It seems that all of the great investors have a ‘eureka moment’ during their investing careers. A ‘eureka moment’ refers to the common human experience of suddenly understanding a previously incomprehensible problem or concept. Sometimes referred to as an ‘Aha’ moment. And so it was two of the world’s greatest … Read More

Warren Buffett – The Only Score That Counts In Investing Is Your Internal Scorecard

One of our favorite investing books here at The Acquirer’s Multiple is – The Snowball: Warren Buffett and the Business of Life, by Alice Schroeder. Schroeder recounts a time in the late ninety’s when Buffett was being humiliated by some of the leading financial commentators of the time and Berkshire’s … Read More

Superinvestors Agree That Business Schools Don’t Make You A Better Investor

While a lot of investors believe that a good finance course at one of the world’s most prestigious business schools is a sure-fire way to becoming a better investor, it seems that some of the greatest investors disagree. Here’s what Buffett, Munger, Greenblatt, Pabrai, and Lynch have to say about … Read More

Buffett on Lou Simpson And His Successful Investing Strategy

One of our favorite investors here at The Acquirer’s Multiple is Lou Simpson. Simpson, the Vice Chairman of GEICO, was mentioned in Buffett’s 1986 Berkshire Hathaway Shareholder Letter in which he said: “The second stage of the GEICO rocket is fueled by Lou Simpson, Vice Chairman, who has run the company’s investments … Read More

Warren Buffett – Mistakes of the First Twenty-Five Years

One of the best resources available to investors are the Berkshire Hathaway shareholder letters. One of my personal favorites is the 1989 letter in which Warren Buffett wrote a piece called – Mistakes of the First Twenty-five Years (A Condensed Version). It’s a great insight into how even the greatest investors … Read More

Warren Buffett’s Hero Philip Carret Says There’s Only One Rule For Selling Winning Stocks

One of our favorite investors here at The Acquirer’s Multiple is value investing legend Philip Carret who Warren Buffett once described as one of his heroes. Carret has written three books – The Art of Speculation, A Money Mind at Ninety, and Classic Carret: Common sense from an uncommon man. After founding … Read More

Is It Better To Buy The Stock And Watch The Price Drop Or Not Act And Watch The Price Soar? – Daniel Kahneman

One of the most common predicaments facing investors is that they’ve analysed a stock, it meets with the investors criteria, and now it’s time to pull the trigger and buy the stock. But something happens, the investor ums and ahs and delays the decision to buy. Next thing you know three … Read More

Great Investors Focus On Absolute-Performance Rather Than Relative-Performance – Seth Klarman

Earlier this month The Washington Post published an article titled – Warren Buffett’s $100 Billion Problem. The article was reporting on the $100 Billion that Berkshire has accumulated in cash over the years, stating: Warren Buffett celebrated his 87th birthday a few days ago, but the bigger number in his life … Read More

Great Investors Create Their Own Version Of Omaha – Buffett, Munger, Klarman, Pabrai

One of the biggest problems facing investors is the amount of ‘noise’ that we get from the financial media and commentators. Financial news sections, the internet, and podcasts are continually bombarding us with the latest ‘hot stock’ or miracle investing strategy. Meanwhile investors get caught up in the noise checking … Read More

The Definitive Guide On Identifying Companies With An Economic Moat – Warren Buffett

With so much talk about a company’s economic moat it’s important to recognize how to clearly identify a moat, understand how wide it is, and figure out how long it will remain in place. One of the best papers ever written on the subject is Michael Mauboussin’s – Measuring the … Read More

How Does Warren Buffett Stay At The Top Of His Game

So it appears that if you want to best investor in the world you have to have a few quirks. As you can see from this video on CNBC: However, while he may be a little quirky that’s not the main reason that sets him apart from other great investors … Read More

Here’s How Charlie And Warren Calculate Intrinsic Value Differently To Everyone Else

One of the biggest problems facing investors is the calculation of intrinsic value. There has been much written about the correct way to calculate intrinsic value but one of the best explanations can be found in the book Charlie Munger: The Complete Investor, by Tren Griffin. The book provides the essential … Read More

Buffett Nears a Milestone He Doesn’t Want: $100 Billion in Cash

One of our favorite investors here at The Acquirer’s Multiple is of course Warren Buffett. This week Bloomberg reported that Buffett’s Berkshire Hathaway is sitting on $100 Billion at the end of its second quarter. The question is, what he is going to do with it? Here’s an excerpt from … Read More

Henry Singleton – (“The Best Capital Deployment Record In American Business” – Warren Buffett)

One of my favorite investing books is The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success, by William N. Thorndike. In fact it’s also the top choice on Warren Buffett’s reading list. The book provides stories on eight of the most successful CEOs in history who were great capital allocators. … Read More

Warren Buffett – How To Become An Intelligent Investor

The Berkshire Hathaway letters are one of the most valuable resources for value investors. One of my favorite letters is the 1996 letter in which Buffett provides some principles for becoming an intelligent investor. It provides some great insights into the types of businesses you should search for, how to … Read More

Just How Did Warren Buffett Make A Quick $12 Billion On Bank Of America

CNBC recently announced that Warren Buffett just made a quick $12 billion on a clever Bank of America investment. Because of an astute investment made in Bank of America six years ago while the bank was struggling, Warren Buffett is about to make a quick $12 billion and become the … Read More

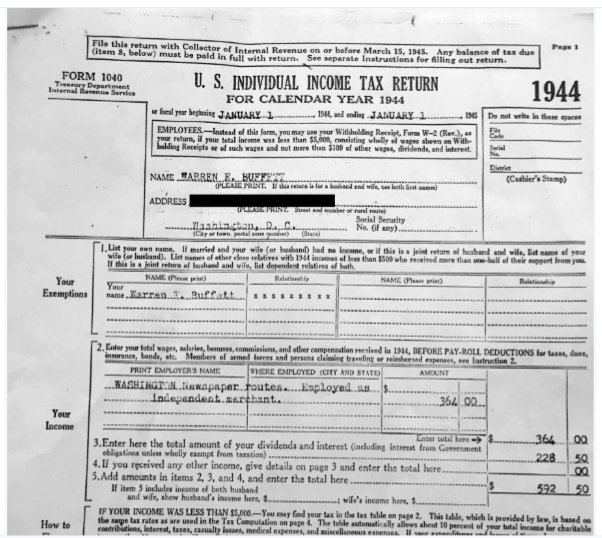

Here is Warren Buffett’s First Tax Return From 1944 (Age 14)

PBS Newshour recently released a copy of Warren Buffett’s first tax return which he filed in 1944 at the age of 14. When Buffett arrived for his PBS NewsHour interview with Judy Woodruff, he pulled out his first tax return while he was in the makeup chair. Buffett’s income in … Read More

How To Develop A Superinvestor Mindset Like Buffett, Munger, Neff, Loeb, Lynch and Soros

One of my favorite investing books is How To Think Like Benjamin Graham and Invest Like Warren Buffett, by Lawrence A Cunningham. One of the best pieces in the book looks at the principles applied by some of the greatest superinvestors of all time. Here’s an excerpt from the book: The … Read More

How Warren Buffett Turned $10.6 Million Into $221 Million While Others Were Embracing The EMT

As a value investor it is important that you read every word of every letter ever written by Warren Buffett in his Berkshire Hathaway Shareholder Letters. One great example of what you can learn comes from his 1985 Chairman’s letter in which he discusses his intrinsic value calculation of The … Read More

The Investment Strategy Pioneered By Warren Buffett Is In Crisis (CNBC)

CNBC reports that Warren Buffett’s value investing long/short strategy generated a 15 percent cumulative loss in the past decade and negative returns in 6 out of the last 10 years, according to Goldman Sachs. Before that, the value strategy had a successful run of more than 70 years. Here’s an … Read More