One of the firms we follow closely here at The Acquirer’s Multiple is that of Whitney Tilson at Empire Financial Research. In his latest piece Tilson provides some fascinating research from his colleague Enrique Abeyta on what history tells us to do when the S&P 500 falls more than 5% … Read More

The Two Big Advantages For The Individual Investor

During his recent interview with Tobias, Mark Simpson, author of Excellent Investing: How to Build a Winning Portfolio, and manager of Danger Capital, discussed the two big advantages for the individual investor. Here’s an excerpt from the interview: Mark Simpson: And I think there’s probably two advantages or probably only … Read More

VALUE: After Hours (S02 E08): Buffett Buys $SPY, Charlie Munger Dunks on Bill, The $DJCO Experience

Summary In this episode of the VALUE: After Hours Podcast, The Three Amigos Of Investing Taylor, Brewster, and Carlisle chat about: Why Is Warren Buffett Buying S&P 500 EFT’s? Daily Journal Corp Meeting Notes 2020 Ian Cassel – Will Berkshire & DJ Corp Annual Meetings Become Ghost Towns Without Buffett … Read More

Michael Burry: Top 10 Holdings (Q4 2019)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Howard Marks: Can You Strap Yourself In For The Long Term Regardless Of What Happens Tomorrow

During his recent interview on CNBC Howard Marks was asked his thoughts on investor psychology as the market briefly tumbled 1011 points due to coronavirus fears. Marks provided some great insights into the importance of thinking like an investor in periods of uncertainty. Here’s an excerpt from the interview: Scott … Read More

How To Avoid Investment Fads, Frauds And Failures

During his recent interview with Tobias, Mark Simpson, author of Excellent Investing: How to Build a Winning Portfolio, and manager of Danger Capital, discussed How To Avoid Investment Fads, Frauds And Failures. Here’s an excerpt from the interview: Tobias Carlisle: Oh, yeah. It’s out of my hands. So I’ve already … Read More

What Can We Learn From Capital Spectator’s – 700-Year Decline In Interest Rates

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Capital Spectator’s – 700-Year Decline In Interest Rates. Here’s an excerpt from the episode: Tobias Carlisle: Well, I like those points. I think we’ve got to move on just for time. My topic, Capital Spectator … Read More

Warren Buffett: Investors Think Stocks Are Different To Other Investments Because They Can Make Decisions Every Second On Stocks

During his recent CNBC interview with Becky Quick, Warren Buffett explained that the reason investors treat stocks differently to other investments is because they can make decisions every second with stocks. Here’s an excerpt from the interview: In 1932 General Motors had 19,000 dealers. That’s more than all the auto … Read More

Michael Burry: Top Buys, Top Sells (Q4 2019)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Behavioral Biases And How To Overcome Them

During his recent interview with Tobias, Mark Simpson, author of Excellent Investing: How to Build a Winning Portfolio, and manager of Danger Capital, discussed Behavioral Biases And How To Overcome Them. Here’s an excerpt from the interview: Tobias Carlisle: It’s very difficult because Ian Cassel, who we were talking about … Read More

Marathon Asset Management and Capital Account

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Marathon Asset Management and Capital Account. Here’s an excerpt from the episode: Bill Brewster: I’m going to slip my topic in here real quick because it’s a long conversation. And Jake’s got to go. But like … Read More

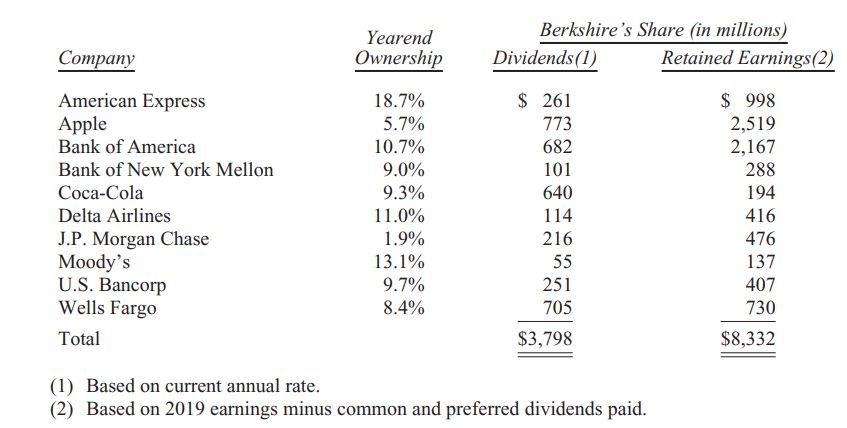

BRK 2019 Annual Report – The Power Of Retained Earnings

Warren Buffett recently released his Berkshire Hathaway Annual Report 2019. One of the key take-aways from the letter is Berkshire’s ongoing focus on the power of retained earnings from the companies in which Berkshire invests. Here’s an excerpt from the letter: At Berkshire, Charlie and I have long focused on … Read More

(Ep.54) The Acquirers Podcast: Mark Simpson – Danger Man, Avoiding Behavioral Errors, Investor Personality Types And Common Mistakes

In this episode of The Acquirer’s Podcast Tobias chats with Mark Simpson. He’s the author of Excellent Investing: How to Build a Winning Portfolio, and the manager of Danger Capital. During the interview Mark provided some great insights into: The Two Big Advantages For The Individual Investor Which Is The … Read More

TAM Stock Screener – Stocks Appearing In Greenblatt, Dalio, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Articles, Research, Podcasts 2/21/2020

Here’s a list of this week’s best investing reads: Never Has a Venial Sin Been Punished This Quickly and Violently! (Cliff Asness) The Biggest Problem in Finance? (A Wealth of Common Sense) Prisoner’s Dilemma: What Game Are you Playing? (Farnam Street) Levered Long (The Irrelevant Investor) Predictability in Times of Crisis … Read More

Tom Gayner On Position Sizing And Strategy

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Tom Gayner on position sizing and strategy. Here’s an excerpt from the episode: Jake Taylor: I’ll go first. I’m going to be talking today about this video that circulated on Twitter where Tom Gayner was discussing different … Read More

Dan Loeb: Latest Activist Positions

As a new weekly feature here at The Acquirer’s Multiple, we’re going to take a look at the latest activist positions from some of our favorite superinvestors based on their latest 13D/13G filings. Activist investors like Warren Buffett, Carl Icahn, David Einhorn, Bill Ackman, Paul Singer, Howard Marks. John Paulson, … Read More

The Golden Age In Duration

During his recent interview with Tobias, Dylan Grice, co-founder of Calderwood Capital Research, and author of the Popular Delusion Reports, discussed the golden age of duration. Here’s an excerpt from the interview: Tobias Carlisle: Last question and then I’ll let you go, but it’s sort of a bigger one. It … Read More

VALUE: After Hours (S02 E07): Gayner’s Sizing, 700 Year Decline In Rates And Marathon’s Capital Account

Summary In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Tom Gayner’s Take On Position Sizing And Strategy Marathon Asset Management and Capital Account What Can We Learn From Capital Spectator’s – 700-Year Decline In Interest Rates Ram Bhupatiraju – If You Like Everything … Read More

Warren Buffett: Top Buys, Top Sells

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More