During this interview with WSJ, Ray Dalio emphasizes the importance of financial security and diversification. He advises first establishing financial immunity to unexpected job loss by securing essential funds. Next, focus on achieving real returns and diversifying investments. Dalio highlights the significance of finding 15 good, uncorrelated return streams to … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Case for a “Small-Cap Summer”

During their recent episode, Taylor, Carlisle, and Brewster discussed The Case for a “Small-Cap Summer”, here’s an excerpt from the episode: Tobias: It took me a little bit of time to read my writing here, but smalls have been hosed. Smalls are back to the 2020 lows relative to the … Read More

Francis Chou: Key Strategies for Successful Value Investing

During this presentation at the Ivey Business School Value Investing Program 2024, Francis Chou emphasizes the principles of value investing, highlighting that success in both bonds and equities stems from selecting companies based on their intrinsic worth rather than their market price. He explains that even underperforming companies, which he … Read More

Bill Nygren: How Value Investing Has Changed In Our Knowledge-Based Economy

During his recent interview with Morningstar Magazine, Bill Nygren discusses value investing, emphasizing paying prices significantly below a company’s business value. He critiques traditional metrics like price/book or P/E ratios, noting their diminishing relevance in today’s knowledge-based economy. GAAP accounting’s conservatism often misrepresents modern investments, such as customer acquisition and … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Can Berkshire’s Investing Lieutenants Carry the Mantle?

During their recent episode, Taylor, Carlisle, and Brewster discussed Can Berkshire’s Investing Lieutenants Carry the Mantle?, here’s an excerpt from the episode: Tobias: Let’s go to Berkshire. Berkshire has this huge cash. Didn’t deploy any in the 2020 drawdown. Just now packed to the gills with cash. Jake: It might … Read More

Seth Klarman: The Size Disadvantage For Large Institutional Investors

In his book – Margin of Safety, Seth Klarman explains why major money management firms focus on large-capitalization securities, as analyzing smaller companies isn’t justifiable due to the modest investment amounts involved. For instance, a manager of a $1 billion portfolio may invest $50 million in each of twenty stocks, … Read More

Jim Chanos: The Best Investment Strategy For Speculative Markets

During his recent interview with Bloomberg, Jim Chanos observes that the current market is as speculative as early 2021, the most speculative period he’s seen in 45 years. He points to the resurgence of meme stocks and SPACs as evidence. Chanos notes Wall Street’s ability to generate financial products irrespective … Read More

Ray Dalio – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E24): Bill Brewster’s back on Roaring Kitty, $NVDA, $TSLA, Isotopes, Small Caps

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Bill Brewster discuss: Can Berkshire’s Investing Lieutenants Carry the Mantle? The Case for a “Small-Cap Summer” Is AI Worth the Environmental Cost? Does Making Money Excuse Bad Corporate Governance? From Isotopes to Investing: An Unconventional … Read More

Netflix Inc (NFLX) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Netflix Inc (NFLX). Profile Netflix’s relatively simple business model … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (06/14/2024)

This week’s best investing news: Howard Marks Interview (In Good Company) Conversation with Bridgewater Associates’ Founder, Ray Dalio (Milken) A Changing Yield Curve Signal (Verdad) Third Avenue’s Matt Fine: Time to invest like a young Buffett in 1999 (CityWire) 15 Lessons from 15 Years (Validea) Interview with Caroline Cai of … Read More

Why eBay Inc (EBAY) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: eBay Inc (EBAY) eBay operates one of the largest e-commerce marketplaces … Read More

Exploring Fishbone Diagrams: A Visual Tool for Root Cause Analysis

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Exploring Fishbone Diagrams: A Visual Tool for Root Cause Analysis, here’s an excerpt from the episode: Tobias: It’s the top of the hour, which means that it’s time for Jake Taylor’s veggies. Mark it down, 11:03 on the 33 minutes. … Read More

Warren Buffett: The Hidden Costs of High Stock Market Activity

In his 1983 Berkshire Hathaway Annual Letter, Warren Buffett criticizes the high activity in the stock market, which brokers promote using terms like “marketability” and “liquidity.” He argues that frequent trading benefits brokers but not investors, as it incurs significant costs. Using a hypothetical company earning 12% on equity with … Read More

Howard Marks: The Six Key Principles for Successful Investing

During his recent interview on the In Good Company Podcast, Howard Marks outlines his six key principles for successful investing. Here’s an excerpt from the interview: My philosophy is I guess it’s Oaktree’s philosophy six very simple points. Number one risk control I believe it’s easy to make money in … Read More

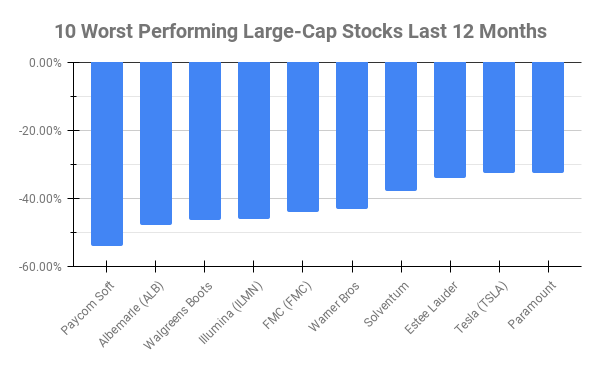

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Paycom Soft (PAYC) -54.21% Albemarle (ALB) -47.88% Walgreens Boots Alliance (WBA) -46.43% Illumina (ILMN) -46.02% FMC (FMC) -44.18% Warner … Read More

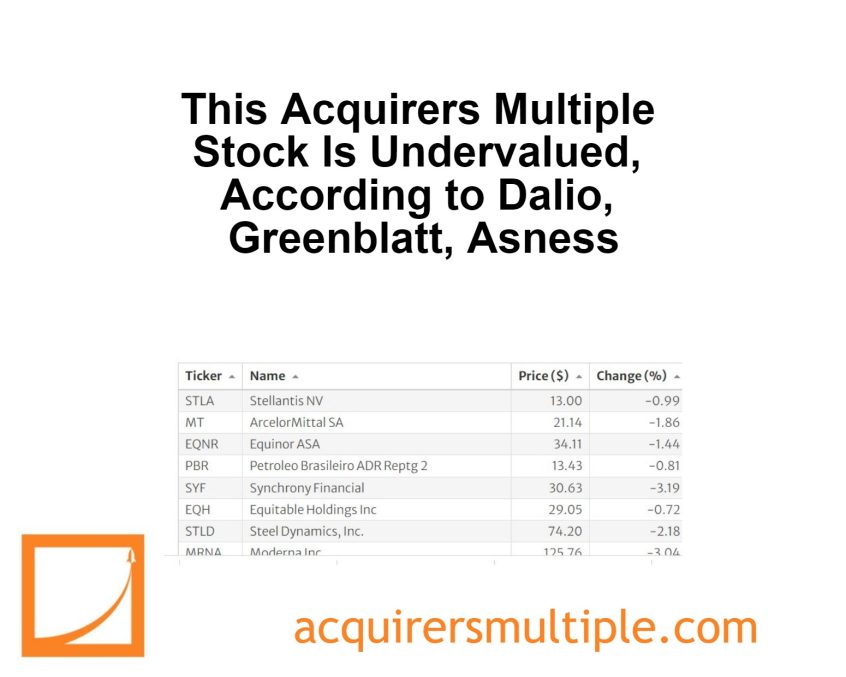

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Greenblatt, Asness

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Why Biologic Drugs Are the Future: A Look at Industry Trends

During their recent episode, Taylor, Carlisle, and Matt Sweeney discussed Why Biologic Drugs Are the Future: A Look at Industry Trends, here’s an excerpt from the episode: Tobias: Do you see any demand destruction? The sales are impacted as a result of the rates or just the general–? Like, does … Read More