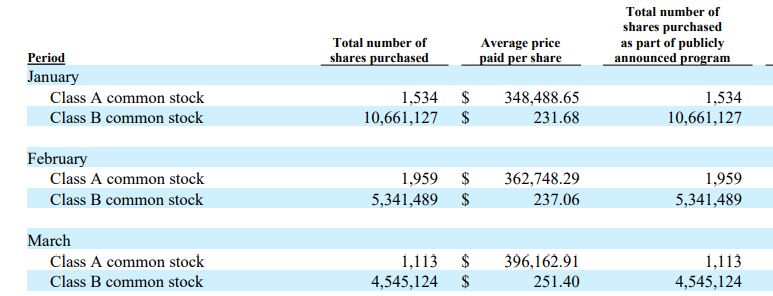

In his latest Q1 2021 Berkshire Hathaway Letter, Warren Buffett discusses all of the company’s share buybacks in Q1 2021. Here’s an excerpt from the letter: Berkshire’s common stock repurchase program permits Berkshire to repurchase its Class A and Class B shares any time that Warren Buffett, Berkshire’s Chairman of … Read More

Warren Buffett: Why We Didn’t Repurchase Our Shares When They Were Relatively Cheap In March

Here’s the entire video of the 2020 Berkshire Hathaway Annual Meeting. One of the questions Buffett was asked was why he didn’t repurchase Berkshire shares in March when they were 30% cheaper than the price he purchased them at earlier in the year. Here’s an excerpt from the meeting: Becky … Read More

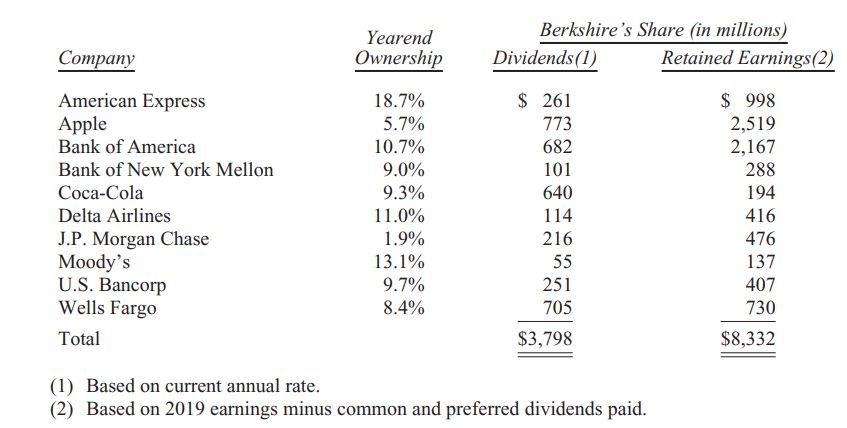

BRK 2019 Annual Report – The Power Of Retained Earnings

Warren Buffett recently released his Berkshire Hathaway Annual Report 2019. One of the key take-aways from the letter is Berkshire’s ongoing focus on the power of retained earnings from the companies in which Berkshire invests. Here’s an excerpt from the letter: At Berkshire, Charlie and I have long focused on … Read More

Berkshire Hathaway (Warren Buffett) – Top 10 Holdings Q1 2019

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Berkshire Hathaway: 10 Books That Every Investor Should Read

We recently started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 Books That Every Investor Should Read Bill … Read More

Whitney Tilson: Analysis of Berkshire Hathaway’s Blowout Earnings

Over the weekend Whitney Tilson tweeted on Berkshire Hathaway’s blowout earnings saying: Berkshire reported blowout earnings this morning, with pretax operating earnings soaring 67%! We’ve posted our take here: https://t.co/VqfX6y4qIj. Our estimate of intrinsic value is now $348,000 for the A shares, meaning that BRK is trading at a 12% … Read More

Buffett Nears a Milestone He Doesn’t Want: $100 Billion in Cash

One of our favorite investors here at The Acquirer’s Multiple is of course Warren Buffett. This week Bloomberg reported that Buffett’s Berkshire Hathaway is sitting on $100 Billion at the end of its second quarter. The question is, what he is going to do with it? Here’s an excerpt from … Read More

Warren Buffett: Berkshire’s Earnings Aided By America’s Economic Dynamism

One our favorite investors here at The Acquirer’s Multiple – Stock Screener is of course Warren Buffett. One of the best resources for investors is Berkshire Hathaway’s Annual Reports and the associated Chairman’s Letters which are are full of investing nuggets. Berkshire’s recently released 2016 Annual Report provides lots of great … Read More