Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Bruce Berkowitz – Top 10 Holdings

This content is restricted to registered paid users who are logged in. Click here to register or log in.

This Week’s Best Investing Reads 4/19/2019

Here’s a list of this week’s best investing reads: Warren Buffett: The Greatest Factor Investor of All Time? (CFA Institute) How to Improve Your Risk-Adjusted Returns (The Irrelevant Investor) The Importance of Working With “A”Players (Farnam Street) Investing Do’s and Don’ts (Morningstar) Looking for Easy Games in Bonds (Michael Mauboussin) Investors … Read More

Investors Need A Set Of Written Rules To Follow – Dumb Rules Are Better Than No Rules

https://www.youtube.com/watch?v=zL0oaAO9DD0?start=935 During his recent interview with Tobias, Michael Batnick of Ritholz Weath Management discusses the importance of having written rules to follow in order to be successful in investing, saying: I’m also a big believer in having written rules, and I had no such rules when I was doing it, … Read More

Prem Watsa: Shorting Cost Us $2 Billion and Why Value Investing Is So Tough

We’ve just been reading through the latest Fairfax Financial Annual Report 2018 in which Prem Watsa discusses his failed attempt to short indices (mainly the S&P500 and Russell 2000) and a few common stocks, saying: In the past, to protect our equity exposures in uncertain times, we shorted indices (mainly … Read More

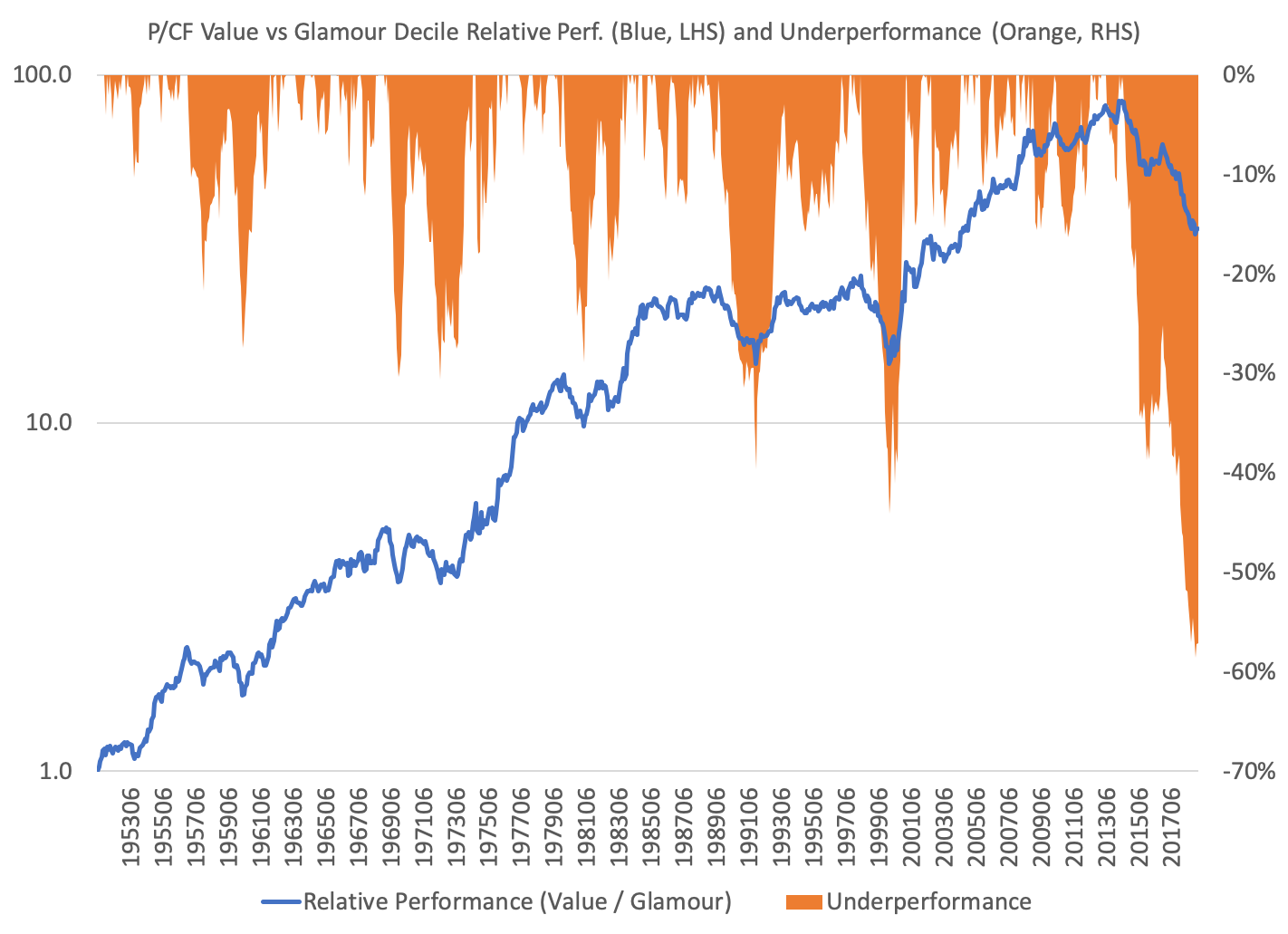

Value portfolios formed on P/CF are underperforming glamour by the widest margin *EVER* going back to 1951 — 59%

The chart below shows the relative performance (blue, left-hand side) and underperformance from the nearest peak (orange, right-hand side) of value-weighted decile portfolios formed on price-to-cash flow from 1951 to February 2019. Value is currently enduring its deepest relative underperformance ever. In December last year, the value decile of portfolios … Read More

Warren Buffett: You Don’t Want To Buy Stock In The Company That Has To Do Everything Right

Here’s a great recent interview with Warren Buffett speaking to Becky Quick at CNBC. During the interview Buffett, while speaking about Apple, provides some great insights into why investors should not buy stocks in companies that have to do everything right, saying: Apple, I’d love to see them succeed. That’s … Read More

In Investing You Don’t Need To Be Perfect, You Just Need To Be Good Enough

https://www.youtube.com/watch?v=zL0oaAO9DD0?start=2040 During his recent interview with Tobias, Michael Batnick of Ritholz Wealth Management discusses just how difficult it is to be an investor. Michael says that the name of the game is not to be perfect, because you’re not going to be. For the average person, it’s pretty easy to … Read More

In Investing Knowing What Not To Do And Not Doing It Are Two Separate Things

https://www.youtube.com/watch?v=zL0oaAO9DD0?start=1324 During his recent interview with Tobias, Michael Batnick of Ritholz Wealth Management discusses some of the big mistakes that have been made by successful investors. Michael makes the point that while these investors knew what not to do, knowing what not to do and not doing it are two … Read More

(Ep.6) The Acquirers Podcast: Michael Batnick of Ritholz Wealth Management – Big Mistakes, The Best Investors And Their Worst Trades

Summary In Episode 6 of The Acquirer’s Podcast, Tobias interviews Michael Batnick, the Director of Research at Ritholz Wealth Management and author of Big Mistakes: The Best Investors and Their Worst Investments. During the interview Michael discusses: How He First Met Josh Brown (Author of The Reformed Broker Blog) Some … Read More

This Week’s Best Investing Reads 4/12/2019

Here’s a list of this week’s best investing reads: You Have To Live It To Believe It (Collaborative Fund) Current Events (csinvesting) Aswath Damodaran – Lyft overvalued here, according to the dean of valuation (YouTube) Five Crashes (Humble Dollar) Danger Zone: Traditional Value Investors (Forbes) Investing In Shipping Stocks: Lessons From Walter Schloss … Read More

TAM Stock Screener – Stocks Appearing in Dalio, Burry, Greenblatt Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

Investors Can Use Consumer Satisfaction Surveys To Capture Alpha

https://www.youtube.com/watch?v=FdtGtzUuA3o?start=1187 During his recent interview with Tobias. Phil Bak of Exponential ETFs discusses how investors can use consumer satisfaction surveys to capture alpha. Here’s an excerpt from the interview: Tobias Carlisle: So just to go back to the ACSI, the consumer sentiment … Is it consumer sentiment? Phil Bak: Satisfaction. … Read More

16 Of The Best Books On The History of Finance & Investing

Our Recommended Books for Superinvestors Some time ago we started a series called – Superinvestors: Books That Every Investor Should Read. So far we’ve provided the book recommendations from: Charles Munger: 32 Books That Every Investor Should Read Seth Klarman: 32 Books That Every Investor Should Read Warren Buffett: 35 … Read More

Investors Can Extrapolate The Premium Provided By An Equal Weight Portfolio Versus Market Cap

https://www.youtube.com/watch?v=FdtGtzUuA3o?start=498 During his recent interview with Tobias. Phil Bak of Exponential ETFs discusses how investors can extrapolate the premium which is provided by equal weight portfolio versus market cap, saying: Well, I think it really started and like you said, with equal weights. My background, I was at Ridex Investments, … Read More

How Can Investors Use ‘Reverse Market Cap’ To Generate Excess Returns

https://www.youtube.com/watch?v=FdtGtzUuA3o?start=71 During his recent interview with Tobias, Phil Bak of Exponential ETFs explains how investors can use ‘Reverse Market Cap’ to generate excess returns, saying: So reverse cap is very simple. We take the … In this case it’s on the S&P 500, and we take the index constituents of … Read More

(Ep.5) The Acquirers Podcast: Phil Bak of Exponential ETFs – How Reverse Cap Beats The Market (Cap)

In Episode 5 of the The Acquirers Podcast, Tobias chats with Phil Bak of Exponential ETFs. During the interview Phil, who is an expert in ETF’s, provides some great insights into: How Investors Can Use ‘Reverse Market Cap’ To Generate Excess Returns The Market Doesn’t Care Where You Live – … Read More

James Montier: Why Does Everyone Hate MMT?

James Montier recently released a great paper titled – Why Does Everyone Hate MMT?, Groupthink in Economics. In the paper he argues that MMT is misunderstood by the ‘great and the good’ such as Rogoff, Krugman, and Summers, saying: Modern Monetary Theory (MMT) seems to provoke a visceral reaction amongst … Read More

TAM Stock Screener – Stocks Appearing in Soros, Dalio, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, … Read More

This Week’s Best Investing Reads 4/5/2019

Here’s a list of this week’s best investing reads: Howard Marks Memo – Growing The Pie (Oaktree) Ray Dalio – Why and How Capitalism Needs to Be Reformed (Part 1) (LinkedIn) How is the Market Doing? (The Irrelevant Investor) Stock Investors: You Have Nothing to Fear but Fear Itself (Vitaliy Katsenelson) Real Estate … Read More