[View the story “Week Beginning May 29th, 2017” on Storify]

This Week’s Best Investing Reads – Curated Links

Here’s a list of this week’s best investing reads:

Jesse Livermore – 21 Investing Rules That Have Stood The Test Of Time For 77 Years

Before the modern day tweeter @Jesse_Livermore, there was a famous investing legend also called Jesse Livermore. The original Livermore was born in 1877 and died in 1940. Livermore was famous for making and losing several multimillion-dollar fortunes and short selling during the stock market crashes in 1907 and 1929. Livermore was an investing … Read More

A Value Investors Mecca Should Extend Beyond Omaha To Toronto And Prem Watsa

Great article in the AFR that suggests Omaha is not the only place that value investors are heading to for great ideas. It seems Denver and Toronto are becoming equally important destinations, as are the annual meetings of Markel Corporation and Fairfax Financial, as investors prepare for life after Buffett … Read More

America Is Great. Home Country Bias Ain’t (GMO)

Here’s a great article from the team at GMO that demonstrates how “home country bias” may be hurting your performance. Home country bias means investors have a natural tendency to focus their investments in companies and markets in their own country. Here’s an excerpt from that article:

Rob Arnott: How “Smart Beta” Investing Can Become Dumb Investing

One investor and writer that we follow closely here at The Acquirer’s Multiple is Rob Arnott. Arnott is the founder and chairman of Research Affiliates. He’s also the portfolio manager on the PIMCO All Asset and All Asset All Authority family of funds and the PIMCO RAE™ suite of funds. … Read More

Global Sources Ltd. (Bermuda) Up 48.96% Overnight

One of the stocks I added to the TAM Deep Value Stock Portfolio last month was Global Sources Ltd. (Bermuda) (NASDAQ:GSOL). Global Sources Ltd. is a business-to-business (B2B) media company that provides information and integrated marketing services, with a particular focus on the Greater China market. I wrote about the purchase in my … Read More

Buffett Says Bogle Is a Hero. Bogle Says He Just Gave A Damn About Investors

During the recent Berkshire Hathaway Annual General Meeting Warren Buffett said Jack Bogle, the founder of Vanguard, had probably done more for investors than anyone. Bogle says, “I’m an ordinary guy just trying to do my best for investors and who gave a damn about investors”. Here’s a recent interview … Read More

Joel Greenblatt – Individual Investors Can Beat Large Institutions And Passive Strategies – Here’s How

One of our favorite Joel Greenblatt interviews is one he did with Steve Forbes at Intelligent Investing. In this interview, Greenblatt explains how small investors can still beat large institutions. Greenblatt also discusses why investing in indexes like The Russell 1000 and the S&P 500 are seriously flawed even though … Read More

Is Amazon Good Value – From A Value Investing Perspective

Just found a great article on Forbes that looks at whether Amazon, with a market cap of $465 Billion, represents good value from a value investing perspective. Here’s an excerpt from that article:

Charles Munger – Still The Best Article Ever Written on Stock Picking – TAM Archives

This is still the best talk ever given on The Art of Stock Picking by Charles Munger. It’s a masterpiece in the world of value investing. The lessons that Munger provides are timeless and it’s an absolute must read for all investors. Here is an excerpt from the article, The Art … Read More

The Olstein Funds – Look For Solid Businesses Facing Strategic Challenges

One of the firms we follow closely at The Acquirer’s Multiple is Olstein Capital Management and its Chairman, Bob Olstein. Last month, Olstein’s Executive Vice Chairman Eric Hayman did a great interview with The Wall Street Transcript (TWST) in which he discussed how the firm finds value opportunities in a world … Read More

Greenwald Says Mitch Julis Is One Of The Best Value Investors – Here’s Why

One of our favorite investors at The Acquirer’s Multiple is Mitch Julis at Canyon Partners. In a recent Barron’s article, Bruce Greenwald was asked who are the best value investors to which he replied, “Warren Buffett, obviously; Seth Klarman [Baupost Group]; Howard Marks [Oaktree Capital Management]; Mitch Julis [Canyon Partners]. … Read More

Returns to The Acquirer’s Multiple® Screeners and The Best Value Stocks

[View the story “Week Beginning May 22nd, 2017” on Storify]

This Week’s Best Investing Reads – Curated Links

Here’s a list of this week’s best investing reads:

TAM Deep Value Stock Screeners – Overnight Market Update – May 19, 2017

The Acquirer’s Multiple® Valuation Ratio All stocks are picked using The Acquirer’s Multiple® valuation ratio. The ratio examines several financial statement items that other multiples like the price-to-earnings ratio do not, including debt, preferred stock, and minority interests; and interest, tax, depreciation, amortization and capital expenditures. The Acquirer’s Multiple® is … Read More

The 12 Commandments of Warren Buffett’s Hero, Philip Carret

Late last year The Telegraph did a great piece on value investing legend Philip Carret, who Warren Buffett described as one of his hero’s. After founding his Pioneer Fund in 1928, one year before the great depression, Carret successfully steered his fund consistently upwards through the Great Depression and the … Read More

Howard Marks And Joel Greenblatt: “I Think You And I Would Agree That People Are Nuts.” Time Favors The Rational.

Earlier this year, Howard Marks and Joel Greenblatt came face to face at the inaugural Forbes and Shook Research Top Financial Advisor Summit in Las Vegas where it became apparent that their worldview is nearly identical. When speaking about the current market conditions the pair said, “Most people, including most people … Read More

TAM Deep Value Stock Screeners – Overnight Market Update – May 18, 2017

The Acquirer’s Multiple® Valuation Ratio All stocks are picked using The Acquirer’s Multiple® valuation ratio. The ratio examines several financial statement items that other multiples like the price-to-earnings ratio do not, including debt, preferred stock, and minority interests; and interest, tax, depreciation, amortization and capital expenditures. The Acquirer’s Multiple® is … Read More

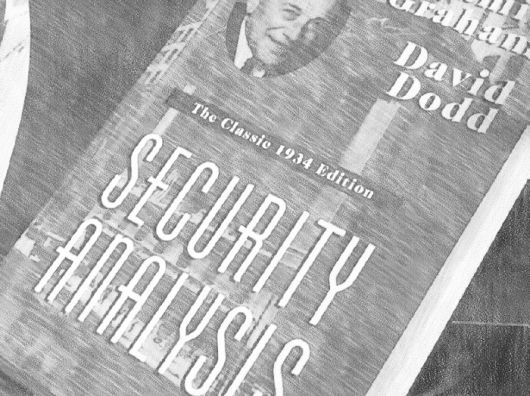

New Evidence Shows Graham and Dodd Were Right About Most Quant Investing Strategies

A recent publication in the Financial Analysts Journal called Facts about Formulaic Value Investing, by U-Wen Kok, Jason Ribando and Richard Sloan demonstrates that most quantitative investing strategies used today are unlikely to generate superior investment performance even with the advent of computers and financial databases. The research states, “We found little compelling evidence … Read More