Here’s a great little video in which Charles Munger is discussing why investing in shares is better than investing in real estate. Munger says: “The trouble with real estate is that everybody else understands it, and the people who you’re dealing with and competed with, they’ve specialized in a little … Read More

Forbes: Contrary To Popular Belief, Value Investing Is Not Dead

Here’s a great article at Forbes discussing the recent performance of value investing saying: “However, a hundred years worth of data says value investing works. One cycle doesn’t change that.” Here’s an excerpt from that article: Many people think value investing is dead. It’s not. Style leadership rotates across cycles. Also, adjusting … Read More

Peter Lynch: 27 Timeless Investing Lessons

We’ve just been re-reading Peter Lynch’s classic book – One Up On Wall Street. In it, Lynch provides 27 timeless investing lessons. Here’s an excerpt from the book: Sometime in the next month, year, or three years, the market will decline sharply Market declines are great opportunities to buy stocks in … Read More

Jeremy Grantham: 4 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Our Book Recommendations for Investors Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That … Read More

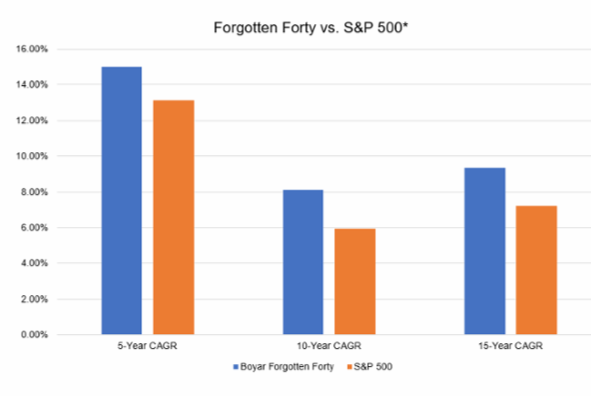

$500 Off Boyar’s Forgotten Forty Report: Special Offer for Acquirers Multiple Readers

Each year, Boyar Research publishes their Forgotten Forty Report featuring the forty stocks that they believe have the greatest potential for capital appreciation in the year ahead due to a catalyst they see on the horizon. To give you an example, Boyar have provided our readers with sample reports from … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Price, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

This Week’s Best Investing Reads 12/14/2018

Here’s a list of this week’s best investing reads: Why Small Habits Make a Big Difference (Farnam Street) Normal Accidents in the Stock Market (A Wealth of Common Sense) Mind the Gap (Humble Dollar) CNBC’s full interview with Paul Tudor Jones (CNBC) Asset Owners Are Falling Out of Love With Index Funds (Institutional Investor) Rational vs. Reasonable (Collaborative … Read More

Charlie Munger: I Made Four Or Five Hundred Million Dollars From Two Decisions, With Almost No Risk

In this short interview Charles Munger explains how he made four or five hundred million dollars from just two decisions: “I talked about patience. I read Barron’s for fifty years. In fifty years I found one investment opportunity in Barron’s. I made about $80 Million, with almost no risk. I … Read More

Shareholder Activism Is On The Rise: Caution Required

Here’s a great article at Forbes about a new generation of activist shareholders: Historically, large institutional investors pursued purely financial strategies and kept a low profile in governance. This may no longer be the case. In a manner vaguely reminiscent of the corporate raiders of the 1980s, a new generation … Read More

Aswath Damodaran: The Inverted Yield Curve: Is There A Signal In The Noise?

Here’s a short presentation by Aswath Damodaran on the recent inverted yield curve and whether there is a signal in the noise. He writes: On December 4, 2018, the yield on a 5-year US treasury dropped below the yields on the 2-year and 3-year treasuries, causing a portion of the … Read More

Jeremy Grantham: Investing Was So Much Easier 40 Years Ago

Here’s a great podcast with Jeremy Grantham chatting to Barry Ritzholt at Boomberg. When asked about the difference between investing forty years ago compared with today he said: “The world was so straight forward forty years ago. There was such a limit on the talent in the business. If you … Read More

James Montier: How To Protect Yourself From Wall Street’s ‘Self-Serving’ Biases

In his book – The Little Book of Behavioral Investing, James Montier wrote a great passage on how investors can identify and protect themselves from becoming victims of Wall Street’s self-serving biases. Here’s an excerpt from that book: So much for nature. Nurture also helps to generate the generally rose-tinted … Read More

George Soros: Q3 2018 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Ray Dalio: 20 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Hussman, Fisher Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Alexander Roepers: “Is It Time For Value Now?”

Here’s a great lecture with Alexander Roepers asking the question – “Is it time for Value now?”: Part 2: (Source: International Value Investing Conference)

This Week’s Best Investing Reads 12/7/2018

Here’s a list of this week’s best investing reads: Love, Happiness, and Time (Farnam Street) The Market Right Now Doesn’t Care How Fantastic Your Stocks Are (Vitaliy Katsenelson) The 80-Hour Workweek (A Wealth of Common Sense) Facebook Is Undervalued (Base Hit Investing) The Law of Large Numbers (The Irrelevant Investor) Why Smart People Are Vulnerable to Putting Tribe Before Truth (Scientific … Read More

Daniel Kahneman: The Trouble With Confidence

Here’s a great little video by Daniel Kahneman on the trouble with confidence. Kahneman makes the point that from a societal perspective confidence is generally very good, but from an individual’s point of view confidence is typically not always good. Here’s an excerpt from the video: Society rewards overconfidence. We … Read More

Seth Klarman Protege – David Abrams: Q3 2018 Top 10 Holdings

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Charles Munger: Why Did Ben Graham’s Net Nets Disappear

Just been re-reading Charles Mungers’ classic speech – A Lesson on Elementary, Worldly Wisdom As It Relates To Investment Management & Business. In it Munger provides some great insights into what happened to the net nets stocks popularized by Ben Graham. Here’s an excerpt from that speech: The second basic … Read More