In his book – The Dhandho Investor, Mohnish Pabrai explains how fear and greed are fundamental to human behavior and significantly influence stock market pricing. Extreme fear can cause irrational actions, likened to a panic in a crowded theater where everyone rushes for the exits, leading to a market crash. … Read More

Rob Vinall: Moats Are Becoming Less Relevant in a Fast-Changing Economy

During his recent presentation at the Value Investor Conference, Rob Vinall discusses the concept of economic moats in both static and dynamic economies. Historically, a wide moat was advantageous, ensuring stability and wealth, as seen with landowners 300 years ago. However, in today’s fast-changing economy, a wide moat can be … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Why Pod Shops Are Gaining Popularity Among Large Capital Pools

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Why Pod Shops Are Gaining Popularity Among Large Capital Pools, here’s an excerpt from the episode: Tobias: Do you want to explain what a pod shop is, and then what’s your thoughts? Jake: As if were five years old. [laughter] … Read More

Howard Marks: Unveiling the Two Key Skills of Masterful Investors

In his book – Mastering the Market Cycle, Howard Marks argues that truly successful investors are neither overly aggressive nor defensive. They excel at both market timing and picking good investments. This “asymmetrical performance” means they have a higher win rate than the market. Most investors can’t do this, and … Read More

Warren Buffett: The Futility of Following Public Opinion in Stocks

During the 1994 Berkshire Hathaway Annual Meeting, Warren Buffett advises against making investment decisions based on others’ opinions, highlighting the irrelevance of public opinion polls in achieving financial success. Instead, he advocates for personal evaluation of businesses. He and Charlie Munger ignore market predictions and analyst opinions, focusing instead on … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Finding Value in Optically Expensive Stocks: A Deep Dive

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Finding Value in Optically Expensive Stocks: A Deep Dive, here’s an excerpt from the episode: Matthew: Concentrated value. It’s a short version of that. It’s typically around 15 stocks. I think I’ve been as high as 20 and as few … Read More

Warren Buffett: We All Make Mistakes: Not Everything Works Out As Planned

In his 2013 Berkshire Hathaway Annual Letter, Warren Buffett discusses the diverse range of companies in Berkshire Hathaway, from those with exceptional profitability to those with poor returns due to his misjudgments. Fortunately, his major acquisitions have generally been successful. Overall, the companies employed $25 billion of net tangible assets … Read More

Bob Robotti: Passive Fund Flows Have Created Many Stock Picking Opportunities

During his recent presentation at the Value Investor Conference 2024, Bob Robotti explains why the passive flow of funds has created investment opportunities by diverting attention away from individual stock research. Investors are focused on indices and speculative patterns, neglecting bottom-up stock analysis. Many companies, especially in overlooked industries, are … Read More

Stanley Druckenmiller – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E23): Matthew Sweeney on Laughing Water’s Boutique Concentrated Value Strategy

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Matt Sweeney discuss: Finding Value in Optically Expensive Stocks: A Deep Dive Why Pod Shops Are Gaining Popularity Among Large Capital Pools Why Biologic Drugs Are the Future: A Look at Industry Trends Exploring Fishbone … Read More

Microsoft Corp (MSFT) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Microsoft Corp (MSFT). Profile Microsoft develops and licenses consumer … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (06/07/2024)

This week’s best investing news: Value Investing: Down But Not Out? With David Einhorn (Money Maze) Bill Ackman sells 10% stake in Pershing Square for $1.05bn (FT) Quantifying Warren Buffett (Validea) Michael Mauboussin – Stock Market Concentration (MS) Meme Stonks Revisited (Verdad) Interview with Terry Smith of Fundsmith: Valuation Is … Read More

Why Dell Technologies Inc (DELL) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Dell Technologies Inc (DELL) Dell Technologies is a broad information technology … Read More

Navigating Public Markets with a Private Equity Mindset

During their recent episode, Taylor, Carlisle, and Robert G Hagstrom discussed Navigating Public Markets with a Private Equity Mindset, here’s an excerpt from the episode: Robert: I’m not going to be the dog chasing the tail that never catches the tail. So, let’s own good businesses, and I will tell … Read More

George Soros: A Contrarian Approach to Trend Following and Market Inefficiencies

In his book – Soros on Soros, George Soros says he is a contrarian investor who is cautious about going against the herd. He follows trends most of the time but looks for inflection points where trends may reverse. His approach assumes markets are wrong, allowing him to identify flaws … Read More

Warren Buffett: Invest in Commercial “Cash Cows” for Compounding Returns

In his 2011 Berkshire Hathaway Annual Letter, Warren Buffett explains why he advocates for investing in productive assets like businesses, farms, and real estate that can retain purchasing power during inflation while requiring minimal new capital investment. He highlights companies like Coca-Cola, IBM, and See’s Candy as meeting this criteria. Buffett … Read More

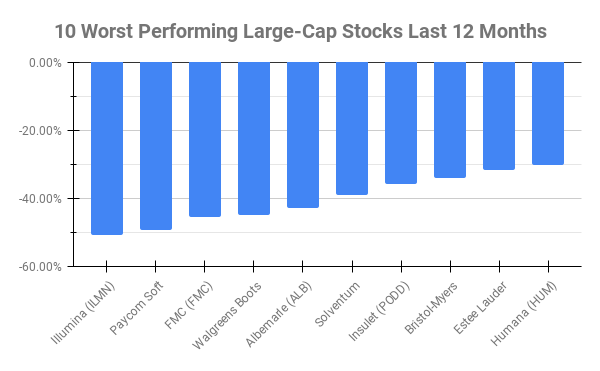

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Illumina (ILMN) -50.97% Paycom Soft (PAYC) -49.28% FMC (FMC) -45.64% Walgreens Boots Alliance (WBA) -45.01% Albemarle (ALB) -42.92% Solventum … Read More

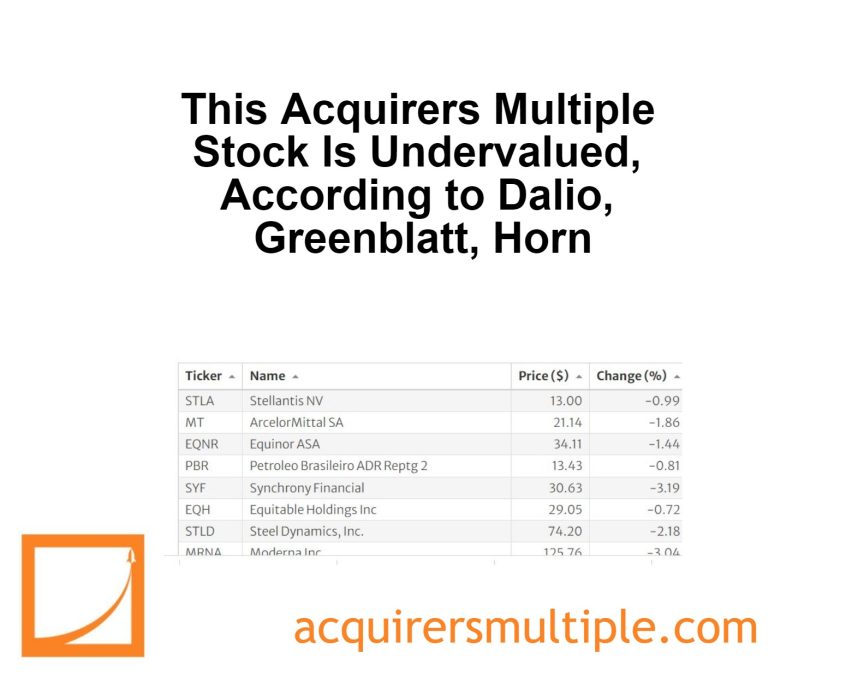

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Greenblatt, Horn

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More