(Image Credit, www.investopedia.com) On July 29 we reported that, “The best value stock in the Small and Micro Screener is WILC G Willi-Food International Ltd (NASDAQ:WILC) on a multiple of -0.42 times operating income”. Willi-Food is a company that specializes in the development, marketing and international distribution of kosher foods. … Read More

If contrarian strategies do so well, why doesn’t everyone use them? – David Dreman

(Image credit – authors.simonandschuster.co.uk) I was recently re-reading one of my favorite investment books by David Dreman, Contrarian Investment Strategies – The Next Generation. David Dreman is the founder and Chairman of Dreman Value Management. He’s published many scholarly articles and has written four books. Dreman also writes a column for Forbes … Read More

What can Pokémon Go teach us about irrational investing?

(Image Credit: www.pokemon.com) A lot has been written about the irrationality of investors. To help them out, they can head over to the SEC website and read the nine investing behaviors that can undermine investment performance. The article’s titled, Investor Bulletin: Behavioral Patterns of U.S. Investors. “The Library of Congress report … Read More

Apple Inc jumps 6.5%, 23% drop in iPhone sales $AAPL

(Image Credit: www.theregister.co.uk) Apple Inc (NASDAQ:AAPL) released its 2016 third quarter results Wednesday. The company recorded revenue of $42.4 billion for the quarter, down 15% from $49.6 billion for the previous corresponding period. Net income was also down 27% for the quarter to $7.8 billion from $10.7 billion for the previous corresponding period. Clearly … Read More

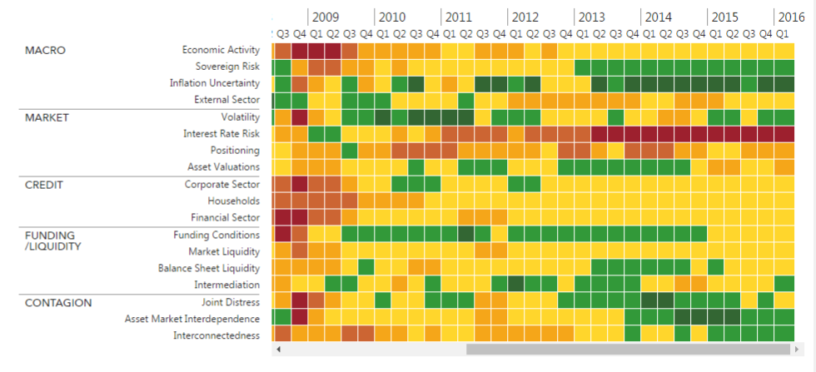

Is the CAPE Ratio providing a warning for investors – OFR

While no single tool, ratio or source should be used to evaluate the economy and its financial stability. The Office of Financial Research (OFR) provides a free bi-annual report, and a really cool heat-map, on their version of what’s happening in the economy. Its called the Financial Stability Monitor, here’s … Read More

Pendrell Corporation trading close to its NCAV $PCO

(Image Credit: http://pendrell.com/) Pendrell Corporation (NASDAQ:PCO) was the biggest mover in ‘The All Investable Screener’ yesterday, up a whopping 14.8%. Who is Pendrell Corporation? For the past five years Pendrell has invested in and acquired IP rights, and continues to monetize those IP rights. For example, during the second quarter of … Read More

The central principle of investment is to go contrary to the general opinion – Keynes

The year is 1543. Think about that! That’s 473 years ago. For most of us, something from the 1920’s is considered old! There was this guy called, Nicolaus Copernicus, Copernicus contended that the Earth revolved around the sun, rather than the other way around. At the time everyone thought he was … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Stocks For the Week Beginning July 25th, 2016” on Storify]

Contemporary Investing Gurus – Ray Dalio (Video + Research Paper)

(Image Credit: www.forbes.com) Recently I started an investing video series called, Contemporary Investing Gurus. Over the years I’ve spent loads of time reading articles, watching videos and listening to podcasts from some of the best investing minds in the world. Names like Joel Greenblatt, Mohnish Pabrai, Warren Buffett, Charlie Munger, Meb Faber, and Guy Spier, just … Read More

Let’s Get Ready to Rumble – The Acquirer’s Multiple vs The Magic Formula

(Image Credit: www.youtube.com) Like two heavyweight boxing champions, there’s been loads of tests and comparisons made between heavyweight stock screeners, The Acquirer’s Multiple (the method provided by the screens here) and The Magic Formula (which of course was developed by Joel Greenblatt). Here is one such article published by Lukas Neely, a … Read More

Minimizing Your Downside Risk – Ty Cobb Batted .367 Cos He Got On Base!

(Image Credit: http://www.outsidepitchmlb.com/) Like baseball, investing is more about safe hits that’ll get you on base rather than hitting home runs. The importance of calculating down-side risk rather than upside gains is one of the most overlooked concepts in stock market investing. Of course Warren Buffett is often quoted as saying, “Rule … Read More

Institutional Investors Are Delusional – Meb Faber (Hilarious)

(Image Credit: mebfaber.com) One of my favorite bloggers is Meb Faber @ mebfaber.com. Meb recently wrote an article called Institutional Investors Are Delusional, where he commented on a recent survey of 400+ real money institutional respondents asked to estimate the net returns they will receive from their hedge funds. The results astounded Meb and they … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning July 18th, 2016” on Storify]

Hang out with losers if you want outstanding results in the stock market

(Image, Do You Have a Friend Who is a Loser? Get Rid of Em!, accessed 18 July 2016, http://persuasive.net/) Let’s face it, no-one wants to hang out with losers. But when its comes to investing, these are the exactly the types of stocks most likely to provide outstanding returns. The problem is … Read More

The Magic of Compounding Returns, The Tyranny of Compounding Costs – John Bogle

(Image, John Bogle on the Rise of Index Funds, accessed 16 July 2016, http://www.barrons.com/) Have you ever looked at the statement you receive from your investment manager and wondered, what the heck are they talking about! You think you’re getting good returns but it turns out you’re underperforming. The question is, WHY? … Read More

Beating the Market | 16 Rules by Walter Schloss, plus 3 more

(Image: The Walter Schloss approach to value investing, accessed 14 July 2016, http://vintagevalueinvesting.com/) The good news is that there’s thousands of websites that provide great information for new investors in the stock market. The bad news is that there are thousands more not providing such great information. If you’re new to … Read More

Value Investing | Danny DeVito (Video)

(Video. Danny DeVito Explaining Value Investing — Benjamin Graham Style (Other People’s Money), accessed Youtube 13 July 2016, https://www.youtube.com/) Bit of humor today. Its aged a little, but here’s a great 3 minute video from the 1991 movie, Other People’s Money. Danny DeVito explains the timeless concept of value investing succinctly. [youtube … Read More

So you want to be a stock market investor? Take this test first!

(PHOTO: Source, www.michaelmauboussin.com) One of the great things about being a stock market investor in the year 2016, is that we have the internet. That means we have access to loads of free information to help us become better investors. There’s lots of great research that tells us why we continue … Read More

Diversified Portfolio | Insure your car, your house, your life, and your portfolio

If you’re like me, you insure your car, your house, and your life. Visit lifecoverquotes.org.uk to find out everything you need to know about getting life insurance when you’re over 40 and why you should consider taking out a policy. The reason I insure my house is because if it … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning July 11th, 2016” on Storify]