(Image Credit, cnbc.com) Why is it that every time you pick up a newspaper or switch on the finance channel, some talking head is making a prediction on what’s likely to occur with macro-economic events like interest rates, currency rates, or movements in the stock market. The simple truth is, … Read More

To outperform in the stock market you will underperform

(PHOTO: Source http://changzw.com/) Part of being a value investor is understanding that your portfolio will underperform some of the time. I recently read an article on this very topic where Mohnish Pabrai was asked a question regarding investors following his Dhandho Investor strategy:

Overriding emotional investing by Klarman, Munger and Buffett

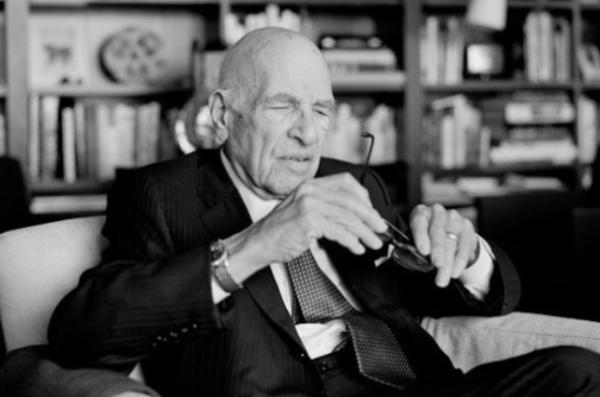

(PHOTO: Source http://www.talkativeman.com/seth-klarmans-recommended-books-on-investing/) Recently I wrote an article on investing and Behavioral Finance. Behavioral finance is a relatively new field that seeks to combine behavioral and cognitive psychological theory with conventional economics and finance to provide explanations for why people make irrational financial decisions. The article is called, The biggest problem in … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Stocks For the Week Beginning July 5th, 2016” on Storify]

How to implement your Acquirer’s Multiple Strategy – 5 Good Questions Answered

(PHOTO: http://dailylendingnews.com/) I often get asked, “What’s the best way to implement an Acquirer’s Multiple (AM) deep value investment strategy?”. Tobias has written a number of articles over the years on how best to implement this strategy. Here are five questions we are regularly asked, answered by Tobias himself. If … Read More

New Series – Contemporary Investing Gurus

Today, I’m starting a new series here at The Acquirer’s Multiple called Contemporary Investing Gurus. Over the past few years I’ve spent a lot of time reading articles, watching videos and listening to podcasts from some of the best investing minds in the world. Names like Joel Greenblatt, Mohnish Pabrai, Warren Buffett, Charlie Munger, … Read More

Deep Value Large Cap Gem – Lear Corporation $LEA

(PHOTO: www.huffingtonpost.com) You have to love the Large Cap Deep Value Stock Screener here at The Acquirer’s Multiple (TAM). The Large Cap Deep Value Stock Screener shows the top 30 companies in The Acquirer’s Multiple® Large Cap 1000 universe, which is drawn from the largest 1,000 U.S. exchange-traded stocks and ADRs excluding financials and utilities.

1. We pick the 90 Best Deep Value Stock Picks

The Acquirer’s Multiple screeners examine the universe of US-listed stocks and ADRs to find the cheapest on the acquirer’s multiple, the name for the metric used by activists, private equity firms and corporate raiders to find deeply undervalued targets. How are the universes defined? We exclude stocks traded over-the-counter (OTC stocks), … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 27th, 2016” on Storify]

Johnny’s Real-Life Acquirers Multiple Portfolio – Update

OK, a few people have asked me what’s happening with my monthly updates for ‘Johnny’s Real-Life Acquirers Multiple Portfolio’ (AM Portfolio). For those of you that are unaware, I constructed my own AM Portfolio, using my own savings, here at The Acquirer’s Multiple starting in December of 2015. You can read all … Read More

The biggest problem in share investing, is you!

Huh! I don’t mean you as an individual, but you as a human being, when it comes to investing in shares. I’ve just finished reading a whole bunch of research from various sources which clearly show that human beings make terrible decisions when it comes to investing in shares. I … Read More

The Acquirer’s Multiple® Strategy Survey

The Acquirer’s Multiple® is the value ratio “acquirers”—buyout firms, activists, deep value investors—use to find undervalued stocks. As Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations shows undervalued companies trading on a low acquirer’s multiple tend to be good targets for investment. We Need Your Help We’d like to … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 20th, 2016” on Storify]

How can individual investors beat institutional investors

I know what you’re thinking! How can one retail investor sitting at home with a laptop and an online brokerage account possibly get better returns than a institutional investor? To answer this question, we first need to understand what an institutional investor is. An institutional investor is an organisation whose … Read More

MIND C.T.I. Ltd. strong balance sheet, undervalued micro cap

This week the ‘Small and Micro Cap’ screener uncovered a little gem called MIND C.T.I. Ltd. (NASDAQ:MNDO) MIND CTI is a leading provider of convergent end-to-end prepaid/postpaid billing and customer care product based solutions for service providers as well as unified communications analytics and call accounting solutions for enterprises. Last week the … Read More

Is Home Bias Hurting Your Portfolio?

One of the things that stops some investors from using The Acquirer’s Multiple investment strategy is that they’re based outside of the United States and are unsure about investment in the US shares provided by the ‘screens’ on this website. Like you, I’m not based in the United States. I’m … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 13th, 2016” on Storify]

Here’s why I prefer The Acquirer’s Multiple over The Discounted Cash Flow Model, for valuation

People often ask me why I use the mechanical method of investing provided by The Acquirer’s Multiple versus The Discounted Cash Flow Model. The answer can be found in this excerpt from the book, Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations, written by the founder … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning June 6th, 2016” on Storify]

Here’s why First Solar is one of the best picks in The Large Cap Screener $FSLR

If you’re like me, you believe that as ageing coal power plants are decommissioned, there’s enormous potential for renewable energy, and utility-scale PV (photovoltaic solar energy solutions) in particular. One company filling this void of providing clean and affordable electricity is First Solar, Inc. (NASDAQ:FSLR). If you want to learn … Read More