In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Luca Dellanna discuss: Ergodicity in Action: A Story of Ski Racing and Investment Value Investing and Ergodicity: A Framework for Long-Term Success Understanding Reproducible Strategies in Investment Why Society Needs More ‘Elon Musks’ with Better … Read More

Merck & Co Inc (MRK) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Merck & Co Inc (MRK). Profile Merck makes pharmaceutical … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (07/19/2024)

This week’s best investing news: Memo from Howard Marks: The Folly of Certainty (Oaktree) Todd Combs on Charlie Munger’s Legacy || Q&A Transcript (2024) (Kingswell) Neglecting Equilibrium (Verdad) Mohnish Pabrai’s Session with Rotary Bangalore DownTown (MP) The Magnificent 7: Which Stocks Are The Most Fundamentally Sound? (Validea) Cliff Asness – … Read More

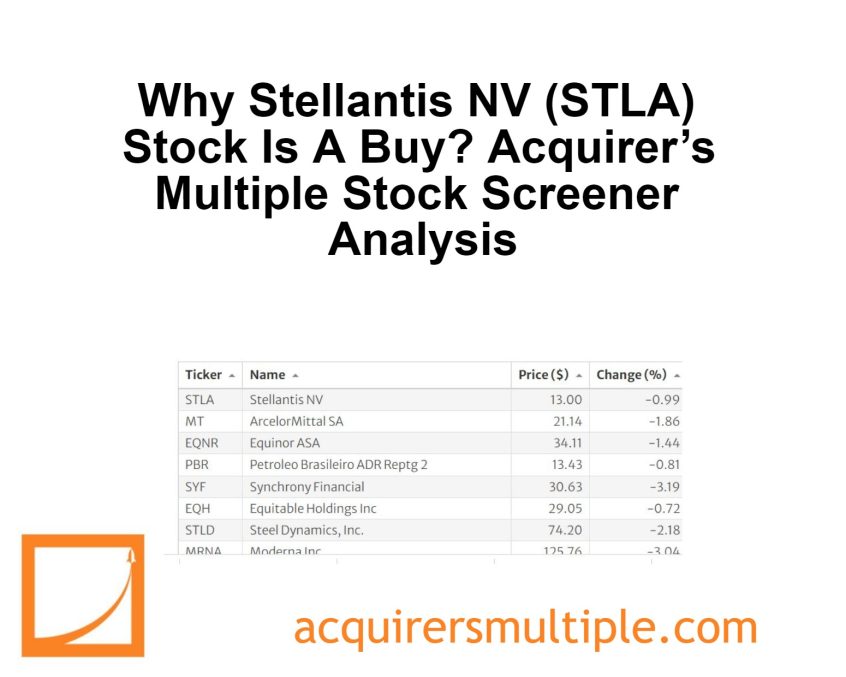

Why Stellantis NV (STLA) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Stellantis NV (STLA) Stellantis NV was formed on Jan. 16, 2021, … Read More

Seth Klarman: The Paradox of Responsible Living and Reckless Investing Explained

In his book – Margin of Safety, Seth Klarman highlights the irrational behavior of some investors who, despite being responsible and deliberate in most aspects of their lives, act recklessly when investing money. These individuals spend months or years saving diligently, only to invest hastily without proper research. Klarman contrasts … Read More

Howard Marks: Why Successful Investors Aren’t Always Intelligent

In his latest memo – The Folly of Certainty, Howard Marks critiques the diverse and often conflicting predictions about the upcoming presidential election, noting that intelligence and data analysis alone cannot ensure accurate forecasts. He references John Kenneth Galbraith’s insights on the fallibility of forecasters and the mistaken association of … Read More

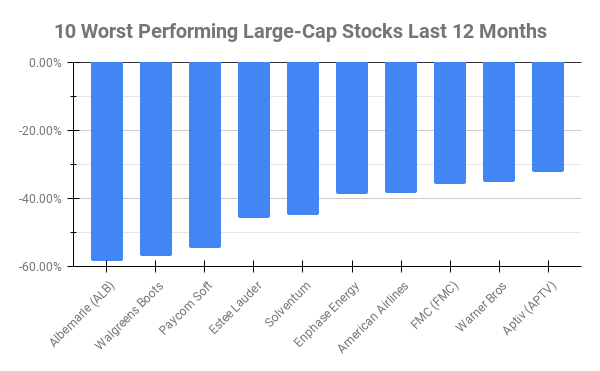

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Albemarle (ALB) -58.45% Walgreens Boots Alliance (WBA) -56.90% Paycom Soft (PAYC) -54.82% Estee Lauder Companies (EL) -45.87% Solventum (SOLV) … Read More

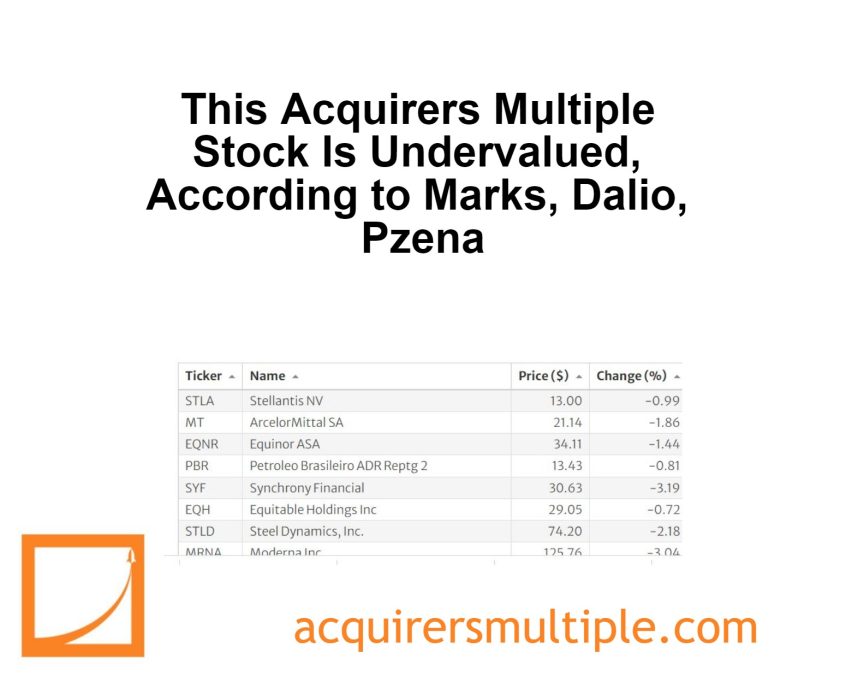

This Acquirers Multiple Stock Is Undervalued, According to Marks, Dalio, Pzena

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Ray Dalio: How To Spot Impending Market Bubbles

In his book – Principles for Navigating Big Debt Crises, Ray Dalio discusses the recurring nature of bubbles in various markets, emphasizing their commonalities despite differing specifics. Understanding the logical cause-and-effect relationships behind bubbles allows for their identification before they manifest as significant crises. By recognizing these patterns and indicators, investors … Read More

Joel Greenblatt: Playing It Safe Could Mean Missing the Next Big Thing

In his book – You Can Be A Stock Market Genius, Joel Greenblatt discusses his cautious investment strategy, emphasizing skepticism toward high-growth, high-multiple stocks. Despite initial excitement about new concepts and products, he often avoids investing due to their typically high price/earnings ratios, which can be unrealistic or infinite for … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Warren Buffett: Why Quality Businesses Can Still Be Overpriced

During the 1997 Berkshire Hathaway Annual Meeting, Warren Buffett discussed his annual report, in which he described Coke and Gillette as “The Inevitables,” noting their exceptional businesses but warning against overpaying for their stocks, which can lead to short-term risks. He emphasized that his praise shouldn’t be seen as an … Read More

Howard Marks: When to Be Cautious and When to Be Aggressive

In his book – Mastering The Market Cycle, Howard Marks explains why in order to make sound investment decisions, we must be alert and perceptive, using inference to understand market participants’ behavior and the investment climate. Observing current events and market sentiment—such as investor optimism or pessimism, media opinions, and … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Warren Buffett: Choosing the Right Discount Rate for Valuations

During the 1996 Berkshire Hathaway Annual Meeting, Warren Buffett explained that when determining a discount rate for valuing future cash flows, he prefers using the long-term government bond rate. He avoids adding extra risk premiums for different businesses, arguing that it’s more important to focus on businesses with predictable futures. … Read More

Mohnish Pabrai: Wait Patiently For That Super-Fast Pitch Down The Center

In his book – The Dhandho Investor, Mohnish Pabrai discusses why Ben Graham’s emphasis on a margin of safety is vital, aiming to minimize risk while maximizing returns, a strategy epitomized by Warren Buffett’s success. Assets usually trade at or above intrinsic value, but during extreme distress, like 9/11 or … Read More

Prem Watsa – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (07/12/2024)

This week’s best investing news: Oaktree’s Howard Marks Weighs In on Market Risks, PE and Credit (Bloomberg) Bill Nygren Q2 2024 Commentary: What goes up… keeps going up. But we aren’t buying it (Oakmark) Bill Ackman Is Behind the Market. Now He’s Launching the Biggest Closed-End Fund Ever (Barron’s) Fundsmith … Read More

Apple Inc (AAPL) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Apple Inc (AAPL). Profile Apple is among the largest … Read More

Why Home Depot Inc. (HD) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Home Depot Inc. (HD) Home Depot is the world’s largest home … Read More