One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E44): Deep Value in Emerging Markets, China, India, Korea with Juan Torres Rodriguez, Schroeders

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Juan Torres Rodriguez discuss: Emerging Markets: 50% of Global GDP but Only 7% of Market Capitalization Why China is the Deepest Value Market in Emerging Markets Today Fallen Angels of Chinese Tech: Understanding Alibaba’s Restructuring … Read More

Apple Inc (AAPL) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Apple Inc (AAPL). Profile Apple is among the largest … Read More

Alpha Metallurgical Resources Inc (AMR): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Alpha Metallurgical Resources Inc (AMR) Alpha Metallurgical Resources Inc is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (11/29/2024)

This week’s best investing news: Howard Marks: The Key to Thriving in an Uncertain Investment Landscape (Global Money) Steve Cohen on How to Build Your Investing Career: Part One (Point 72) Jim Rogers: Market Party Will End in Crisis | Why He’s Not Shorting ‘Yet’ (The Julia La Roche Show) … Read More

How Bacterial Mutation Informs Investment Strategy

During their recent episode, Taylor, Carlisle, and Phil Pearlman discussed How Bacterial Mutation Informs Investment Strategy. Here’s an excerpt from the episode: Tobias: It’s coming up to the top of the hour, which means that it’s JT’s vegetables. Mark it down, folks. Phil, there are people who tune in this … Read More

Mohnish Pabrai: The Evolution and Erosion of Moats

In his book The Dhandho Investor, Mohnish Pabrai explains how a business’s hidden moat, or competitive advantage, can often be identified through its financial statements. Businesses with strong moats generate high returns on invested capital, as seen in examples like Chipotle, which reinvests profits to fuel exponential growth. Pabrai draws … Read More

Li Lu: Markets Are Designed To Catch Human Weaknesses

In this CCBC Fireside Chat with Bruce Greenwald, Li Lu discusses the importance of understanding businesses deeply, drawing inspiration from Ben Graham’s concept of Mr. Market. He warns that financial markets can be volatile and are designed to exploit human weaknesses. Investors who lack true understanding will eventually face losses, … Read More

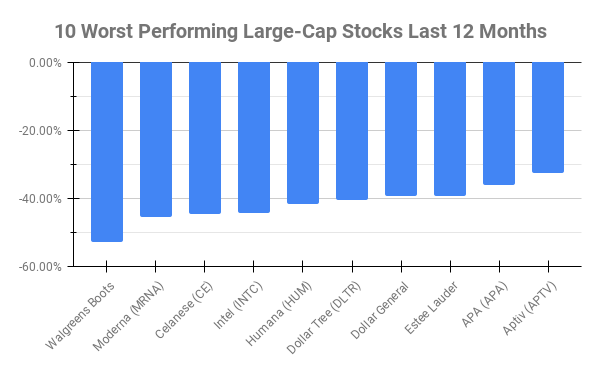

10 Worst Performing Large-Caps Last 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -53.01% Moderna (MRNA) -45.62% Celanese (CE) -44.52% Intel (INTC) -44.22% Humana (HUM) -41.69% Dollar Tree … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and … Read More

Overachiever’s Dilemma: Rest, Injury, and Staying Consistent

During their recent episode, Taylor, Carlisle, and Phil Pearlman discussed Overachiever’s Dilemma: Rest, Injury, and Staying Consistent. Here’s an excerpt from the episode: Tobias: When you’re listening to this feedback a little bit more from your body, how do you balance that with– We’ve all got an inner bitch that … Read More

Warren Buffett: Most of My Capital-Allocation Decisions Have Been No Better Than So-So

In his 2022 Berkshire Hathaway Annual Letter, Warren Buffett reflects on his mistakes and successes over 58 years of managing Berkshire Hathaway. He acknowledges that most of his capital-allocation decisions have been average, with a few standout successes and some bad decisions salvaged by luck. Buffett highlights the dual nature … Read More

David Einhorn: Where to Find Value in Today’s Expensive Market

During his recent interview with CNBC, David Einhorn acknowledges that the current stock market as the most expensive he’s seen, with many companies overvalued. However, he isn’t outright bearish, as overpriced markets can persist for extended periods, citing past examples like negative interest rates. While he doubts this is an … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray … Read More

Stupid Simplicity: Four Pillars of Health and Wellness

During their recent episode, Taylor, Carlisle, and Phil Pearlman discussed Stupid Simplicity: Four Pillars of Health and Wellness. Here’s an excerpt from the episode: Tobias: Let’s just start with the health program. What’s your philosophy about getting healthy, staying healthy? What are the big muscle movements that people can do … Read More

Joel Greenblatt: Why Buying “Cheap” and “Good” Stocks Is a Winning Strategy

In this interview with the RWH Podcast, Joel Greenblatt explains the core idea behind his investment strategy in The Little Book, emphasizing a simple approach of using basic metrics for identifying “cheap” and “good” stocks. He tested this method, combining these metrics into a portfolio, and it proved successful. Greenblatt acknowledges … Read More

Mohnish Pabrai: The All-In Investing Mindset: Lessons from Entrepreneurs

During this Q&A session with Columbia Business School, Mohnish Pabrai highlights the all-in mentality of entrepreneurs, such as a first-generation Chinese couple opening a restaurant, who invest nearly all their money and time into their ventures. This scenario mirrors millions of U.S. entrepreneurs, who rarely consider diversification yet sleep soundly … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Fitness Alpha: Unlocking Outperformance Through Health and Well-Being

During their recent episode, Taylor, Carlisle, and Phil Pearlman discussed Fitness Alpha: Unlocking Outperformance Through Health and Well-Being. Here’s an excerpt from the episode: Tobias: I like the idea of mind and body being one. I just wanted you to talk a little bit about the idea of how that … Read More

Warren Buffett: Every Company Needs an Owner’s Manual

During the 2004 Berkshire Hathaway Annual Meeting, Warren Buffett discussed his approval of Google’s adoption of a communication style inspired by Berkshire Hathaway’s Owner’s Manual. He emphasizes the importance of companies being transparent with their investors about their principles and operational approaches. Buffett believes this straightforwardness builds trust, akin to what … Read More