In his 2018 Annual Letter, Terry Smith discussed why you should stay invested in the stock market. Here’s an excerpt from the letter: Imagine a fund manager approached you with an offer for you to invest in a portfolio of high quality companies. You may quite like the strategy but … Read More

Terry Smith: Where To Find The Great Businesses Of The Future

In this interview with AJ Bell, Terry Smith discussed where to find the great businesses of the future. Here’s an excerpt from the interview: Smith: The same place they came from in the past actually. I will go back once again, third time in one interview, to the Warren Buffett … Read More

Terry Smith: Most Companies Are Not Susceptible To Reason

In this recent edition of medirectalk, Terry Smith explained why most companies are not susceptible to reason. Here’s an excerpt from the interview: Terry Smith: Yes, I’ll elaborate. As my colleagues will attest I think if you speak to them this was one where I was very, very, very, close … Read More

Terry Smith: ‘When The Police Raid The Bawdy House Even The Nice Girls Get Arrested’

In his recent 2022 Annual Letter, Terry Smith explained how sometimes good companies, with solid fundamentals, get taken down in a meltdown, together with their underperforming counterparts. Here’s an excerpt from the letter: Our highly valued and technology holdings did not fare as poorly as some of the companies which … Read More

Terry Smith: Tech Companies Should Stop Behaving As Though Money Is Free, And Stick To Their Core Business

In his latest Annual Letter, Terry Smith explains why tech companies should stop behaving as though money is free, and stick to their core business. Here’s an excerpt from the letter: However, as well as the lower valuations caused by higher rates, technology stocks are facing some fundamental headwinds. A … Read More

Terry Smith – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: We Still Haven’t Reached The ‘Capitulation Phase’

In his recent interview with the Master Investors podcast, Terry Smith explained why we still haven’t reached the ‘capitulation phase’. Here’s an excerpt from the interview: Smith: I think there’s more to come, it’s just gut feel actually. As you said I’ve been doing this for quite a long time … Read More

Terry Smith – Top 10 Holdings – Latest 13F – New Buys ADBE, MTD, SABR, CGNX, WING

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: TINA — There Is No Alternative

In his latest 2022 Semi Annual Letter, Terry Smith discusses TINA — There Is No Alternative. Here’s an excerpt from the letter. In inflationary periods, an acronym which is sometimes used to describe the investment options is TINA — There Is No Alternative. It refers to the concept that equities … Read More

Terry Smith Top 10 Holdings – Q1 2022, BUYS ADBE, MTD, SABR, CGNX, WING

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Buffett’s Simple Rule Of Thumb For Buying

In his latest Fundsmith Annual Meeting 2022, Terry Smith discusses Buffett’s simple rule of thumb for buying. Here’s an excerpt from the meeting: There’s a rule of thumb, which is a sort of a Buffett and a number of others rule of thumb, which is if you can invest in … Read More

Terry Smith Top 10 Holdings – Q4 2021, Buys GOOGL, MSFT, EL, CHD, MKC

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Good Companies Don’t Become Bad Companies

In his latest presentation with MeDirect Malta, Terry Smith illustrates why good companies don’t become bad companies. Here’s an excerpt from the presentation: This slide (below) shows quite a long period of time back to 1966 and it shows the return on capital for companies, the ones in the red … Read More

Terry Smith: In Investing You Can’t Have Your Cake And Eat It Too

In his latest 2021 Annual Letter, Terry Smith explains why in investing you can’t have you cake and eat it too. Here’s an excerpt from the letter: Whilst a period of underperformance against the MSCI World Index is never welcome it is nonetheless inevitable. No investment strategy will outperform in … Read More

Terry Smith Top 10 Holdings – Latest 13F, Buys AMZN, CHD, WAT, HD, SABR

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Terry Smith: Investors Just Don’t Read The Accounts

In this interview with the Investors’ Chronicle, Terry Smith provides a great illustration of investors not reading the accounts of the companies they’re investing in. Here’s a excerpt from the interview: When we were established ten years ago we were looking through our list of potential investee companies and one … Read More

Terry Smith: We’re The Groucho Marx of Investment

In this Fundsmith presentation, Terry Smith explains his Groucho Marx style of investment. Here’s an excerpt from the presentation: Ok last point on this. We’re the Groucho Marx of investment. We don’t invest… Groucho Marx famously would never join any club that would not have him as a member. We … Read More

Terry Smith: Investors Miss The Most Important Thing By Focusing On Whether A Company Is Cheap Or Expensive

In his recent presentation with Canaccord Genuity Wealth Management, Terry Smith discusses why investors miss the most important thing by focusing on whether a company is cheap or expensive. Here’s an excerpt from the presentation: In his recent presentation with Canaccord Genuity Wealth Management, Terry Smith discusses why investors miss … Read More

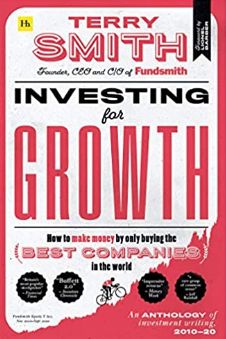

Terry Smith: How To Ensure Share BuyBacks Add Value For Shareholders

In his book, Investing For Growth, Terry Smith discusses how to ensure share buybacks add value for shareholders. Here’s an excerpt from the book: Simply by executing a share buyback rather than paying out dividends, companies can inflate their earnings per share (EPS) and are almost universally seen to have … Read More