In his latest video titled, The Difference Between a Correction and a Bear Market, Ken Fisher explains how bear markets hornswoggle the last greater fool into stocks. Here’s an excerpt from the video:

The first three months of a real bear market, a conventional bear market, tend to be relatively gentle, and the totality of the bear market from its absolute peak to its absolute bottom tends to average two to three percent per month. It vacillates around it of course but averages from top to bottom about two to three percent per month.

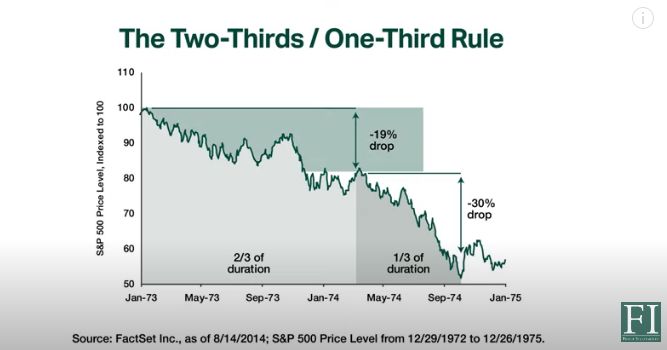

The back two thirds in magnitude of the drop, the back two thirds of the drop in magnitude tends to only be the last one third approximately of time. And the first two thirds of time from the top to the bottom… that first two thirds of time tends to only be about one-third of the drop.

And in that early gentle phase after the bull markets rolled over and started to go down, what you hear people say all the time is I didn’t get in enough before, this is my opportunity to get in. And this is in a sense the great humiliator. The stock market hornswoggling the last greater fool to get into stocks before you get to that last two-thirds that go whaaaa…

You can watch the entire presentation here:

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: