During the 2002 Berkshire Hathaway Annual Meeting Warren Buffett provided some great insights into why buying a basket of stocks in an industry is better than picking individual stocks. Here’s an excerpt from the meeting: AUDIENCE MEMBER: Hi, my name is Jennifer Pearlman from Toronto, Canada. Mr. Buffett, in 1998, … Read More

What Are The Steps Investors Can Take To Discover A Company’s Hidden Assets

https://www.youtube.com/watch?v=Ry_HO9V4xHI?start=621 During his recent interview with Tobias. Joseph Calandro Jnr discusses the steps that investors can take to uncover a company’s hidden assets. Here’s an excerpt from the interview: Tobias Carlisle: So you describe the strategy to exploit these hidden assets or, in particular, these intellectual property character-type assets as … Read More

Hidden Assets: Just How Did Disney Unlock $17 Billion+ From A $4 Billion Acquisition Of Marvel?

https://www.youtube.com/watch?v=Ry_HO9V4xHI?start=328 During his recent interview with Tobias. Joseph Calandro Jnr discusses how investors can find value in companies with hidden assets. He illustrates the point with the case study of Disney’s purchase of Marvel for $4 Billion. Here’s an excerpt from the interview: Tobias Carlisle: You describe in your paper … Read More

(Ep.8) The Acquirer’s Podcast: Joseph Calandro Jr – Hidden Assets, M&A Dealmaking: Disney And Marvel’s Movies

Summary In this episode of The Acquirer’s Podcast Tobias chats with Joseph Calandro, Jr. During the interview Joseph, who is the author of Applied Value Investing and 50 research publications, provides some great insights into: – Investors Can Find Value In Companies With ‘Hidden Assets’ – Case Study Disney Buys … Read More

TAM Stock Screener – Stocks Appearing in Marks, Griffin, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Reads 4/26/2019

Here’s a list of this week’s best investing reads: The Anatomy of a Great Decision (Farnam Street) The Problem With Most Financial Advice (Of Dollars and Data) What a Strange Round Trip It’s Been (A Wealth of Common Sense) The Intangibles of Assessing Management Quality (Safal Niveshak) Three Reasons You’re Never Satisfied (The Reformed Broker) … Read More

Rich Pzena – Top 10 Holdings

This content is restricted to registered paid users who are logged in. Click here to register or log in.

Why Buying Options Is A Very Difficult Investment To Manage

This content is restricted to registered paid users who are logged in. Click here to register or log in.

Charlie Munger: Focus Investing – One Way To Beat The Market

One of our favorite investing books is Poor Charlie’s Almanack by Peter Kaufman, and there’s one passage in the book in which Charlie Munger explains how he and Buffett use ‘focus investing’ to beat the market, saying: “Our investment style has been given a name-focus investing-which implies ten holdings, not … Read More

Why ‘Covered Calls’ Are A Great Strategy For Enhancing Yield

https://www.youtube.com/watch?v=g45heRGKrpE?start=1492 During his recent interview with Tobias. Tim Travis of T&T Capital Management discusses why ‘covered calls’ are a great strategy for enhancing yield, saying: Tim Travis: Sure. So, covered calls we use less frequently, but it’s a great strategy to enhance the yield. So, if you have a dividend … Read More

How ‘Cash Secured Puts’ Can Provide Investors With Downside Price Protection

https://www.youtube.com/watch?v=g45heRGKrpE?start=1294 During his recent interview with Tobias. Tim Travis of T&T Capital Management discusses how ‘cash secured puts’ provide investors with downside price protection, saying: Tim Travis: Yeah. So, a cash secured put just means you’re not necessarily exploiting the margin factor. So, if we’re selling just a stock, let’s … Read More

(Ep.7) The Acquirer’s Podcast: Tim Travis – True Value, Value In Options And Insurance

Summary In this episode of The Acquirer’s Podcast Tobias chats with Tim Travis of T&T Capital Management. During the interview Tim, who is one of the top ranked investors in the TipRanks, provides some great insights into: – His Investments In Assured Guaranty Ltd, Puerto Rico, and Ireland – Managing … Read More

TAM Stock Screener – Stocks Appearing in Greenblatt, Simons, Griffin Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Bruce Berkowitz – Top 10 Holdings

This content is restricted to registered paid users who are logged in. Click here to register or log in.

This Week’s Best Investing Reads 4/19/2019

Here’s a list of this week’s best investing reads: Warren Buffett: The Greatest Factor Investor of All Time? (CFA Institute) How to Improve Your Risk-Adjusted Returns (The Irrelevant Investor) The Importance of Working With “A”Players (Farnam Street) Investing Do’s and Don’ts (Morningstar) Looking for Easy Games in Bonds (Michael Mauboussin) Investors … Read More

Investors Need A Set Of Written Rules To Follow – Dumb Rules Are Better Than No Rules

https://www.youtube.com/watch?v=zL0oaAO9DD0?start=935 During his recent interview with Tobias, Michael Batnick of Ritholz Weath Management discusses the importance of having written rules to follow in order to be successful in investing, saying: I’m also a big believer in having written rules, and I had no such rules when I was doing it, … Read More

Prem Watsa: Shorting Cost Us $2 Billion and Why Value Investing Is So Tough

We’ve just been reading through the latest Fairfax Financial Annual Report 2018 in which Prem Watsa discusses his failed attempt to short indices (mainly the S&P500 and Russell 2000) and a few common stocks, saying: In the past, to protect our equity exposures in uncertain times, we shorted indices (mainly … Read More

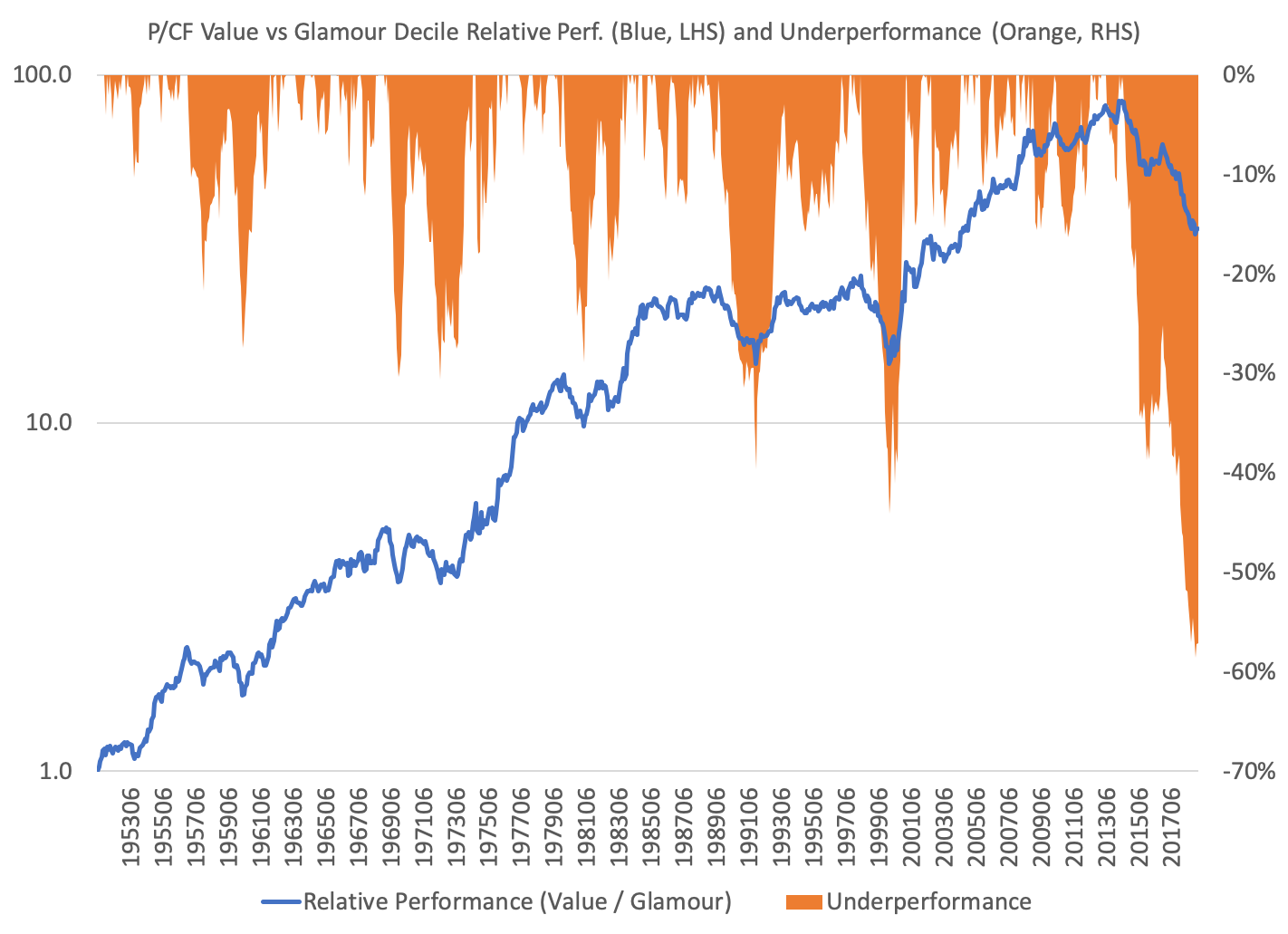

Value portfolios formed on P/CF are underperforming glamour by the widest margin *EVER* going back to 1951 — 59%

The chart below shows the relative performance (blue, left-hand side) and underperformance from the nearest peak (orange, right-hand side) of value-weighted decile portfolios formed on price-to-cash flow from 1951 to February 2019. Value is currently enduring its deepest relative underperformance ever. In December last year, the value decile of portfolios … Read More

Warren Buffett: You Don’t Want To Buy Stock In The Company That Has To Do Everything Right

Here’s a great recent interview with Warren Buffett speaking to Becky Quick at CNBC. During the interview Buffett, while speaking about Apple, provides some great insights into why investors should not buy stocks in companies that have to do everything right, saying: Apple, I’d love to see them succeed. That’s … Read More

In Investing You Don’t Need To Be Perfect, You Just Need To Be Good Enough

https://www.youtube.com/watch?v=zL0oaAO9DD0?start=2040 During his recent interview with Tobias, Michael Batnick of Ritholz Wealth Management discusses just how difficult it is to be an investor. Michael says that the name of the game is not to be perfect, because you’re not going to be. For the average person, it’s pretty easy to … Read More