(Image Credit, kotaku.com) Last week I compiled a list called (50 of the Best Value Investing Resources (plus a few more). It seemed to be quite popular with readers so today I’ve compiled a list of what I consider to be 10 of the Top Value Investing Tweeters and their top … Read More

How to Value a Company and, Everyone Should go Shark Fishing [metaphor] – Mario Gabelli

(Image Credit, wsj.com) If you follow this blog regularly, you’ll know that I’m a big fan of The Columbia Business School and their student newsletters. These newsletters are an awesome resource for value investors. Every newsletter contains a number of interviews with some of the smartest value investors on the planet. … Read More

Benjamin Graham and Security Analysis: A Reminiscence – Walter J. Schloss

One of my favorite investment classics is Walter Schloss reminiscing about Benjamin Graham and Security Analysis. It’s a timeless piece from one of the world’s greatest super-investors. Let’s take a look…

How to Succeed in Investing, and Why You Shouldn’t Listen to Analysts – James Chanos

I recently read an interview with James Chanos, which was conducted by The Heilbrunn Center for Graham & Dodd Investing, in the Spring of 2012. James Chanos is the founder and Managing Partner of Kynikos Associates, a firm he founded in 1985. Throughout his career, Chanos has identified and sold short the … Read More

How do we hand-pick the 90 best Deep Value Stocks for our Screens

(Image Credit, www.123rf.com) One question we always get asked is, how to we hand-pick the 90 best Deep Value Stocks for our screens? Hand-picking the 90 best Deep Value opportunities from 1000’s of stocks is like trying to find a needle in a haystack but, we know that historically once they’re found, … Read More

The Psychology of Human Misjudgment – Charlie Munger (Audio & Transcript)

(Image Credit, danshipper.com) Here’s the timeless speech by Charlie Munger, given to an audience at Harvard University back in 1995. The speech is titled, “The Psychology of Human Misjudgment”. I never get tired of listening to this classic orator.

There are three central elements to a value-investment philosophy – Part 1 – Seth Klarman

(Image Credit, advisoranalyst.com) One of the best books on investing is Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor, by Seth Klarman. According to Forbes: Investing legend Seth Klarman runs Boston-based firm Baupost. With $27 billion under management, Baupost is one of the largest hedge funds. It posted small … Read More

Lame and boring value stocks outperform ‘glamour’ stocks – Patrick O’Shaughnessy

Another one of my favorite bloggers is Patrick O’Shaughnessy. Patrick is a CFA and portfolio manager at O’Shaughnessy Asset Management. He also has an awesome blog called The Investors Field Guide which is a must read for all investors. Last year he did an excellent piece on the comparative performance between value stocks … Read More

Does the current climate make markets vulnerable to a black swan event? – The Royce Funds

(Image Credit, www.mirror.co.uk) This month The Royce Funds Portfolio Manager, Charlie Dreifus discussed how the current climate of slow growth, high valuations, and interventionist monetary policy makes the markets potentially vulnerable to black swan events. Charlie Dreifus manages the firm’s Special Equity mutual funds that attempt to combine classic value … Read More

Dividends are making you poorer – Meb Faber

One of my favorite bloggers is Meb Faber. Meb has an awesome blog at mebfaber.com. Back in May this year Meb released the results of his study into dividend stocks. He wanted to research the ‘real’ returns of a dividend strategy when we consider tax. “Dividends are taxed every year … Read More

Being contrarian is not enough, you must be very sure you are right – Philip Fisher

(Image Credit, youtube.com) One of my favorite investment books is of course, Common Stocks and Uncommon Profits and Other Writings, written by investing legend Philip Fisher. Philip Fisher was an investor best known as the author of Common Stocks and Uncommon Profits, a guide to investing that has remained in … Read More

If contrarian strategies do so well, why doesn’t everyone use them? – David Dreman

(Image credit – authors.simonandschuster.co.uk) I was recently re-reading one of my favorite investment books by David Dreman, Contrarian Investment Strategies – The Next Generation. David Dreman is the founder and Chairman of Dreman Value Management. He’s published many scholarly articles and has written four books. Dreman also writes a column for Forbes … Read More

What can Pokémon Go teach us about irrational investing?

(Image Credit: www.pokemon.com) A lot has been written about the irrationality of investors. To help them out, they can head over to the SEC website and read the nine investing behaviors that can undermine investment performance. The article’s titled, Investor Bulletin: Behavioral Patterns of U.S. Investors. “The Library of Congress report … Read More

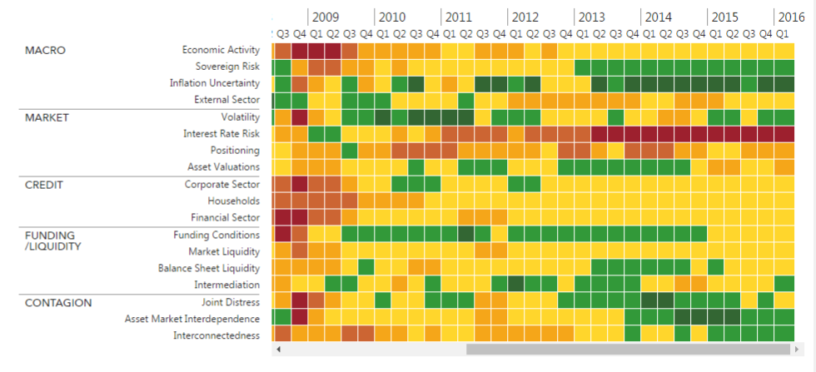

Is the CAPE Ratio providing a warning for investors – OFR

While no single tool, ratio or source should be used to evaluate the economy and its financial stability. The Office of Financial Research (OFR) provides a free bi-annual report, and a really cool heat-map, on their version of what’s happening in the economy. Its called the Financial Stability Monitor, here’s … Read More

The central principle of investment is to go contrary to the general opinion – Keynes

The year is 1543. Think about that! That’s 473 years ago. For most of us, something from the 1920’s is considered old! There was this guy called, Nicolaus Copernicus, Copernicus contended that the Earth revolved around the sun, rather than the other way around. At the time everyone thought he was … Read More

Contemporary Investing Gurus – Ray Dalio (Video + Research Paper)

(Image Credit: www.forbes.com) Recently I started an investing video series called, Contemporary Investing Gurus. Over the years I’ve spent loads of time reading articles, watching videos and listening to podcasts from some of the best investing minds in the world. Names like Joel Greenblatt, Mohnish Pabrai, Warren Buffett, Charlie Munger, Meb Faber, and Guy Spier, just … Read More

Let’s Get Ready to Rumble – The Acquirer’s Multiple vs The Magic Formula

(Image Credit: www.youtube.com) Like two heavyweight boxing champions, there’s been loads of tests and comparisons made between heavyweight stock screeners, The Acquirer’s Multiple (the method provided by the screens here) and The Magic Formula (which of course was developed by Joel Greenblatt). Here is one such article published by Lukas Neely, a … Read More

Minimizing Your Downside Risk – Ty Cobb Batted .367 Cos He Got On Base!

(Image Credit: http://www.outsidepitchmlb.com/) Like baseball, investing is more about safe hits that’ll get you on base rather than hitting home runs. The importance of calculating down-side risk rather than upside gains is one of the most overlooked concepts in stock market investing. Of course Warren Buffett is often quoted as saying, “Rule … Read More

Institutional Investors Are Delusional – Meb Faber (Hilarious)

(Image Credit: mebfaber.com) One of my favorite bloggers is Meb Faber @ mebfaber.com. Meb recently wrote an article called Institutional Investors Are Delusional, where he commented on a recent survey of 400+ real money institutional respondents asked to estimate the net returns they will receive from their hedge funds. The results astounded Meb and they … Read More

Hang out with losers if you want outstanding results in the stock market

(Image, Do You Have a Friend Who is a Loser? Get Rid of Em!, accessed 18 July 2016, http://persuasive.net/) Let’s face it, no-one wants to hang out with losers. But when its comes to investing, these are the exactly the types of stocks most likely to provide outstanding returns. The problem is … Read More