One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

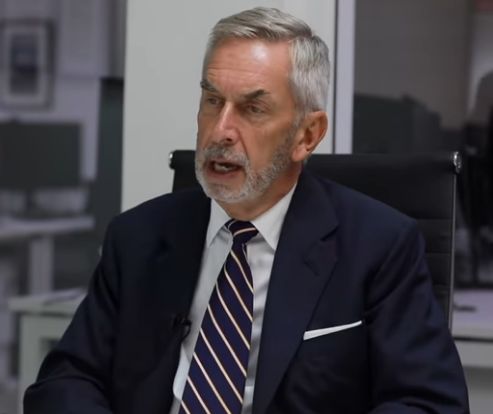

Terry Smith: TINA — There Is No Alternative

In his latest 2022 Semi Annual Letter, Terry Smith discusses TINA — There Is No Alternative. Here’s an excerpt from the letter. In inflationary periods, an acronym which is sometimes used to describe the investment options is TINA — There Is No Alternative. It refers to the concept that equities … Read More

Terry Smith Top 10 Holdings – Q1 2022, BUYS ADBE, MTD, SABR, CGNX, WING

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Buffett’s Simple Rule Of Thumb For Buying

In his latest Fundsmith Annual Meeting 2022, Terry Smith discusses Buffett’s simple rule of thumb for buying. Here’s an excerpt from the meeting: There’s a rule of thumb, which is a sort of a Buffett and a number of others rule of thumb, which is if you can invest in … Read More

Terry Smith Top 10 Holdings – Q4 2021, Buys GOOGL, MSFT, EL, CHD, MKC

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Good Companies Don’t Become Bad Companies

In his latest presentation with MeDirect Malta, Terry Smith illustrates why good companies don’t become bad companies. Here’s an excerpt from the presentation: This slide (below) shows quite a long period of time back to 1966 and it shows the return on capital for companies, the ones in the red … Read More

Terry Smith: In Investing You Can’t Have Your Cake And Eat It Too

In his latest 2021 Annual Letter, Terry Smith explains why in investing you can’t have you cake and eat it too. Here’s an excerpt from the letter: Whilst a period of underperformance against the MSCI World Index is never welcome it is nonetheless inevitable. No investment strategy will outperform in … Read More

Terry Smith Top 10 Holdings – Latest 13F, Buys AMZN, CHD, WAT, HD, SABR

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Investors Just Don’t Read The Accounts

In this interview with the Investors’ Chronicle, Terry Smith provides a great illustration of investors not reading the accounts of the companies they’re investing in. Here’s a excerpt from the interview: When we were established ten years ago we were looking through our list of potential investee companies and one … Read More

Terry Smith: We’re The Groucho Marx of Investment

In this Fundsmith presentation, Terry Smith explains his Groucho Marx style of investment. Here’s an excerpt from the presentation: Ok last point on this. We’re the Groucho Marx of investment. We don’t invest… Groucho Marx famously would never join any club that would not have him as a member. We … Read More

Terry Smith: Investors Miss The Most Important Thing By Focusing On Whether A Company Is Cheap Or Expensive

In his recent presentation with Canaccord Genuity Wealth Management, Terry Smith discusses why investors miss the most important thing by focusing on whether a company is cheap or expensive. Here’s an excerpt from the presentation: In his recent presentation with Canaccord Genuity Wealth Management, Terry Smith discusses why investors miss … Read More

Terry Smith: How To Ensure Share BuyBacks Add Value For Shareholders

In his book, Investing For Growth, Terry Smith discusses how to ensure share buybacks add value for shareholders. Here’s an excerpt from the book: Simply by executing a share buyback rather than paying out dividends, companies can inflate their earnings per share (EPS) and are almost universally seen to have … Read More

Terry Smith: Investing Lessons From The Tour de France

In his book – Investing For Growth, Terry Smith discusses investing lessons from the Tour de France. Here’s an excerpt from the book: Searching for an investment strategy or fund manager who can outperform the market in all reporting periods and varying market conditions is as pointless as trying to … Read More

Terry Smith: Investors Should Reconsider Using The Bond Rate As A Base Rate For Returns

At a recent event organised by Jupiter Asset Management, Terry Smith suggests investors should reconsider using the bond rate as a base rate for returns. Here’s an excerpt from the event: Critics of these defensive stocks argue they have become too expensive. But while Smith concedes that the sort of … Read More

Terry Smith: CEOs Are Better Investors Than Most Fund Managers

In this article by Trustnet, Terry Smith explains why CEOs have one major advantage over most fund managers. Here’s an excerpt from the article: The Fundsmith Equity manager says that as a long-term investor, he is in effect sub-contracting to the CEOs of the companies he invests in. Terry Smith … Read More

Terry Smith: 6 Criteria For Finding Exceptional Businesses

Fundsmith has just released its latest factsheet in which Terry Smith outlines his six criteria for finding exceptional businesses. Also included is the optimum number of stocks to hold. Here’s an excerpt from the factsheet: The Company will invest in equities on a global basis. The Company’s approach is to … Read More

Terry Smith Top 10 Holdings (Q2 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Investing In Bitcoin Is Greater Fool Theory

Earlier this year in his Annual Shareholder Meeting, Terry Smith was asked about his thoughts on investing in Bitcoin. Here’s an excerpt from the meeting: Smith: When I think about investing in Bitcoin, it’s not investing it’s speculating. It’s playing greater fool theory at the moment. Can I buy some … Read More

Terry Smith: How To Select Companies That Will Perform Well In The Future

In Terry Smith’s book – Investing for Growth, he discusses how he selects companies that will perform well in the future. Here’s an excerpt from the book: Even if they were not handicapped by blinkers in predicting the outcome of events, those who wish to rely upon forecasts would still … Read More

Terry Smith Top 10 Holdings (Q4 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More