This week’s best investing news:

Value Investing: Down But Not Out? With David Einhorn (Money Maze)

Bill Ackman sells 10% stake in Pershing Square for $1.05bn (FT)

Quantifying Warren Buffett (Validea)

Michael Mauboussin – Stock Market Concentration (MS)

Meme Stonks Revisited (Verdad)

Interview with Terry Smith of Fundsmith: Valuation Is Not as Important as Quality (Fundsmith)

Canadian billionaire Prem Watsa to step down as Fairfax India chairman (Globe & Mail)

Karen Karniol-Tambour on Where to Find Diversification, Handling Geopolitical Risk, and AI (Bridgewater)

Ackman to sell stake in Pershing Square ahead of planned IPO (AFR)

A Conversation with Citadel CEO Ken Griffin | Milken Institute Global Conference 2024 (Milken)

You Bought Gold at Costco. What Are the Taxes When You Sell It? (WSJ)

On the Legacy of Danny Kahneman (AB)

Warren Buffett’s son Howard Buffett on his life as the potential next chairman of Berkshire Hathaway (Yahoo)

Keith Gill’s GameStop Trades Pose Conundrum for Market Cops (WSJ)

How This 92-Year-Old Money Manager Became One Of America’s Richest Self-Made Women (Forbes)

Jeffrey Sherman, DoubleLine Deputy CIO (MiB)

We fought Stein’s Law… (Havenstein)

William Sharpe – Ivey Business School (Ivey)

Stock Picking with a Rifle, Ferrari, Druckenmiller’s Nvidia Bet, & A Very Long Hill (Investment Talk)

Stocks for the Long Run? Setting the Record Straight (CFA)

Fish and Grits (Humble Dollar)

When Past Performance Doesn’t Even Predict Past Performance (WSJ)

The Short Vol Trade Is Back! (Felder)

This week’s best value Investing news:

Value and Growth: The Indivisible Dichotomy (Franklin Templeton)

Value Investing Strategies for the Current Market (Nasdaq)

Market is RIGHT, Value Investing is the WRONG BET! (Sven Carlin)

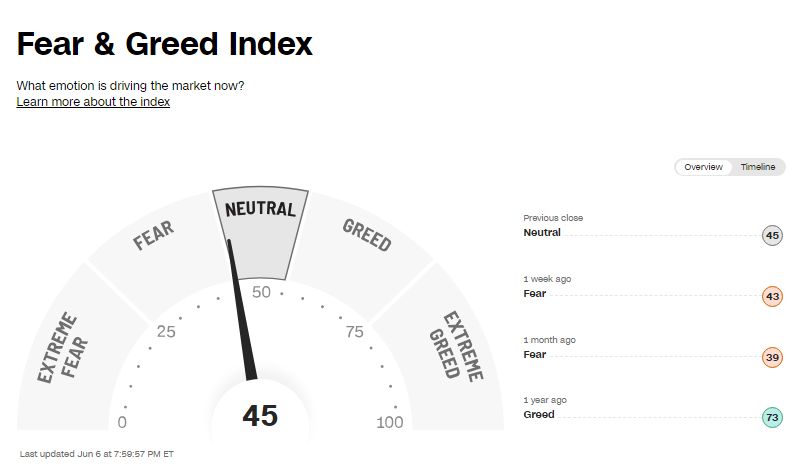

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Adam Sandow – The Power of Print Media (ILTB)

KraneShares’ Brendan Ahern on China’s Economic Landscape: Is It Still Investable? (Meb Faber)

Charles Lemonides – ValueWorks (Business Brew)

Keith Lee: ‘We Think Revenues Are a Better Indicator of Size Than Market Capitalization’ (Long View)

Are you wasting 11% of your salary? (Equity Mates)

The Value Perspective with Joe McDonnell (Value Perspective)

Bill Chen on Public Equity Investing in Real Estate (Part 2) (TWIII)

Small-Cap Value Opportunities (Guest: Tucker Scott) (Market Huddle)

Stock Market Expectations Getting Ahead of Economic Realities: Bob Elliott (CIP)

WTT: The Investment Manager Playbook – What Allocators Don’t See (Capital Allocators)

Chris Geczy: Unpacking the Role of AI in Finance (Enterprising Investor)

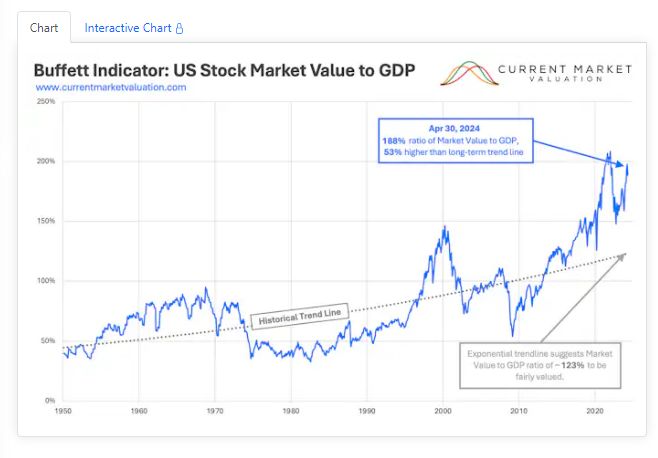

This week’s Buffett Indicator:

Overvalued

This week’s best investing research:

Quality, Factor Momentum, and the Cross-Section of Returns (AlphaArchitect)

Let’s Find The Next $100B Company (ASC)

Gold and Inflation: An Unstable Relationship (CFA)

A Hard-To-Beat Strategy (PAL)

This week’s best investing tweet:

This is a preview of @JohnHuber72’s latest article. I loved every word of it. Every word. It also has a nice shout-out to @davidein … pic.twitter.com/2JXwh8gJwe

— John Rotonti Jr (@JRogrow) June 6, 2024

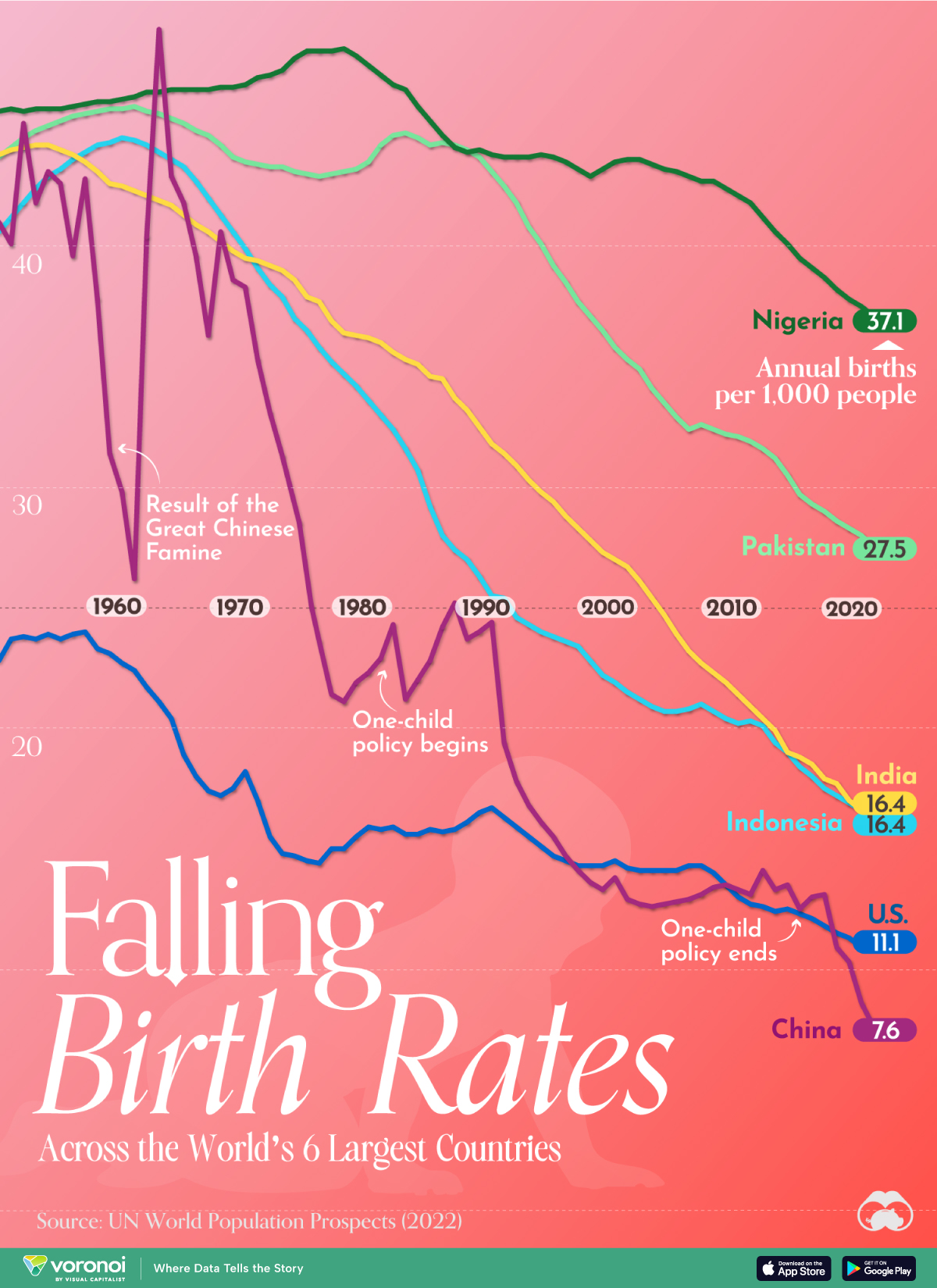

This week’s best investing graphic:

Charted: Declining Birth Rates in the Most Populous Countries (1950-Today) (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: