During his CSIMA Guest Speakers Series, Bill Nygren discussed the three key features he looks for in his potential investments. Nygren invests in companies with these three key features: Significant discount: He buys stocks at a price significantly below their estimated business value, typically around 60% of that value. The discount … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

The Power of Absolute Return Investing

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and Eric Cinnamond discussed The Power of Absolute Return Investing. Here’s an excerpt from the episode: Eric: Yeah. Absolute for us is an attractive return over a full market cycle. We discount our cash flows and our valuations … Read More

Stanley Druckenmiller – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E12): Eric Cinnamond On Small Cap Value, Absolute Return, And The Stock Market

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Eric Cinnamond discuss: The Power of Absolute Return Investing The Lower Risk, Steady Returns Investment Strategy From Earnings Calls to Investment Ideas: Bottom-Up Stock Picking From Laplace’s Demon to AI Ethics: Biases, Surveillance, and the Limits of … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (03/29/2024)

This week’s best investing news: Jeremy Grantham: Bubbles, AI, Climate Change, Population Growth (Insightful Investor) Terry Smith: ‘Most investors today are too short-term’ (Fundsmith) The Enduring Appeal of Dividend Aristocrats (Validea) Bill Nygren interview at Columbia Student Investment Management Association (CSIMA) Famously Obstinate, Bill Ackman Is Now Real-Life Famous. What … Read More

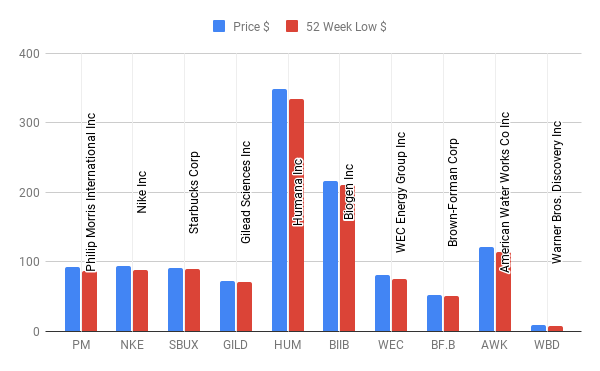

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ PM Philip … Read More

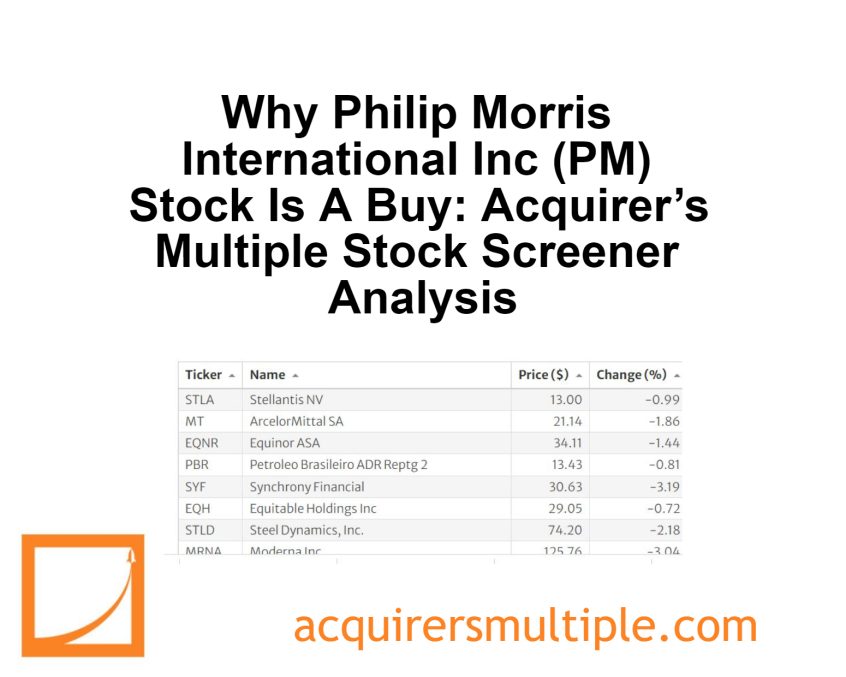

Why Philip Morris International Inc (PM) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Philip Morris International Inc (PM) Philip Morris International is an international … Read More

Invasive Ants, Hunting Lions, and the Future of Private Equity

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and John Rotonti Jr discussed Invasive Ants, Hunting Lions, and the Future of Private Equity. Here’s an excerpt from the episode: Jake: All right. So, this is called ants and lions hunting and private equity. So, we’ll see … Read More

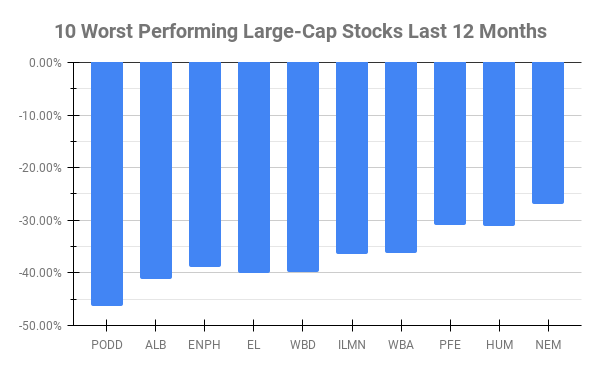

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) PODD Insulet Corp -46.28% ALB Albemarle Corp -41.16% … Read More

Unveiling the Best Predictor of Stock Market Performance

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and John Rotonti Jr discussed Unveiling the Best Predictor of Stock Market Performance. Here’s an excerpt from the episode: John: Yeah, that’s true. That was awesome. My question is, if everything is a complex adaptive system, which I … Read More

Warren Buffett: Stealing with a Pen: The Devastating Effects of Corporate Fraud

In his 1988 Berkshire Hathaway Annual Letter, Warren Buffett argues that some companies view Generally Accepted Accounting Principles (GAAP) as guidelines to be creatively interpreted, rather than strict rules. This can lead to misleading financial statements and even fraud. Investors and creditors who rely on GAAP figures are vulnerable to … Read More

Jeremy Grantham: Why Today’s Magnificent Titans Are Likely To Fail

During this interview with Insightful Investor, Jeremy Grantham discusses the difficulty of achieving good investment returns in the current market. He argues that past winners, like the “Magnificent” Nifty 50 stocks of the 1970s, often underperform in subsequent cycles. Grantham believes this pattern will likely repeat, despite the impressive nature … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Nygren Effect: 6x PE + Share Repurchases = 20% EPS Growth

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and John Rotonti Jr discussed The Nygren Effect: 6x PE + Share Repurchases = 20% EPS Growth. Here’s an excerpt from the episode: John: So, the way you asked the question, Tobias was, do you think value investor … Read More

Prem Watsa: How To Achieve 20%+ Returns

In his 1987 Shareholder Letter, Prem Watsa discusses how short-term market fluctuations are driven by emotions and don’t reflect underlying business fundamentals. They advise investors to focus on company fundamentals and not be swayed by market swings. Here’s an excerpt from the letter: We have been asked many times as … Read More

Howard Marks: Sometimes The Most Prudent Investing Simply Doesn’t Work

In his memo titled Irrational Exuberance, Howard Marks discusses two investment philosophies: prudent investing and the approach that worked during the 1999 tech boom. Prudent investing emphasizes factors like diversification, value investing, and taking profits. This approach would have led to underperformance in 1999. The 1999 tech boom approach focused … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

David Einhorn’s Shift in Value Investing Strategy: Prioritizing Cash Flow

During their latest episode of the VALUE: After Hours Podcast, Carlisle, Taylor, and John Rotonti Jr discussed David Einhorn’s Shift in Value Investing Strategy: Prioritizing Cash Flow. Here’s an excerpt from the episode: Tobias: Just before we came on, we were talking about Einhorn’s latest letter. John: Yeah. So, it’s … Read More

VALUE: After Hours (S06 E11): John Rotonti Jr on Best Value Firm Processes and Valuing Buybacks

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and John Rotonti Jr discuss: David Einhorn’s Shift in Value Investing Strategy: Prioritizing Cash Flow The Nygren Effect: 6x PE + Share Repurchases = 20% EPS Growth (Even Without Earnings Growth!) Murray Stahl’s Blueprint for Investing … Read More