Here’s a great interview with Bill Ackman on The Knowledge Project Podcast speaking about a number of really interesting topics including lessons he learned from Warren Buffett, saying: Question: What are some of the lessons that you’ve learned over the years from Warren Buffett and Charlie Munger? Ackman: So a … Read More

Ken Fisher: Top 10 Holdings (Q1 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Chris Bloomstran (SAI): One Reason Why Berkshire Doesn’t Pay Dividends

One of the best shareholder letters provided to investors is the one from Chris Bloomstran at Semper Augustus Investments (SAI). In his latest 2019 year end letter he provided an incredibly detailed fifty plus page analysis on Berkshire Hathaway with topics including: BERKSHIRE HATHAWAY: THE SKY IS FALLING 69 Interval … Read More

Why Is Warren Buffett Selling Stocks Down Under 10%

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed some reasons Why Warren Buffett Is Selling Stocks Down Under 10%. Here’s an excerpt from the episode: Tobias Carlisle: Yeah. Let’s talk about WEB and his kind of perplexing maneuver. So biggest- Bill Brewster: We’re … Read More

Dealing With The Long-Term Consequences Of Moth-Balling A Business For Months

During his recent interview with Tobias, Brent Beshore, Founder & CEO of Permanent Equity, and author of The Messy Marketplace: Selling Your Business in a World of Imperfect Buyers, discussed Dealing With The Long-Term Consequences Of Moth-Balling A Business For Months. Here’s an excerpt from the interview: Tobias Carlisle: You’ve got a reasonably … Read More

Jeffrey Gundlach: A Retest Of The Market Low Is ‘Very Plausible’

Here’s a great interview with Jeffrey Gundlach in which he discusses why a retest of the market low is ‘very plausible’. Here’s an excerpt from the interview: Question: You think… is that now off the table? Is it off the table now, retesting the low because of the Fed? Gundlach: … Read More

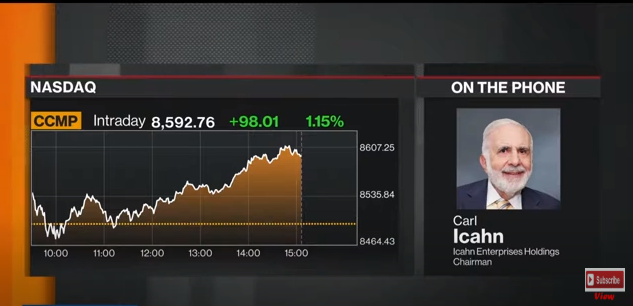

Carl Icahn: The Best Opportunities Ahead Are In Graham And Dodd Type Stocks

Here’s a great interview with Carl Icahn on CNBC in which he states that the best opportunities ahead will be in Graham and Dodd type stocks saying: I think that you will see some great opportunities ahead. But mostly I think rather than in these… in these technology stocks, and … Read More

Making Sense Of FWONK’s/FWONA’s Latest Transactions

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Making Sense Of FWONK’s/FWONA’s Latest Transactions. Here’s an excerpt from the episode: Tobias Carlisle: Well, just like every value manager out there, this podcast has gone full macro. So let’s do some micro for a … Read More

Finding Good Companies That Are Available For Sale

During his recent interview with Tobias, Brent Beshore, Founder & CEO of Permanent Equity, and author of The Messy Marketplace: Selling Your Business in a World of Imperfect Buyers, discussed Finding Good Companies That Are Available For Sale. Here’s an excerpt from the interview: Tobias Carlisle: How are you sourcing the deals that … Read More

(Ep.64) The Acquirers Podcast: Brent Beshore – Baby Buffett, How Permanent Equity Is Building The Next Berkshire

In this episode of The Acquirer’s Podcast Tobias chats with Brent Beshore, Founder & CEO of Permanent Equity, and author of The Messy Marketplace: Selling Your Business in a World of Imperfect Buyers. During the interview Brent provided some great insights into: Finding Good Companies That Are Available For Sale The … Read More

This Week’s Best Investing Articles, Research, Podcasts 4/24/2020

Here’s a list of this week’s best investing reads: Who Pays For This? (Collaborative Fund) Do We Need to Worry About Government Debt? (A Wealth of Common Sense) She’s the Boss of Her Money: Four Trends in Women’s Online Investing (CFA Institute) The Art of Survival (Ian Cassel) A Historic Opportunity in Small Cap … Read More

Self Organized Criticality And How It Applies To Markets

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Self Organized Criticality And How It Applies To Markets. Here’s an excerpt from the episode: Jake Taylor: Yeah, sure. So there’s this Danish theoretical physicist whose name is Per Bak, shortest name on record I … Read More

Stock In Focus – TAM Stock Screener – Saga Communications, Inc. (NASDAQ: SGA)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Saga Communications, Inc. (NASDAQ: SGA). Saga Communications Inc is engaged in … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Pzena, Price Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

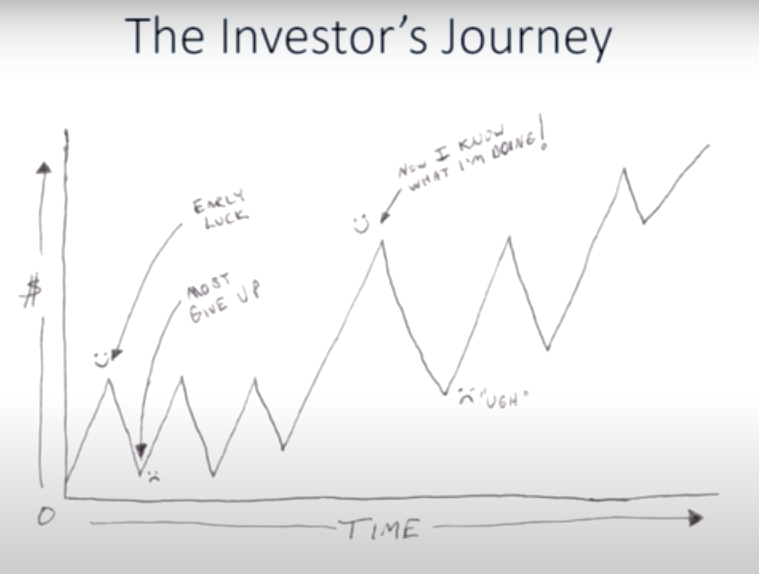

Ian Cassel: 7 Lessons For Surviving As An Investor

Ian Cassel recently provided a great keynote presentation titled – “The Art of Survival” from the Planet MicroCap Showcase hosted by @BobbyKKraft. During the presentation Ian provided his seven lessons for surviving as an investor: Cash Is King Cut Your Ego And Cut Expenses Control Your Emotions Create Your Wish List/Buy … Read More

Chris Cole: The Law Of Cosmic Duality In Investing

Here’s a great interview with Chris Cole, founder of Artemis Capital, on the MacroVoices Podcast in which he discusses a number of topics including his counterintuitive concept called – The Law Of Cosmic Duality In Investing. Here’s an excerpt from the interview: Erik: Chris, one of the concepts that you … Read More

VALUE: After Hours (S02 E16): Warren Buffett’s Selling, Sand Pile Criticality, and FWONK / FWONA

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Self Organized Criticality And How It Applies To Markets Making Sense Of FWONK’s/FWONA’s Latest Transactions Why Is Warren Buffett Selling Stocks Down Under 10% Will We See A New Bottom Later This Year? Japan’s Warren … Read More

The Best Companies To Buy Are ‘New Zealand’ Type Businesses

During his recent interview with Tobias, Andrew Wilkinson, co-founder of Tiny, discusses why the best companies to buy are ‘New Zealand’ type businesses. Here’s an excerpt from the interview: Tobias Carlisle: How do you think about valuation? How does that play out? The private multiples used to be much, much lower. … Read More

Howard Marks: Lower Lows Ahead In The Stockmarket

In a recent interview with CNBC Howard Marks provided his thoughts on the short term future for the stock market saying: “We’re only down 15% from the all-time high of Feb. 19,” Marks, co-founder of Oaktree Capital Management, said Monday on CNBC’s “Halftime Report.” But “it seems to me the … Read More

One Stock Superinvestors Are Buying Or Holding (9)

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More