Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Cliff Asness: Broken Markets: The Illusion of Control in Modern Financial Markets

During this interview with Bloomberg, Cliff Asness discusses the unpredictable nature of financial markets, reflecting on his experiences since 2002. He highlights how extreme events, like the tech bubble and COVID-19, challenge assumptions. Asness emphasizes the importance of understanding both severity and duration in investment pain, noting that prolonged downturns … Read More

Warren Buffett: How Edgar Lawrence Smith’s Insights Shaped My Investing Philosophy

In his 2019 Berkshire Hathaway Annual Letter, Warren Buffett discusses the lessons that he learned from Edgar Lawrence Smith’s “Common Stocks as Long Term Investments”, the crucial insight that well-managed companies retain and reinvest a portion of their profits, generating compound interest and increasing long-term value. This challenged the pre-Smith … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Bob Robotti: Why Active Stock-Pickers Will Dominate The Next Decade

During his recent interview on the RWH Podcast, Bob Robotti says that he recently hosted a dinner with value investors and former active managers who have transitioned to family offices. He referred to the gathering as the “restoration of the fallen,” inspired by Horace’s line from Graham’s “Security Analysis.” Robotti … Read More

Ray Dalio: The Top 3 Considerations When Diversifying Investments

During his recent presentation at The Greenwich Economic Forum, Ray Dalio discusses the importance of diversification across countries, asset classes, and currencies. He outlines three key factors for evaluating countries: financial health (whether the country earns more than it spends), an environment that promotes healthy competition and productivity, and the … Read More

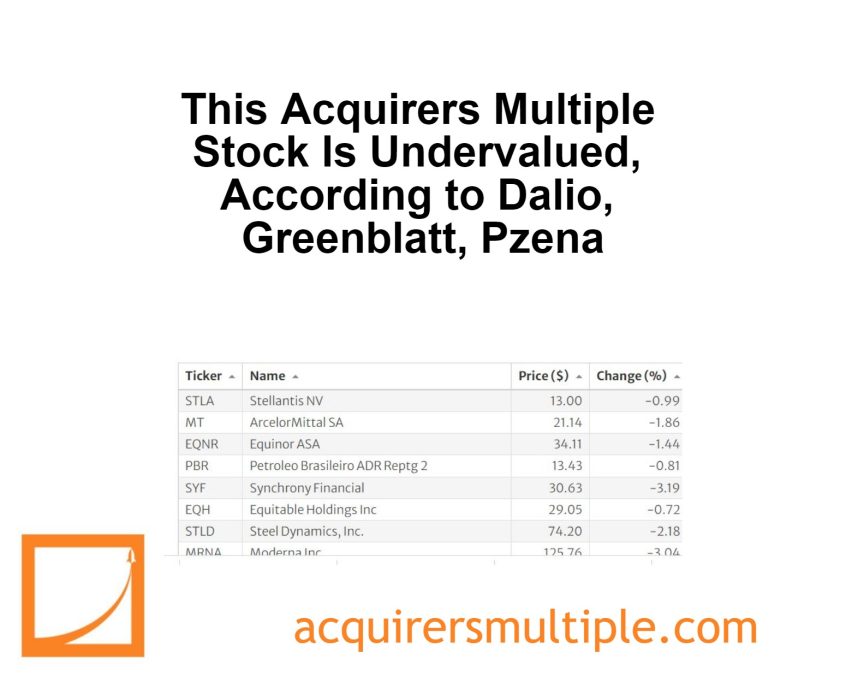

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Mohnish Pabrai: Why Debt-Free Companies Are the Best Investment Choice

During this presentation at The University of Nebraska, Mohnish Pabrai discusses his investment philosophy, emphasizing the importance of staying within one’s circle of competence. He mentions past investments in Maotai, Alibaba, and Tencent, noting their mixed results. Pabrai advocates for businesses that operate with zero debt, citing Berkshire Hathaway as … Read More

Howard Marks: Strategic Investing: Opportunities Outside the Mainstream

During this interview with Bloomberg, Howard Marks highlights the U.S economy’s swift recovery in the third quarter of 2020 despite stable interest rates and the absence of additional stimulus. He notes the robust performance of the labor market and investor confidence in the U.S, driven by its legal and economic … Read More

Michael Burry – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Visa Inc (V) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Visa Inc (V). Profile Visa is the largest payment … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (06/21/2024)

This week’s best investing news: Mohnish Pabrai’s Session at The University of Nebraska (MP) Bonus Episode: Howard Marks on “In Good Company” (HM) Ronald Olson – Partnership Lessons from Buffett-Munger (Bloomberg) Buffett’s Investment Evolution (WealthTrack) The Penny Stock Anomaly (Verdad) Francis Chou – 2024 Ivey Value Investing Classes Guest Speaker … Read More

Why Andersons Inc (ANDE) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Andersons Inc (ANDE) Andersons Inc is diversified company with its main … Read More

Some Stocks Trade Like Apartment Blocks And Others Like Rembrandts

During their recent episode, Taylor, Carlisle, and Brewster discussed Some Stocks Trade Like Apartment Blocks And Others Like Rembrandts, here’s an excerpt from the episode: Tobias: Speaking of big pay packages, what’s Musk’s chances of getting that across the line, do you think? What’s he got? Is it like $50 … Read More

Howard Marks: How to Gauge Where We Are In Any Market Cycle

In his book – Mastering the Market Cycle, Howard Marks emphasizes understanding market cycles through two key assessments: quantitative analysis of valuations and qualitative observation of investor behavior. Valuations aligned with historical norms suggest the cycle isn’t highly extended. Observing investor behavior provides additional insights. These assessments help gauge the … Read More

Warren Buffett: The 3 Ways Investors Self-Sabotage Their Returns

In his 2004 Berkshire Hathaway Annual Letter, Warren Buffett explained how in 2004, the stock market had a rare “normal” return of around 11.2%, a rate only seen once before in 35 years. Despite strong business performance making it theoretically easy to achieve high returns, many investors experienced poor results. … Read More

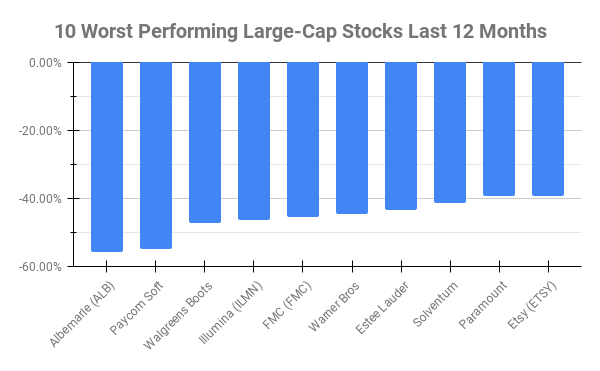

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Albemarle (ALB) -55.93% Paycom Soft (PAYC) -54.89% Walgreens Boots Alliance (WBA) -47.21% Illumina (ILMN) -46.43% FMC (FMC) -45.69% Warner … Read More

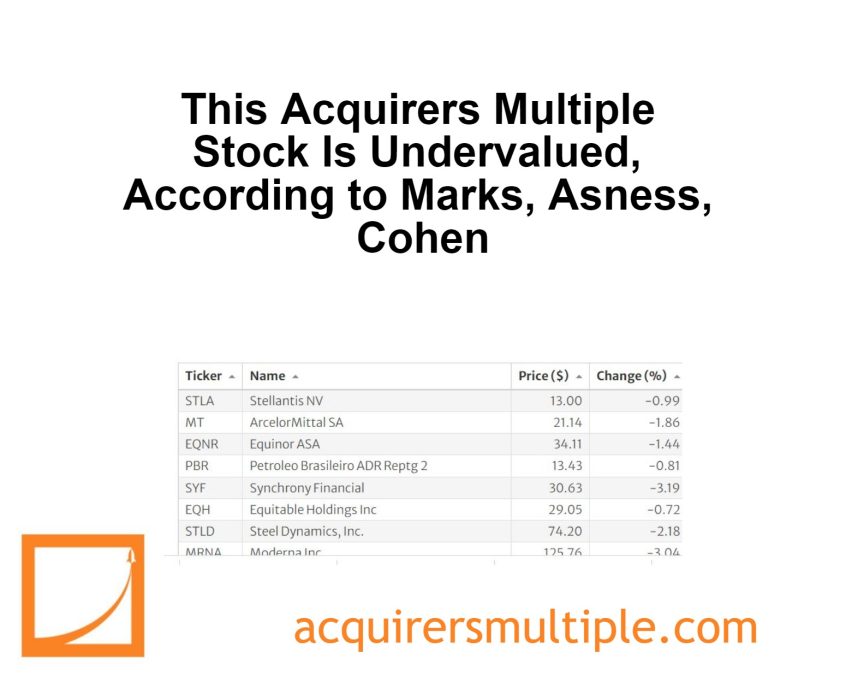

This Acquirers Multiple Stock Is Undervalued, According to Marks, Asness, Cohen

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Is AI Worth the Environmental Cost?

During their recent episode, Taylor, Carlisle, and Brewster discussed Is AI Worth the Environmental Cost?, here’s an excerpt from the episode: Bill: Got through unscathed. You know what bothers me about this AI stuff, Jake? I called Jake to talk about this to get his take on it. We’re supposed … Read More

Francois Rochon: A Proven Strategy for Succeeding During Market Downturns

In this interview with The Investor’s Podcast, Francois Rochon discusses the inevitability of significant stock market drops, noting that most stocks, including Berkshire Hathaway, have experienced 50% declines. He highlights two major market downturns since he began investing 30 years ago: in 2001-2002 and 2008-2009. During the 2008-2009 crisis, despite … Read More