Richard Pzena has just released his firm’s Q3 2019 Commentary, in which he discusses the similarities between today’s extended bull market, and the period leading up to 1998, and what that means for value investors, saying:

“History has demonstrated that the longer and deeper the anti-value cycle, the greater the recovery for undervalued stocks when markets eventually normalize.”

Here’s an excerpt from that letter:

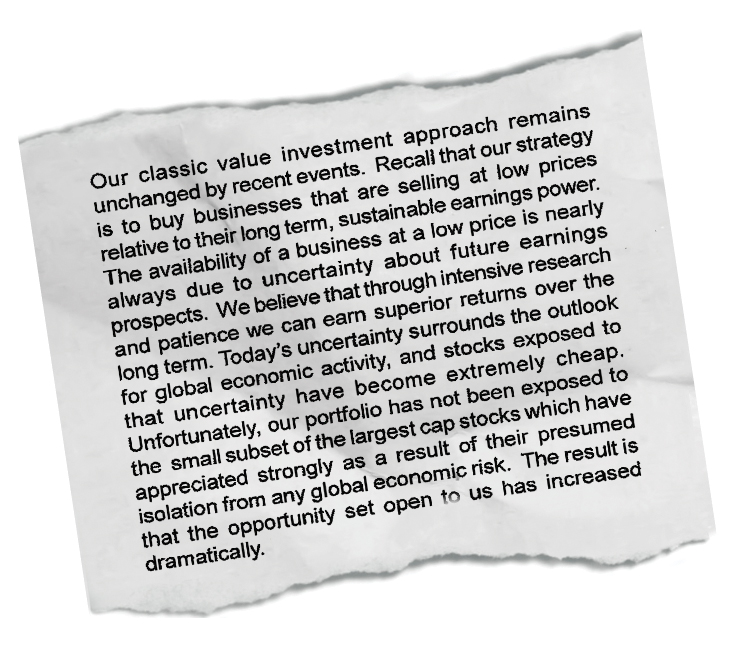

The clipping below was written in the second quarter of 1998, when Pzena was approaching its second anniversary.

Figure 1: “Nostalgia is not what it used to be”1

1Source: French film actress Simone Signoret (1978)

Source: Pzena Investment Management, Shareholder letter, June 1998

At the time, value had been thrashed by growth for years. While a small subset of stocks ticked ever higher, the rest were left behind. Everything we said back then applies today. We can’t help but think of the old proverb, “the more things change, the more they stay the same.”

Today’s pro-growth cycle has lasted more than twice as long, as demonstrated in Figure 2. The chart shows the ratio of the MSCI World Value Index and the MSCI World Growth Index, illustrating that while value has had a tough run, it’s still the undeniable winner over the long term. The length and magnitude of the current cycle has prompted investors to perpetually choose growth over value thinking that the current environment is fundamentally different from the past. But history has demonstrated that the longer and deeper the anti-value cycle, the greater the recovery for undervalued stocks when markets eventually normalize.

Figure 2: Value Works Over Longer Periods — but is this Time Different?

MSCI WORLD VALUE INDEX RELATIVE TO MSCI WORLD GROWTH INDEX, RESULTS SINCE INCEPTION

Results since inception of the indices. The gold-bar periods represent anti-value cycles. The numerical labels represent the number of months when growth beat value in the last two cycles. Returns are calculated in US dollars. Past performance is not indicative of future returns. The information is provided for equity returns including dividends net of withholding tax rates as calculated by MSCI.

Source: MSCI.com

VALUE’S NOT DEAD: WE’RE STILL HERE BUYING GREAT COMPANIES AT EXTREME DISCOUNTS

For over 20 years, we have remained steadfast in our commitment to value investing with no drifting and no excuses. We still own good companies that are facing questions over their ability to generate future earnings. Once again, global economic and stock-specific uncertainty are testing their resilience.

CONCLUSION:

Without a doubt, underpriced value stocks have near-term concerns embedded in the valuation. Riding momentum irrespective of valuation has produced better returns for many years now. Yet, when we look at the fundamental long-term earnings power of what we own and compare these companies to the broader market, we don’t mind waiting for today’s anomalies to readjust. Ultimately, we believe our holdings offer significant opportunity for improvement with a better margin of safety.

You can download the entire letter here: Pzena Investment Management – Q3 2019 Commentary.

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: