This week’s best investing news:

Mohnish Pabrai’s Talk with GreenHaven Road Partners Fund (MP)

Cliff Asness on Equity Investing, Taxes and AI (Bloomberg)

Ken Griffin on the 2024 Election and What’s Next for the U.S. Economy (Dealbook)

Verdad’s Most Read Research Articles from the Past Year (Verdad)

Aswath Damodaran – Magnificent 7 ‘Cash Machine’ Unlikely to Slow Down (Bloomberg)

Pzena’s John Goetz: What “quality” means to these stock pickers (LiveWire)

Buffett, Munger, Bitcoin & More! w/ Ray Dalio, Bill Miller, Chris Davis & Michael Berg (RWH052)

The Next Frontier: Sam Altman on the Future of A.I. and Society (NY Times)

All roads lead to inflation (Havenstein)

Christopher Mayer: 100 Baggers, and General Semantics Revisited & Expanded (Talking Billions)

Bet on Low Costs (Humble Dollar)

U.S. Markets Are Swallowing the Rest of the World (Ben Carlson)

The Investor’s Paradox: When to Act and When to Wait (Safal)

Interview with Chris Davis of Davis Advisors: Real Value to be Found Between the Extremes (Barron’s)

Jim Grant – Interest Rates Are not Sticking to the Central Banks’ Script (The Market)

The Forgotten Lessons of 2008 by Seth Klarman (Onveston)

Transcript: Michael Morris on Tribalism (MiB)

Thankful Investors — Last 20 Years (Bespoke)

Is It Too Late to Buy Bitcoin? (Ben Carlson)

The big rate breakout in historic context (DSGMV)

Polen Capital Management: Small Caps – Resilience & Agility Amid Uncertainty (Polen)

This week’s best value investing news:

Schroder Global Recovery: focused on value (Fidelity)

Why China is the Deepest Value Market in Emerging Markets Today (AM)

Growth vs value investing: time for value to shine? (Yahoo)

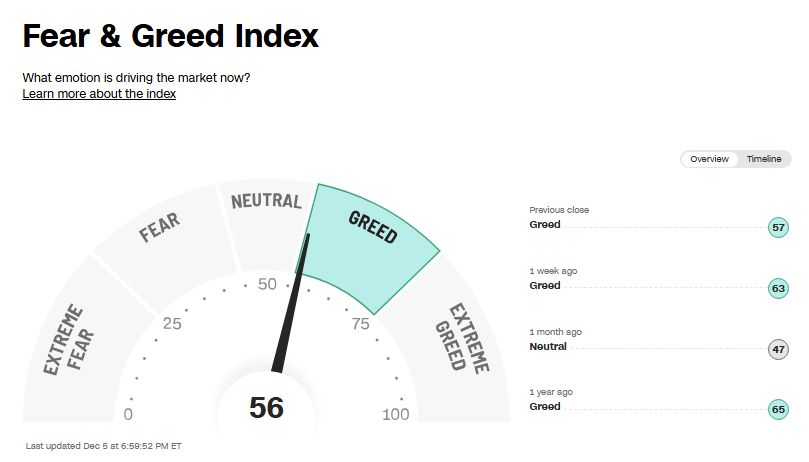

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Buffett, Munger, Bitcoin & More! w/ Ray Dalio, Bill Miller, Chris Davis & Michael Berg (RWH052)

#254 – Gold Investing with American Gold Exchange President Dana Samuelson (Absolute Return)

Chris Heller – Ten Years of Weird Alternatives (Capital Allocators)

What the Rise of Passive Investing Means for Your Portfolio (Excess Returns)

Ronnie Fieg – Building Kith (ILTB)

Ryan Dobratz – Real Opportunities (Business Brew)

Research Solutions: The Bloomberg of Scientific Research (MicroCapClub)

Conceptualizing the Future with Deiya Pernas (PlanetMicroCap)

Why a Long-Term Investment Focus Makes All the Difference (Stansberry)

The Value Perspective with Adam Rozencwajg (Value Perspective)

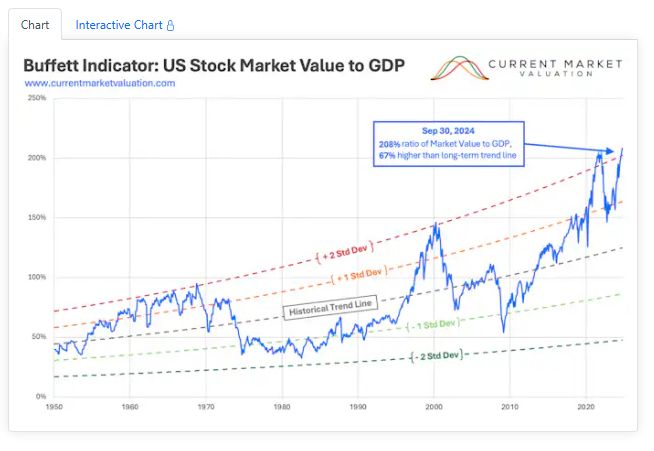

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Time-Varying Drivers of Stock Prices (AlphaArchitect)

The Multi-Period Conundrum of Private Market Performance Metrics (AllAboutAlpha)

The Endowment Syndrome: Why Elite Funds Are Falling Behind (CFA)

China GDP and investor returns – the big disconnect (DSGMV)

This week’s best investing tweet:

This brand new study (Dec 2024) evaluates the effectiveness of four popular investing formulas. Figure from paper shows the F-Score, Magic Formula, Acquirer’s Multiple, and Conservative Formula in the risk/return space. @HanauerMatthias https://t.co/L0tWSZ5XBW pic.twitter.com/azouhAndrK

— Pim van Vliet (@paradoxinvestor) December 4, 2024

This week’s best investing graphic:

Ranked: Top 20 Countries by Average vs. Median Wealth (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: