Host: That’s a nice phrase but what does it mean? Buffett: It means that I can’t add a group of … Read More

Warren Buffett: You Don’t Need Brains To Be Successful In The Market, You Need The Right Orientation

In his recent interview with Charlie Rose, Warren Buffett explains why you don’t need brains to be successful in the market. Here’s an excerpt from the interview: Buffett: I’m a bright guy who’s terribly interested in what he does. So I’ve spent a lifetime doing it. I’ve surrounded myself with … Read More

Warren Buffett: Discard Your Hypothesis If It Turns Out To Be Wrong

In this interview with Jeff Cunningham at Arizona State University, Warren Buffett discusses journalists looking to confirm their hypothesis regarding a story, a lesson that is equally applicable to investors who have investing so much time and effort into a potential investment. Here’s an excerpt from the interview: Buffett: The … Read More

Warren Buffett: We Find Little That Excites Us!

In his latest Berkshire Hathaway Annual Letter 2022, Warren Buffett says, “Today, though, we find little that excites us.” This would explain why he’s currently holding $144 Billion in cash and cash equivalents. Here’s an excerpt from the letter: Berkshire’s balance sheet includes $144 billion of cash and cash equivalents … Read More

Warren Buffett: Berkshire’s ‘Edge’ When It Comes To Making Acquisitions

In his 2020 Berkshire Hathaway Shareholder Letter, Warren Buffett discusses Berkshire’s ‘edge’ when it comes to making acquisitions. Here’s an excerpt from the letter: Buffett: Aside from the economic factors that benefited us, we now enjoy a major and growing advantage in making acquisitions in that we are often the … Read More

Warren Buffett: During Scary Periods, You Should Never Forget Two Things

In his 2016 Shareholder Letter, Warren Buffett discusses the two things you should never forget during scary periods. Here’s an excerpt from the letter: American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead. Innovation, productivity gains, entrepreneurial … Read More

Warren Buffett Top 10 Holdings – Latest 13F, Buys CVX, RPRX, FND

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Warren Buffett: Growth Can Have Both A Positive And Negative Impact For The Investor

In his 1992 Berkshire Hathaway Letter, Warren Buffett explained that growth can have both a positive and negative impact for the investor. Here’s an excerpt from the letter: Similarly, business growth, per se, tells us little about value. It’s true that growth often has a positive impact on value, sometimes … Read More

Warren Buffett: Why We Continue To Hold Businesses That Are Unprofitable

During the 2014 Berkshire Hathaway Annual Meeting, Warren Buffett explained why he continues to hold businesses that are unprofitable. Here’s an excerpt from the meeting: Q. Berkshire is known to buy companies for many years. But that wasn’t the same earlier in your career. What do you do to gain … Read More

Warren Buffett: This Is How You Manage Risk!

In his 1989 Shareholder Letter, Warren Buffett provided a great example on how you manage risk. Here’s an excerpt from the letter: Ike Friedman is not only a superb businessman and a great showman but also a man of integrity. We bought the business without an audit, and all of … Read More

Warren Buffett: How To Deal With Financial Shenanigans

In the book – Talent, Strategy, Risk: How Investors and Boards Are Redefining TSR, there’s a couple of great quotes by Warren Buffett on how to deal with financial shenanigans. Here’s an excerpt from the book: Whether people deviate from ethical behavior through bad intention or bad practices, you must put … Read More

Warren Buffett: Most Major Acquisitions Don’t Make Sense

In his 1994 Shareholder Letter, Warren Buffett explained why most major acquisitions don’t make sense. Here’s an excerpt from the letter: The sad fact is that most major acquisitions display anegregious imbalance: They are a bonanza for the shareholders of the acquiree; they increase the income and status of the … Read More

How Warren Buffett Consistently Borrowed Money At Rates Lower Than The US Government

In Chris Mayer’s Book – 100 Baggers, he explains how Warren Buffett consistently borrowed money at rates lower than the US government. Here’s an excerpt from the book: Along with more than 40,000 other people, I was in Omaha, NE, for the Berkshire annual meeting, which also celebrated the 50th … Read More

Warren Buffett: All Earnings Are Not Created Equal

In his 1984 Shareholder Letter, Warren Buffett discussed his dividend policy and why all earnings are not created equal. Here’s an excerpt from the letter: Dividend policy is often reported to shareholders, but seldom explained. A company will say something like, “Our goal is to pay out 40% to 50% … Read More

Warren Buffett: Putting 75% Of Your Net Worth Into A ‘Lead-Pipe Cinch’

During this Berkshire Annual Meeting, Warren Buffett discussed putting seventy five percent of his net worth into one position when you’re working with smaller sums. Here’s an excerpt from the meeting: There have been times… well initially I had 70, several times I had 75% of my net worth in … Read More

Warren Buffett: Beware Of Investment Activity That Produces Applause

In his 2008 shareholder letter, Warren Buffett discussed the U.S Treasury Bond bubble of 2008 and why investors should beware of investment activity that produces applause. Here’s an excerpt from the letter: The investment world has gone from underpricing risk to overpricing it. This change has not been minor; the … Read More

Warren Buffett: Investors Should Avoid The ‘Noah School Of Investing’

In his 1966 Buffett Partnership Letter, Warren Buffett discussed diversification and why investors should avoid the ‘Noah School of Investing’. Here’s an excerpt from the letter: There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing … Read More