During his recent interview with TIP, Bill Nygren discussed how he’s finding lots of opportunities with the market down so much. Here’s an excerpt from the interview: Nygren: That bottom would be somewhere around October, and that’s basically what we went through. Now, of course, that’s no guarantee that we’re … Read More

Bill Nygren: How To Identify And Value Quality Businesses

During his recent interview with The Motley Fool, Bill Nygren discussed how to identify and value quality businesses. Here’s an excerpt from the interview: Nygren: I recently read an interview with Berkshire Hathaway’s Todd Combs where he said the worst business imaginable is one that grows and needs infinite capital. … Read More

Bill Nygren: Investors Must Take Larger Positions To Have Maximum Impact On Their Portfolios

During his recent presentation, Bill Nygren discussed why investors must take larger position sizes to have maximum impact on their portfolios. Here’s an excerpt from the presentation: Nygren: We think the biggest skill we bring to the table is stock selection. And we want to magnify the impact that our … Read More

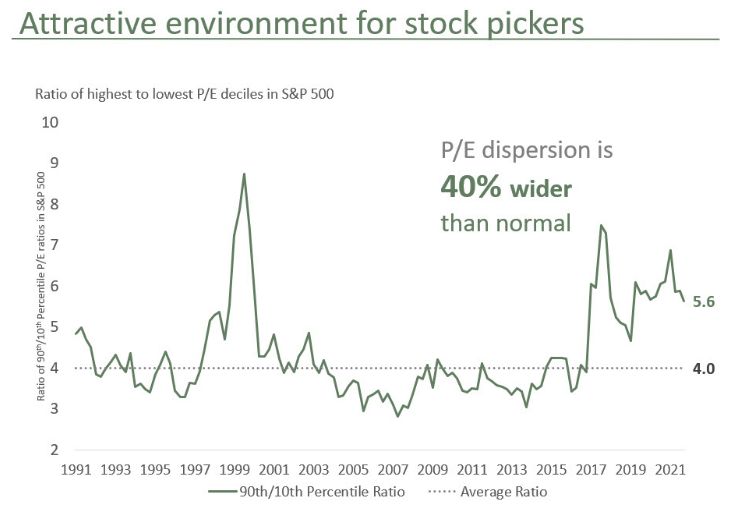

Bill Nygren: This Is A Stock-Pickers Market

In his latest Q3 2022 Market Commentary, Bill Nygren explained why this is a stock-pickers market. Here’s an excerpt from the commentary: “A stock pickers’ market” This is another meaningless phrase that permeates the financial media. It is mostly used when the market is high, and the speaker is trying … Read More

Bill Nygren: Why This ‘Recession’ Is Different

In his recent interview on CNBC, Bill Nygren explained why this ‘recession’ is different. Here’s an excerpt from the interview: Nygren: We’ve had two quarters of down GDP. In the past that’s always been called a recession. What’s different this time is the employment outlook is so much stronger, especially … Read More

Bill Nygren: Now Is The Time To Take Advantage Of Increased Volatility & Market Declines

In his latest Q2 2022 Market Commentary, Bill Nygren explains why now is the time for investors to take advantage of increased volatility and market declines. Here’s an excerpt from the letter: Though it is tempting to believe that one should sell stocks following the onset of a bear market, … Read More

Bill Nygren: Investors Get Excited At Precisely The Wrong Time

In his recent interview with CNBC, Bill Nygren explains why investors get excited at precisely the wrong time. Here’s an excerpt from the interview: Nygren: Yes the market is coming to us [value investors], and we think there are a lot of very cheap stocks out there right now. But … Read More

Bill Nygren: Buy & Hold Beats 35 Major Global Events

In his latest Q1 2022 Market Commentary, Bill Nygren lists 35 major global events that could have significantly impacted markets, but only proved that buy and hold is the best strategy for long term results. Here’s an excerpt from the commentary: Here is an update to the list I used … Read More

Bill Nygren: Stock Selection: Devil’s Advocate Reviews

In his recent interview on The Investor’s Podcast, Bill Nygren discussed his Devil’s Advocate Reviews, when it comes to new stock selection and existing holdings. Here’s an excerpt from the interview: Nygren: Each week we have what we call it our stock selection group meeting. And all of the domestic … Read More

Bill Nygren: How To Avoid Value Traps

In his latest interview on the Millennial Investing Podcast, Bill Nygren discusses how to avoid value traps. Here’s an excerpt from the interview: Anything that we look to buy in any of our Oakmark Funds has to meet three criteria. First, it has to be cheap. We want it to … Read More

Bill Nygren: How To Apply Value Investing To Growth Stocks

In his latest Q4 2021 Market Commentary, Bill Nygren discusses how to apply value investing to growth stocks. Here’s an excerpt from the commentary: Oakmark was one of the first value managers to acknowledge that accounting rules overly penalize the companies investing to grow their businesses. Thirty years ago, we … Read More

Bill Nygren: Low PE Stocks Provide A Very Good Hunting Ground For Long-Term Investors Today

In his latest interview on CNBC, Bill Nygren explained why low PE stocks provide a very good hunting ground for long-term investors today. Here’s an excerpt from the interview: At Oakmark we think really long term and you look back over the past decade it has been a great decade … Read More

Bill Nygren: We’re Excited About The Prospects Of A Value Recovery

In his latest interview with CityWire, Bill Nygren discussed why he’s excited about the prospects of a value recovery. Here’s an excerpt from the interview: Nygren: I think the fact that the Oakmark fund has continued to perform well versus value indices shows that our consistent investment philosophy continues to … Read More

Bill Nygren: How To Pick The Winners In A Disruptive World

In his recent conversation at The Morningstar Investment Conference, Bill Nygren discussed a number of topics including how to pick the winners in a disruptive world. Here’s an excerpt from the conversation: Nygren: I’ve been doing this long enough that I remember when newspapers were viewed as about the safest business … Read More

Bill Nygren: Chasing Short Term Profits At The Expense Of Stakeholders

In his latest Q3 2021 Market Commentary, Bill Nygren discusses the problem with companies chasing short-term profits at the expense of stakeholders. Here’s an excerpt from the commentary: We believe that if stakeholders are mistreated, neither profits nor value can be maximized. CEOs can increase the next quarter’s or the … Read More

Bill Nygren: There Is An Unusually Large Opportunity To Add Value By Focusing On Stock Price

In the latest article from Oakmark titled – The Opening Ceremony of the Value Recovery, Bill Nygren believes there is an unusually large opportunity to add value by focusing on stock price rather than just expected earnings growth. Here’s an excerpt from the article: So, is this the end of … Read More

Bill Nygren: Avoid Activist Investments

In his latest Q2-2021 Market Commentary, Bill Nygren says investors should avoid activist investments and invest only in those companies that are already well-managed. Here’s an excerpt from the commentary: Some investors like to buy shares in companies that are not maximizing long-term value and then fight for change. We … Read More

Bill Nygren: What Determines The Multiple You Should Pay

In his latest interview on the Natixis Access Series, Bill Nygren discussed what determines the multiple you should pay. Here’s an excerpt from the interview: Nygren: Our view is that the quality of the business is what determines what a fair multiple would be for that business. We would gladly pay … Read More

Bill Nygren: Why Value Investors Should Consider Owning FAANG Stocks

In his recent interview on the Virtual Value Investing Q&A Speaker Series Event at Brown University, Bill Nygren discusses why value investors should consider owning FAANG stocks. Here’s an excerpt from the interview: Nygren: I mean the way we’ve thought about Alphabet you know it misses a lot of value … Read More

Bill Nygren: Value Outperforms Growth Two Consecutive Quarters

In his latest Q1 2021 Market Commentary, Bill Nygren discusses value’s recent outperformance over growth in two consecutive quarters. Here’s an excerpt from the commentary: Following a painful four years for value investors, we’ve finally had two consecutive quarters where value has outperformed growth, the first time in more than … Read More