In his book – You Can Be A Stock Market Genius, Joel Greenblatt explains why selling stocks is often harder than buying them. While buying opportunities are well-defined, especially after special events like spinoffs or bankruptcies, selling decisions are more complex. The market will eventually recognize the value revealed by … Read More

Warren Buffett: The Best Indicator For Assessing Operating Performance

In his 1979 Berkshire Hathaway Annual Letter, Warren Buffett explained why the most appropriate way to measure annual operating performance is by the ratio of operating earnings to shareholders’ equity, valuing securities at cost. Using market value can distort performance due to fluctuations in securities’ market values. In 1979, Berkshire’s … Read More

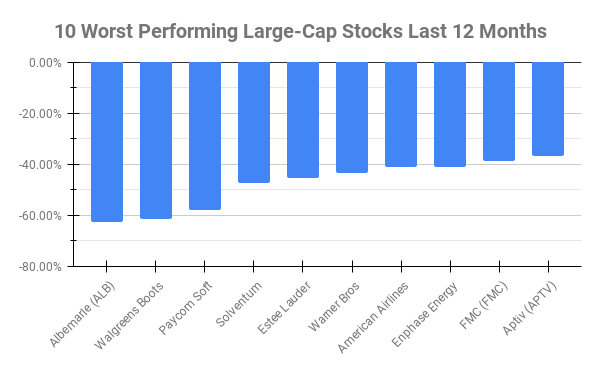

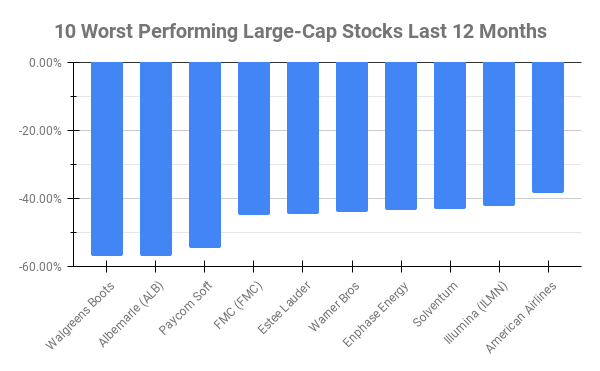

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Albemarle (ALB) -62.55% Walgreens Boots Alliance (WBA) -61.49% Paycom Soft (PAYC) -57.81% Solventum (SOLV) -47.26% Estee Lauder Companies (EL) … Read More

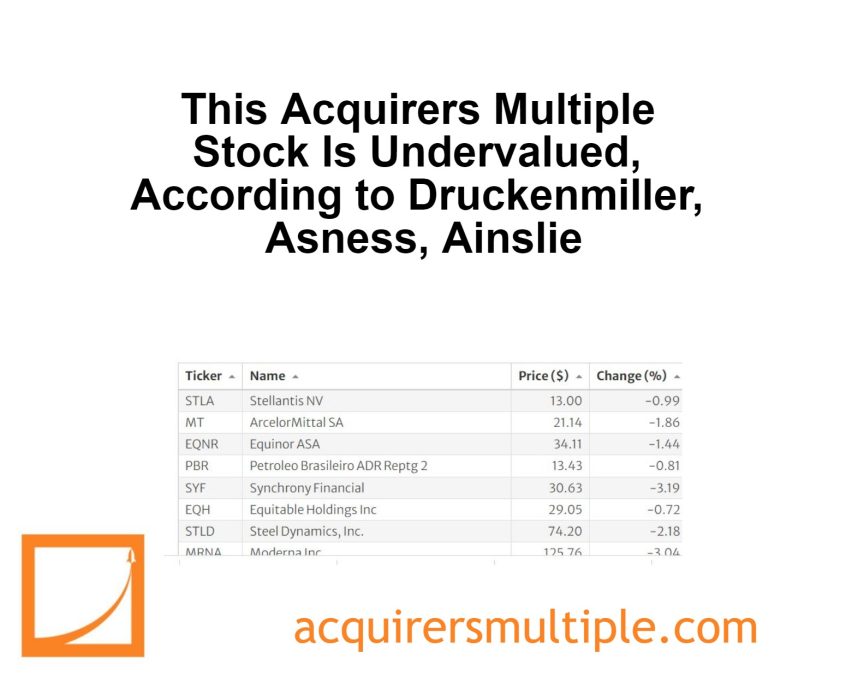

This Acquirers Multiple Stock Is Undervalued, According to Druckenmiller, Asness, Ainslie

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Mohnish Pabrai: Decoding Business DNA: Predicting Future Performance and Investment Insights

In this article titled – Decoding A Company’s DNA, Mohnish Pabrai explains how a business’s foundational DNA is set in its first 90 days, making later changes difficult. This genetic code dictates how a company handles challenges. Investors can gain insights by understanding a company’s early-stage DNA, predicting future performance. Lucent, … Read More

Bill Nygren: AI Excitement vs. Historical Tech Hype: Investor Caution Advised

In his latest Q2 2024 market commentary Bill Nygren discusses how giant cap growth companies that performed well in 2023 continued their success in 2024, while large cap, slower growth companies that underperformed in 2023 continued to struggle. High-priced growth stocks need to maintain growth rates or high P/E ratios … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Warren Buffett: We Prefer Outperformance in Down Markets

In his 1960 Partnership Letter, Warren Buffett outlines his goal of achieving long-term performance superior to the Industrial Average, emphasizing that this superior performance will not be consistently evident compared to the Average. He explains that outperformance is likely in stable or declining markets, while performance may be average or … Read More

Howard Marks: The Best Investment Opportunities In 2024

During his recent interview with Bloomberg, Howard Marks explains that leveraged companies will face difficulties renewing their debt and will incur higher costs, creating better investment opportunities. Six years ago, banks offered generous loans at low interest rates, but now the terms are much stricter. This shift particularly impacts private … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Howard Marks: Accepting & Adapting In The Current Market Environment

Howard Marks emphasizes the importance of understanding and accepting the current investment environment, recognizing that it may not always present clear opportunities. Investors should assess market conditions accurately and act accordingly, avoiding actions based on ignorance or attempts to change the market. Marks’ investment philosophy is influenced by Japanese concepts, … Read More

Warren Buffett: WPC: From $10.6 Million to $221 Million

In his 1985 Berkshire Hathaway Annual Letter, Warren Buffett explained how in mid-1973, he purchased Washington Post Company (WPC) shares at a quarter of their business value, capitalizing on a significant market undervaluation. Most investors, influenced by academic theories on market efficiency, ignored intrinsic business value. By year-end 1974, despite … Read More

Bill Ackman – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Coca-Cola Co (KO) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Coca-Cola Co (KO). Profile Founded in 1886, Atlanta-headquartered Coca-Cola … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (07/05/2024)

This week’s best investing news: Warren Buffett has finally revealed what will happen to his money after he dies (CNN) Hedge Fund Baupost Cuts Almost a Fifth of Investing Staff (Bloomberg) Mohnish Pabrai: Who Made Billions By Following Warren Buffett’s Strategy (MSN) Show Us Your Portfolio: Eric Crittenden (Validea) Ray … Read More

Why Peabody Energy Corp (BTU) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Peabody Energy Corp (BTU) Peabody Energy Corp is a producer of … Read More

Warren Buffett: How To Identify Outstanding Managers

In his 1986 Annual Letter, Warren Buffett acknowledges his underperformance in deploying capital compared to the excellent management by his company’s managers. Buffett and Vice Chairman Charlie Munger focus on retaining talented managers, who typically come with acquired companies and perform exceptionally due to their passion and owner-like mentality. Their … Read More

Prem Watsa: Caveat Emptor: The Risks of Long-Term Investment Optimism

In his 2015 Annual Letter, Prem Watsa criticizes the belief that common shares are always great long-term investments, noting historical downturns like the 1929 Dow Jones crash and the Nikkei’s stagnation since 1989. He highlights the potential for significant market risks and emphasizes cautious investment strategies. Watsa cites Ben Graham’s … Read More

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -57.17% Albemarle (ALB) -56.96% Paycom Soft (PAYC) -54.81% FMC (FMC) -44.86% Estee Lauder Companies (EL) … Read More

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Greenblatt, Asness

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More