In this presentation with Indiana University MBA and MsF students, Vitaliy Katsenelson takes a deep dive into his approach to investing, including how to think about margin of safety. Here’s an excerpt from the presentation: In my firm this is a very important mental model. You can modify the hell … Read More

Tweedy Browne: The Near-Term Prospects For Value Investors

In their latest Q1 2021 Letter, Tweedy Browne discuss the near-term prospects for value investing. Here’s an excerpt from the letter: Despite rising valuations, we continue to uncover attractively valued equities, as pockets of undervaluation still remain from the bifurcated markets of the last year. As value investors, we are … Read More

Investing Lessons From The Dutch Famine Of 1944-45

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Investing Lessons From The Dutch Famine Of 1944-45. Here’s an excerpt from the episode: Jake: Yeah. [laughs] All right. Let’s transport ourselves back to towards the end of World War II. Food supplies are really … Read More

Value Investors Are Too Meta-Analytical

During his recent interview on The Acquirers Podcast with Tobias, Dan Rasmussen of Verdad Capital discussed Value Investors Are Too Meta-Analytical. Here’s an excerpt from the interview: Tobias: I mean when you said that there was a lot of pessimism in Japan, it did excite me a little bit. It … Read More

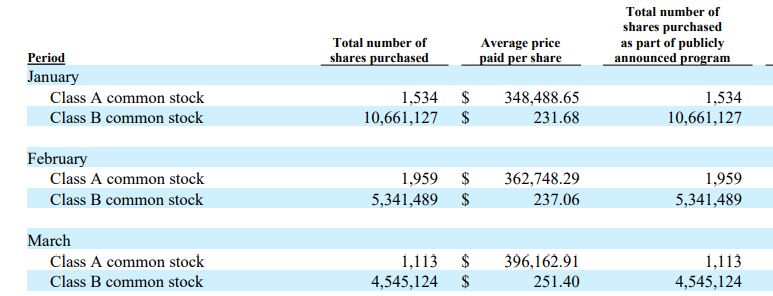

Berkshire Hathaway’s Share Buyback Summary Q1 2021

In his latest Q1 2021 Berkshire Hathaway Letter, Warren Buffett discusses all of the company’s share buybacks in Q1 2021. Here’s an excerpt from the letter: Berkshire’s common stock repurchase program permits Berkshire to repurchase its Class A and Class B shares any time that Warren Buffett, Berkshire’s Chairman of … Read More

Aswath Damodaran: The 7 Deadly Sins In Acquisitions

In his latest investing session titled – Acquirers’ Anonymous: Seven Steps to Sobriety, Aswath Damodaran discusses the seven deadly sins in acquisitions. Here’s an excerpt from the lesson: Acquisitions are exciting and fun to be part of but they are not great value creators and in today’s session, I tried to … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Fading To Average

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Fading To Average. Here’s an excerpt from the episode: Tobias: If you’re confident that it’s going to do that, so that means in five years’ time, it’s on 30 times earnings, five years after that … Read More

Marrying Baupost And Bridgewater

During his recent interview on The Acquirers Podcast with Tobias, Dan Rasmussen of Verdad Capital discussed Marrying Baupost And Bridgewater. Here’s an excerpt from the interview: Dan: You can think about this, a variety of influences, but one influence for thinking this way is Seth Klarman and Baupost. To simplify … Read More

Stanley Druckenmiller: Top 10 Holdings (Q4 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: This Is The Beginning Of A Long Pro-Value Cycle

In his latest Q1 2021 Earnings Call, Rich Pzena explained why this is beginning of a long pro-value cycle. Here’s an excerpt from the call: Last quarter in these remarks, I observed the clients were asking us what are the fourth quarter’s big value run. Was the start of a … Read More

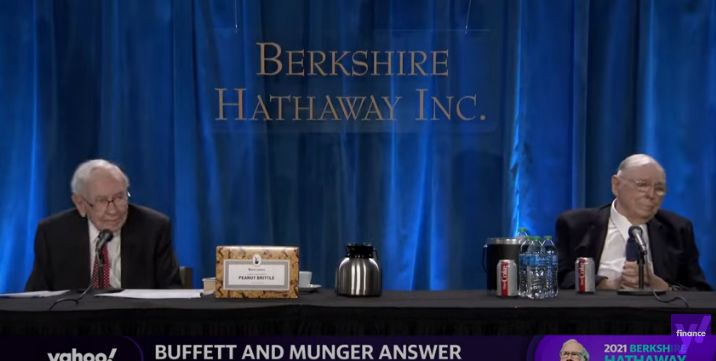

Warren Buffett: I Do Not Think The Average Person Can Pick Stocks

In his latest 2021 Berkshire Annual Meeting, Warren Buffett reiterated what he has been saying for many years, and that is that the average person cannot pick stocks and should consider investment in the S&P 500, or Berkshire. Here’s an excerpt from the meeting: Buffett: I do not think the … Read More

(Ep.112) The Acquirers Podcast: Dan Rasmussen – Countercyclical: Small-Caps, Crisis And A Cycle-Driven Approach To Asset Allocation

In this episode of The Acquirers Podcast, Tobias chats with Dan Rasmussen of Verdad Capital who discusses his new paper Countercyclical Investing. During the interview Dan provided some great insights into: Countercyclical Investing Four Quadrants For An All-Weather Portfolio Own The Trend Japan Is A Brilliant Market For Value Investors … Read More

Stock In Focus – TAM Stock Screener – Turkcell Iletisim Hizmetleri A.S. (NYSE: TKC)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Turkcell Iletisim Hizmetleri A.S. (NYSE: TKC). Turkcell Iletisim Hizmetleri AS … Read More

Francois Rochon – Flexible Valuations

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Francois Rochon – Flexible Valuations. Here’s an excerpt from the episode: Tobias: Let me read it out. François Giverny, I love the name of that firm. “There’s not much difference between 20 and 25 times … Read More

This Week’s Best Value Investing News, Research, Podcasts 4/30/2021

Here’s a list of this week’s best investing news: Taxing Speculation (Jamie Catherwood) Do Treasuries Still Work? (Verdad) Investing At The Later Stage (Collaborative Fund) Legendary Value Manager Charles de Vaulx Found Dead (Barron’s) What The Boom In Fraud Says About The Current Market Environment, Part Deux (Felder) Nassim Taleb calls bitcoin an ‘open … Read More

Acquirer’s Multiple Stock $LEN Appearing In Dalio, Simons, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Sir John Templeton: Mastering The Inner Game

During his recent interview on The Acquirers Podcast with Tobias, William Green, author of Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life discussed Sir John Templeton: Mastering The Inner Game. Here’s an excerpt from the interview: Tobias: You’ve been conducting these interviews– it says on … Read More

VALUE: After Hours (S03 E16): Francois Rochon And Valuation; Dutch Famine Of 44-45; $DIS and $MO

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Francois Rochon – Flexible Valuations Fading To Average Dutch Famine Of 1944-45 Are Equity Investors Missing On Other Asset Classes Technological Obsolescence Or Momentum Early Life Affects Your Investing Style The Impact Of Tobacco Regulations … Read More

Jim Rogers: You’re Never Going To Make Money Buying Hot Stocks

In his latest interview with Real Vision, Jim Rogers discussed some historical examples which demonstrate why you’re never going to make money buying ‘hot’ stocks. Here’s an excerpt from the interview: Jim Rogers: This is not my first rodeo, Raoul. I’ve seen this movie before. Many times, people get very … Read More