Steve Romick doesn’t mince words. The veteran value investor from the FPA Crescent Fund offers a welcome dose of level-headed perspective — especially during chaotic times like these.

“It’s only April,” Morningstar’s Leslie Norton noted, “but you’ve had an eventful year.” Fires in Los Angeles, whipsaw markets, and political uncertainty are just the tip of the iceberg. But Romick? Cool as ever. “A decade ago, I gave a speech… and said the one thing you shouldn’t be surprised by is surprises,” he told her. “Nothing’s ever certain.”

He doesn’t just mean market volatility. Romick’s critique of current trade policy is equally pointed. “These trade tariffs seem to be more calculated on whimsy rather than sound reasoning,” he said, quoting Larry Summers: “This is to economics what creationism is to biology.” It’s not just ideological — it’s practical. Tariffs that ignore services (like Netflix subscriptions paid by Japan) miss the full picture of modern trade.

So what’s he doing with his money? Sitting tight, mostly. “We’re the cleanest shirt in the dirty clothes hamper,” Romick quipped, explaining why his fund has been backing away from stocks and sitting on a big cash pile — 25% at one point. He’s not rushing to deploy it either: “The market’s not down so much… it’s not like they’re giving stuff away.”

Still, he’s watching closely. “If things get cheap enough where you can assume the worst, prepare for the worst, and then hope for the best… you’ll be fine.” That’s Romick’s whole approach: build in bad outcomes, and if you can still make money, go for it.

He’s cautious on credit, too. “The yield spread is average-ish. The absolute yield you’re getting isn’t great… the covenants are so light.” Translation: you’re not being paid to take on this risk.

Romick’s advice to everyday investors? Broaden your view — geographically and psychologically. “Some of us might be overexposed to stocks, period,” he said. And don’t assume bear markets are quick — “We haven’t had a long bear market in many years… people look at the recent past and extrapolate.”

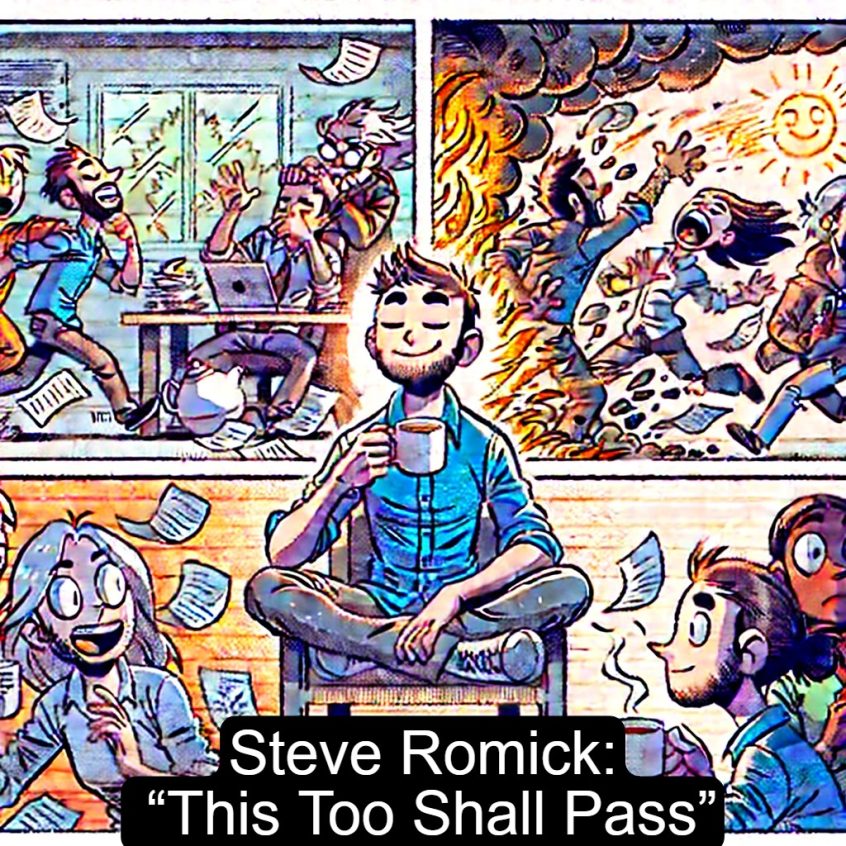

Ultimately, he reminds us of something timeless: “This too shall pass.” But only if you’ve got the right mindset. “If you can’t invest with a five-to-seven-year horizon, you should not be investing, period.”

In other words: be patient, stay rational, and don’t try to outguess chaos. That’s Romick’s edge — and it’s probably the one most of us need.

You can read a transcript of the entire interview here:

Steve Romick Interview Morningstar

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: