In his latest paper titled Feedback- Information as a Basis for Improvement, Michael Mauboussin explains how feedback can improve your investment process. Here’s an excerpt from the paper: Feedback is information that is applied to improve results. In this report, we focused on how feedback can improve the long-term outcomes … Read More

Michael Mauboussin: When Negative Free Cash Flow Makes Sense

In his latest interview with eToro, Michael Mauboussin discusses when negative free cash flow makes sense. Here’s an excerpt from the interview: Mauboussin: The other thing that I would just underscore is that there have been and there will continue to be great businesses that have negative free cash flow. … Read More

Michael Mauboussin: A Framework To Analyze Any M&A Deal

In his latest interview with TMF, Michael Mauboussin offers a framework for investors to analyze any M&A deal. Here’s an excerpt from the interview: M&A deals generally have a strategic and a financial rationale. A target company may be a great business but the acquirer still risks overpaying if its … Read More

Michael Mauboussin: The 3 Buckets Of Investing In Today’s Markets

In his latest interview on Masters in Business, Michael Mauboussin discussed the three buckets of investing in today’s markets. Here’s an excerpt from the interview: RITHOLTZ: So — so here’s the pushback that I think we would get from a Robinhood trader today who is looking in their portfolio over … Read More

Michael Mauboussin: Why Do Smart People Make Dumb Decisions?

In his book – Think Twice: Harnessing the Power of Counterintuition, Michael Mauboussin explains why smart people make dumb decisions. Here’s an excerpt from the book: No one wakes up thinking, “I am going to make bad decisions today.” Yet we all make them. What is particularly surprising is some of … Read More

Michael Mauboussin: What Distinguishes A Great Investor From A Good Investor

In his recent interview with RIAIntel, Michael Mauboussin discussed a number of topics including what distinguishes a great investor from a good investor. Here are some excerpts from the interview: What distinguishes a good from a great investor? This difference rarely has to do with the tools they’re using but … Read More

Michael Mauboussin: How To Calculate The Present Value Of An Investment

In his book Expectations Investing, Michael Mauboussin provides a simple explanation of how to calculate the present value of an investment. Here’s an excerpt from the book: We return to first principles to see why the stock market bases its expectations on long-term cash flows. A dollar today is worth … Read More

Michael Mauboussin: How To Use The Expectations Investing Process

In their book – Expectations Investing: Reading Stock Prices for Better Returns, Michael Mauboussin and Alfred Rappaport discuss how to use the expectations investing process. Here’s an excerpt from the book: THE EXPECTATIONS INVESTING PROCESS In the following chapters, we’ll walk you carefully through the three-step process of expectations investing. Step … Read More

Michael Mauboussin: Reclassifying Cash Flow Items Provides Investors With Greater Insights

In his latest paper titled – Categorizing for Clarity, Michael Mauboussin shows how reclassifying certain items in the cash flow statement can substantially improve the description of a business, without impacting the integrity of the cash flow statement. Here’s an excerpt from the paper: Understanding the magnitude and prospective return … Read More

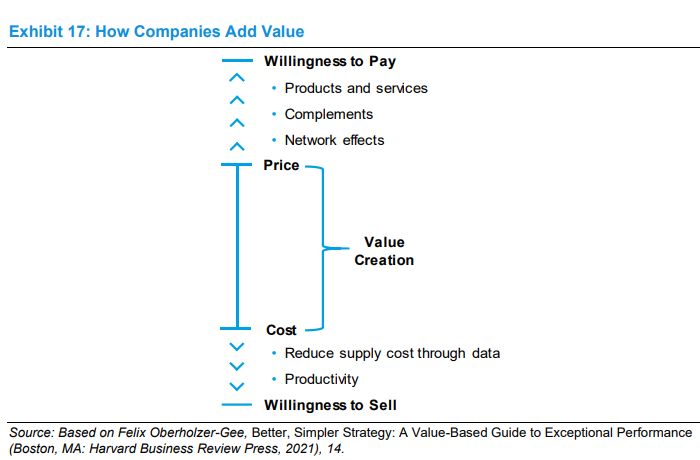

Michael Mauboussin: You Have To Earn The Right To Use Multiples

In this recent presentation at Columbia Business School, Michael Mauboussin discusses expectations investing and why you have to earn the right to use multiples. Here’s an excerpt from the presentation: Mauboussin: I would always like to say, by the way it’s got two sides of the factor. You have to … Read More

Michael Mauboussin: Make Better Investing Decisions – Seek Out Dissenting Views

In Michael Mauboussin’s book – Think Twice, he recommends one of the best ways to make better decisions, which is particularly relevant to investing decisions, is to seek out dissenting views. Here’s an excerpt from the book: Much easier said than done, the idea is to prove your views wrong. There … Read More

Michael Mauboussin: Investors Won’t Make Good Decisions That May Appear Wrong In The Short-Term

In his latest paper titled – Turn and Face the Strange – Overcoming Barriers to Change in Sports and Investing, Michael Mauboussin discusses the reasons why sporting organizations and investors won’t make good decisions. The main reason is that even though their decision may be the correct one, the outcome … Read More

Michael Mauboussin: The 3 Big Behavioral Investing Mistakes

In this interview with Outlook Business, Michael Mauboussin discusses the three big behavioral mistakes that investors make. Here’s an excerpt from the interview: Mauboussin: Investors make a lot of behavioral mistakes but I’ll mention three I think are particularly prominent. The first is this notion of overconfident. People tend to … Read More

Michael Mauboussin: Everything Is a DCF Model

In his latest paper titled – Everything Is A DCF Model, Michael Mauboussin discusses DCF models, and why they still remain relevant today. Here’s an excerpt from the paper: A Mantra for Valuing Cash-Generating Assets We suggest the mantra “everything is a DCF model.” Whenever investors value a stake in … Read More

Michael Mauboussin: The Impact Of Intangibles On Base Rates

In his latest paper titled – The Impact of Intangibles on Base Rates, Michael Mauboussin discusses how the dominance of intangibles will lead to higher growth and more dispersion in base rates. Here’s an excerpt from the paper: Accurate forecasts combine causal and statistical thinking in proper measure. Statistical thinking … Read More

Michael Mauboussin: The Economics of Customer Businesses

In his latest paper titled – The Economics of Customer Businesses, Calculating Customer-Based Corporate Valuation, Michael Mauboussin discusses a robust framework called ‘customer based corporate valuation’ (CBCV), which was developed by professors of marketing, Daniel McCarthy and Peter Fader, that links customer economics to corporate value. This allows investors to … Read More

Michael Mauboussin: MEROI – Bridging Accounting and Valuation

In his latest paper titled – Market-Expected Return on Investment (MEROI), Michael Mauboussin explains why MEROI, which measures the return at which the present value of a company’s profits equals the present value of the investments a company makes, is a better measurement of corporate returns that the traditional measurements … Read More

Michael Mauboussin: Animating Mr Market

Some years ago, Michael Mauboussin wrote a paper titled Animating Mr Market, in which he discussed Ben Graham’s Mr Market metaphor saying, “One way to animate Mr. Market is to consider the wisdom of crowds. What’s key is that crowds are wise under some conditions and mad when any of … Read More

Michael Mauboussin: The Importance Of Utilizing Base Rates

In his recent interview on the Decision Education Podcast, Michael Mauboussin discussed the importance of utilizing base rates in investing. Here’s an excerpt from the interview: Mauboussin: Yeah, thanks for slowing that down a little bit. So, as I mentioned, rather than thinking about your problem as unique to you, what … Read More

Michael Mauboussin: The Trouble with Earnings and Price/Earnings Multiples

Some years ago Michael Mauboussin and Alfred Rappaport released a great paper titled – The Trouble with Earnings and Price/Earnings Multiples, in which they discuss the shortcomings of traditional valuation metrics ROE, and P/E. Here’s an excerpt from the paper: Wall Street is a world filled with rules of thumb … Read More