During their recent episode, Taylor, Carlisle, and Robert G Hagstrom discussed How Isaac Asimov’s Theories on Creativity Can Inspire Modern Innovation, here’s an excerpt from the episode: Tobias: Should we do veggies at the top of the art, JT? Jake: Absolutely. So, knowing that Robert was coming on, one of … Read More

Mohnish Pabrai: Mastering the Odds for Outsized Returns

In his book – The Dhando Investor, Mohnish Pabrai advocates investing like playing blackjack – bet heavily when the odds are overwhelmingly in your favor. His “Dhandho” approach involves finding a temporarily distressed but good business with a durable moat, within your circle of competence. Determine its intrinsic value 2-3 years … Read More

Warren Buffett: Avoid High-Risk Industries Despite Exciting Products

In his 2009 Berkshire Hathaway Annual Letter, Warren Buffett explains that he and Charlie Munger avoid investing in businesses with uncertain futures, even if their products seem exciting. Historical examples like the auto industry in 1910, aircraft in 1930, and television sets in 1950, showed significant growth but intense competition … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

How to Apply Buffett’s Snickers Bar Analogy to Investing

During their recent episode, Taylor, Carlisle, and Robert G Hagstrom discussed How to Apply Buffett’s Snickers Bar Analogy to Investing, here’s an excerpt from the episode: Robert: Yeah. It was brilliant. It’s a brilliant thing that said. And so, Lou Simpson said it in a slightly different way. He says, … Read More

Warren Buffett: We Curate the Metropolitan Museum of Businesses

During the 2000 Berkshire Hathaway Annual Meeting, Buffett provides a story about Jack Ringwalt from 1967. He asked Ringwalt whether he preferred to sell his business, which he lovingly built, or risk it being mishandled after his death. By positioning Berkshire Hathaway as a “museum” where businesses are respected and … Read More

Terry Smith: The Quality of a Company Is More Crucial Than Its Valuation

During this interview with The Market NZZ, Terry Smith explains why the quality of a company is more crucial than its valuation. By examining historical data, he demonstrates that even if investors had paid high price-to-earnings (P/E) ratios for certain quality companies they would still have outperformed the S&P 500 … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Buffett’s Purposeful Detachment from the Stock Market

During their recent episode, Taylor, Carlisle, and Robert G Hagstrom discussed Buffett’s Purposeful Detachment from the Stock Market, here’s an excerpt from the episode: Tobias: What is The Warren Buffett Way in the book, The Warren Buffett Way. What’s your conception about that Robert: Well, yeah, it is– Warren has … Read More

Howard Marks: Why Overconfidence in Investing Is Dangerous

In his book – The Most Important Thing, Howard Marks highlights the importance of recognizing the limits of our knowledge in investing. If the future were certain, it would be rational to invest aggressively, targeting the biggest winners without fear of loss, making diversification unnecessary. However, because the future is … Read More

Warren Buffett: Investing Like Rip Van Winkle: A Guide to Long-Term Gains

In his 1989 Berkshire Hathaway Annual Letter, Warren Buffett explains that long-term investing, like his Rip Van Winkle approach, has a significant advantage due to tax timing. By comparing two scenarios, he shows that reinvesting after annual taxes over 20 years yields about $25,250, while a single long-term investment grows … Read More

Howard Marks – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E22): Robert G Hagstrom On The Warren Buffett Way And The Art Of Value

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Robert G Hagstrom discuss: Buffett’s Purposeful Detachment from the Stock Market How to Apply Buffett’s Snickers Bar Analogy to Investing How Isaac Asimov’s Theories on Creativity Can Inspire Modern Innovation Navigating Public Markets with a … Read More

Alphabet Inc (GOOG) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Alphabet Inc (GOOG). Profile Alphabet is a holding company. … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (05/31/2024)

This week’s best investing news: Mohnish Pabrai VALUEx BRK 2024 (Guy Spier) Ray Dalio’s Principles of Investing in a Changing World (WSJ) Inside the Investment Strategy of John Neff (Validea) Why Did Warren Buffett Buy Chubb? (Forbes) Where the Value Investing Strategy Still Works (Verdad) Daily Journal: The Canary in … Read More

Investing as a Form of Addiction: The Thrill of the Chase

During their recent episode, Taylor, Carlisle, and Bares discussed Investing as a Form of Addiction: The Thrill of the Chase, here’s an excerpt from the episode: Jake: I think Viktor Frankl had this great quote about, “When a man can’t find, or woman, I guess, can’t find meaning in their … Read More

Why Philip Morris International Inc (PM) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Philip Morris International Inc (PM) Philip Morris International is an international … Read More

Warren Buffett: Financial Deception: How Small Deceptions Lead To Habitual Dishonesty

In his 1998 Berkshire Hathaway Annual Letter, Warren Buffett critiques corporate manipulation of financial results using a humorous golf metaphor. He describes a golfer who records atrocious scores initially, then claims to “restructure” their swing and counts only good scores in subsequent rounds, thus masking true performance. Another tactic involves … Read More

Joel Greenblatt: How Emotional Investing Hurts Your Returns

In his book – Common Sense: The Investor’s Guide to Equality, Opportunity, and Growth, Joel Greenblatt highlights a broader trend illustrated by the best-performing U.S. stock mutual fund of the 2000s, which achieved an annual return of over 18 percent. However, due to poor timing—investors withdrawing during downturns and investing after … Read More

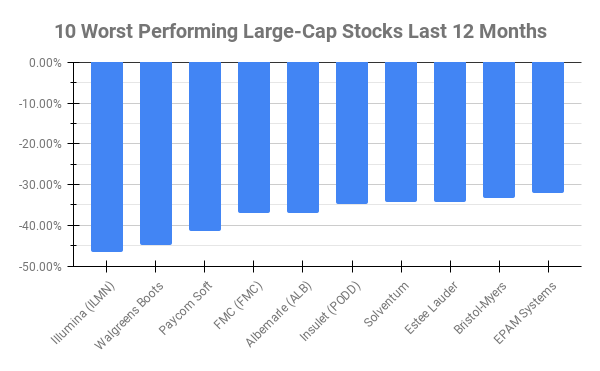

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Illumina (ILMN) -46.47% Walgreens Boots Alliance (WBA) -44.74% Paycom Soft (PAYC) -41.33% FMC (FMC) -37.05% Albemarle (ALB) -36.98% Insulet … Read More