Here’s a list of this week’s best investing reads:

Warren Buffett: The Greatest Factor Investor of All Time? (CFA Institute)

How to Improve Your Risk-Adjusted Returns (The Irrelevant Investor)

The Importance of Working With “A”Players (Farnam Street)

Investing Do’s and Don’ts (Morningstar)

Looking for Easy Games in Bonds (Michael Mauboussin)

Investors Catch Can’t-Lose Fever Just in Time for Hot IPOs (Bloomberg)

No More Recessions Ever Again? (UPFINA)

Operating at an Elite Level (The Reformed Broker)

When You’ll Believe Anything (Collaborative Fund)

Is There Hope for Value Investing? (Validea)

Here’s Where Active Management Actually Works (Institutional Investor)

Thinking Outside the Box: How and Why to Invest in a Climate Change Strategy (GMO)

Why We May Be Headed For Another ‘Volatility Event’ (The Felder Report)

Uber’s Coming out Party: Personal Mobility Pioneer or Overpriced Car Service Company? (Musings on Markets)

Fidelity’s Index-Fund Bashing Misses the Mark (Jason Zweig)

Softbank Will Succeed Even If Its WeWork Investment Doesn’t Work Out (Vitaliy Katsenelson)

Investing’s False Positives (Safal Niveshak)

Why We’ll Never All Be Happy Again (A Wealth of Common Sense)

Don’t Pay Too Much for Stocks That Pay Dividends (NY Times)

On the Other Hand (Humble Dollar)

The Will To Survive (Of Dollars and Data)

The Speed Limit of Trend (Flirting With Models)

Jamie Dimon says the US economic expansion ‘could go on for years’ (CNBC)

Ten Behavioural Advantages Amateur Investors Hold Over Professionals (Behavioural Investment)

This week’s best investing research reads:

Investment Strategy in an Uncertain World (Alpha Architect)

A Census of the Factor Zoo (papers.ssrn)

Forecasting Future Oil Prices & New Economy Stocks (Value Expectations)

Hard Truths for the Inflation Truthers (Pragmatic Capitalism)

When Performance Is too Good to Be True (Price Action Lab)

Cognitive Priming and Trend-following – Not a Bad Thing (Mark Rzepczynski)

The Value of Taking the Long View (Advisor Perspectives)

This week’s best investing podcasts:

Katherine Collins – Impact and ESG Investing – EP.129 (Invest Like The Best)

TIP238: NetSuite Founder Evan Goldberg (The Investors Podcast)

Paul Rabil – Lacrosse and Entrepreneurship (EP.95) (Capital Allocators)

Catalyzing Success – Daniel Gross, former Y Combinator partner and current founder of Pioneer (The Knowledge Project)

Episode #151: Divya Narendra, “Valuation Is Probably The Most Critical Component Of SumZero’s Thesis” (Meb Faber)

Ep 120: Building A Personal Finance Media Brand By Focusing On Being Your Authentic Self, with Manisha Thakor (FA Success)

Episode 77: Money Made By Chance (Animal Spirits)

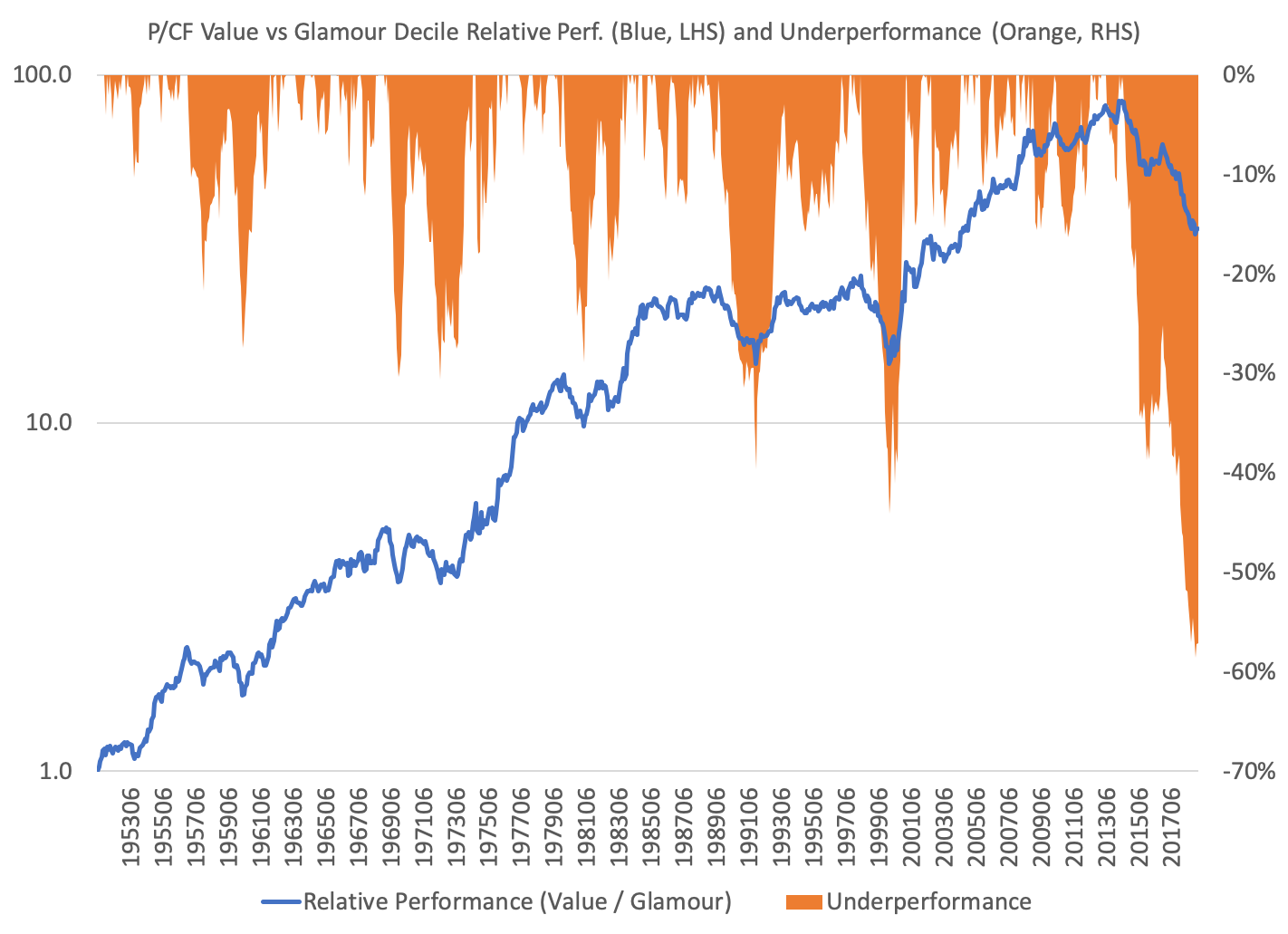

This week’s best investing chart:

Value portfolios formed on P/CF are underperforming glamour by the widest margin *EVER* going back to 1951 — 59% (The Acquirer’s Multiple)

(Source: The Acquirer’s Multiple)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: