Howard Hughes Corporation has long been an outlier in Bill Ackman’s portfolio. Unlike his usual large-cap investments, HHC is an undervalued real estate business with long-term potential that public markets have struggled to appreciate. But for Ackman, this company isn’t just another real estate play—it’s the foundation of a much … Read More

Berkshire’s Capital Charge Philosophy

During their recent episode, Taylor, Carlisle, and Alex Morris discussed Berkshire’s Capital Charge Philosophy. Here’s an excerpt from the episode: Tobias: It’s so different to the way that Berkshire does it, where, the $40 billion went to Apple, some of it goes to buybacks. Jake: I think more importantly than … Read More

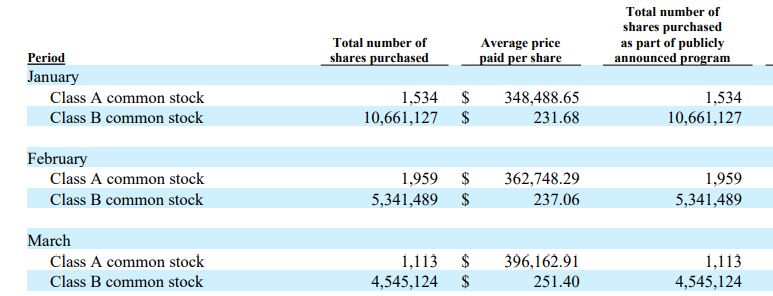

Berkshire Hathaway’s Share Buyback Summary Q1 2021

In his latest Q1 2021 Berkshire Hathaway Letter, Warren Buffett discusses all of the company’s share buybacks in Q1 2021. Here’s an excerpt from the letter: Berkshire’s common stock repurchase program permits Berkshire to repurchase its Class A and Class B shares any time that Warren Buffett, Berkshire’s Chairman of … Read More

Warren Buffett: Why We Didn’t Repurchase Our Shares When They Were Relatively Cheap In March

Here’s the entire video of the 2020 Berkshire Hathaway Annual Meeting. One of the questions Buffett was asked was why he didn’t repurchase Berkshire shares in March when they were 30% cheaper than the price he purchased them at earlier in the year. Here’s an excerpt from the meeting: Becky … Read More

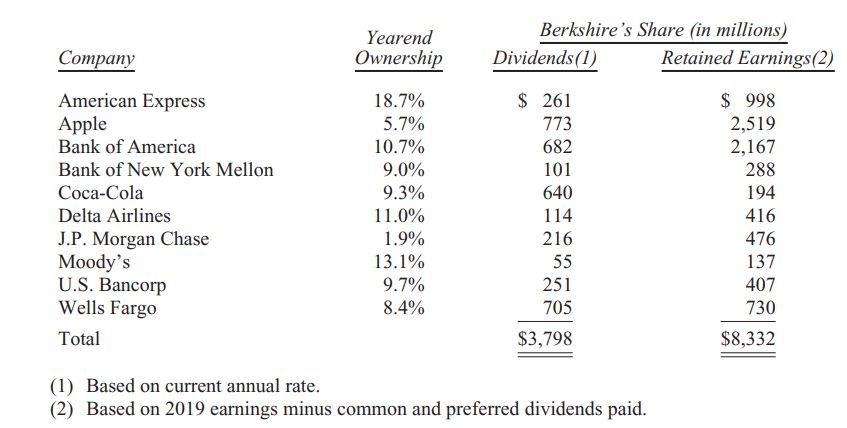

BRK 2019 Annual Report – The Power Of Retained Earnings

Warren Buffett recently released his Berkshire Hathaway Annual Report 2019. One of the key take-aways from the letter is Berkshire’s ongoing focus on the power of retained earnings from the companies in which Berkshire invests. Here’s an excerpt from the letter: At Berkshire, Charlie and I have long focused on … Read More