In this interview with the Graham & Doddsville Newsletter investing legend Julian Robertson provided some great insights into the best way to invest. Here’s an excerpt from the interview: JR: I believe that the best way to manage money is to go long and short stocks. My theory is that … Read More

Munger’s FOMO Moment Made Him Millions

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed how Munger’s FOMO Moment Made Him Millions. Here’s an excerpt from the episode: Tobias: So, I got a question, bit personal to me. But if I had to write Deep Value today, would I add … Read More

Do Fundamentals Still Matter?

During his recent interview with Tobias, Cliff Asness, Co-Founder of AQR discussed Do Fundamentals Still Matter? Here’s an excerpt from the interview: Tobias: That’s a good segue into– one of the questions that they ask is, do fundamentals still matter? They have a very interesting approach to assessing that– create this look– it’s … Read More

(Ep.74) The Acquirers Podast: Cliff Asness – Cliff’s Perspective, Systematic Value. Do Fundamentals Matter?

In this episode of The Acquirer’s Podcast Tobias chats with Cliff Asness, Co-Founder of AQR. During the interview Cliff provided some great insights into: Systematic Value Investing Do Fundamentals Still Matter? Does Price-To-Book Still Work? Is There A Correlation Between Value Investing And Interest Rates The Reason That Value Hasn’t … Read More

Charles Munger: Top 10 Holdings (Q2 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Stock In Focus – TAM Stock Screener – Heidrick & Struggles International, Inc. (NASDAQ: HSII)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Heidrick & Struggles International, Inc. (NASDAQ: HSII). Heidrick & Struggles … Read More

Bernstein’s Deep Risk: How History Informs Portfolio Design

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed lessons learned from William Bernstein’s Book – Deep Risk: How History Informs Portfolio Design. Here’s an excerpt from the episode: Jake: All right. This week, I’m going to be talking about this neat little … Read More

This Week’s Best Investing Articles, Research, Podcasts 7/3/2020

Here’s a list of this week’s best investing reads: Fraud, Short Sellers & Media (Jamie Catherwood) Joe Granville: The Original Dave Portnoy (A Wealth of Common Sense) Asset Allocation Beyond the Zero Bound (Verdad) When should you sell your stocks? Only in these cases (Forbes) A Viral Market Update XI: An Ode … Read More

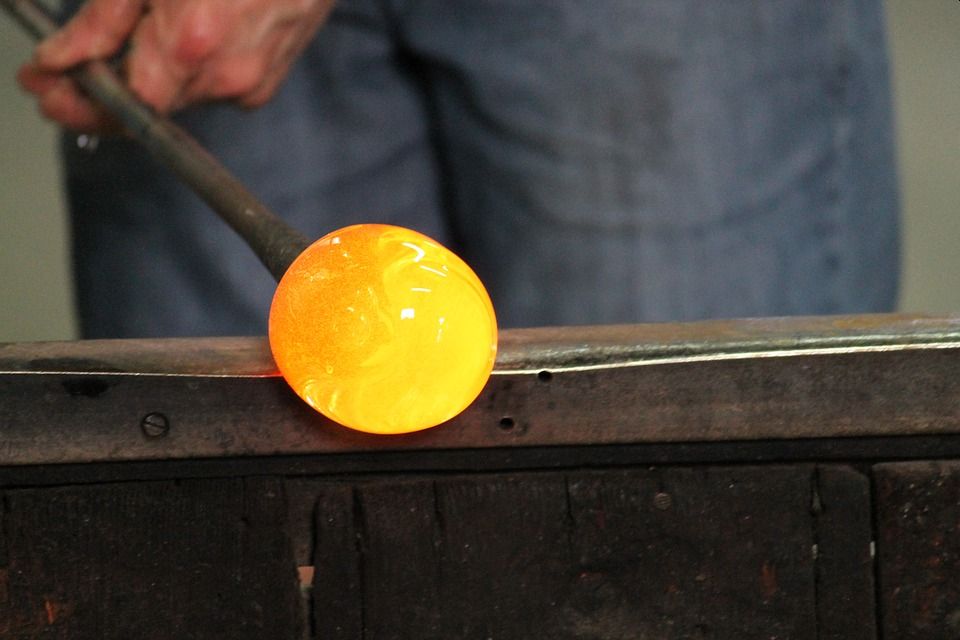

Aswath Damodaran: The Venetian Glassmaker – Dumbing-Down Valuation Techniques

In a recent interview with Barron’s, Aswath Damodaran discussed glamour stocks, gig-economy companies, buying Tesla, and valuation techniques including how investors can dumb-down their valuation process to the bare minimum. Here’s an excerpt from the interview: Barron’s: Tell us about teaching stock valuation. Aswath Damodaran: Everything I know about valuation I’ve … Read More

Michael Mauboussin: Perform A ‘Premortem’ Before You Invest

In Michael Mauboussin’s book, Think Twice: Harnessing the Power of Counterintuition, there’s a great passage on how investors can make better investment decisions using what he terms a ‘premortem’. Here’s an excerpt from the book: Many people are familiar with a postmortem, an analysis of a decision after the outcome is … Read More

TAM Stock Screener – Stocks Appearing In Klarman, Greenblatt, Simons Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

VALUE: After Hours (S02 E26): Bill’s Robinhood Follow-up, Bernstein’s Deep Risk, $INTC and $LMT

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Bernstein’s Deep Risk: How History Informs Portfolio Design Great Opportunities Today For Deep Value Investors Munger’s FOMO Moment Made Him Millions How Would A Young Warren Buffett Invest Today? Bill’s Robinhood Follow Up Comparing This … Read More

How Share-Based Compensation Lowers Returns

During his recent interview with Tobias, Partha Mohanram, a Professor of Accounting and John H. Watson Chair in Value Investing at The University of Toronto discussed How Share-Based Compensation Lowers Returns. Here’s an excerpt from the interview: Tobias: One of your papers that I discovered it after you got in contact with me, … Read More

Jim Simons: Make A Decision Even If It’s Wrong! Don’t Dawdle.

Here’s a great interview with Jim Simons on the Into The Impossible Podcast in which he discusses life lessons and leadership lessons, including his thoughts on decision making which is particularly relevant to investing. Here’s an excerpt from the interview: Q: You once told me that you read a fiction … Read More

One Stock Superinvestors Are Buying Or Holding (19)

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Treacherous Markets

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Treacherous Markets. Here’s an excerpt from the episode: Tobias: So, I just been really enjoying watching Davey Day Trader on the Twitter machine and everything else. Clearly, there are lots of folks following him and … Read More

The Efficacy Of Fundamental Analysis Has Declined

During his recent interview with Tobias, Partha Mohanram, a Professor of Accounting and John H. Watson Chair in Value Investing at The University of Toronto discussed how The Efficacy Of Fundamental Analysis Has Declined. Here’s an excerpt from the interview: Tobias: That was one of the things that I wanted to talk to … Read More

Are Robinhood Investors Buying The Dip? – Here’s The Verdict

With all of the talk about Robinhood investors and their stock picks lately we thought we’d take a look at the Robintrack Leaderboard to see how the top 10 picks have performed over the past twelve months to try to determine whether the collective strategy appears to be based more … Read More

Dark Matter, And Why It’s Important To Investors

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed dark matter, and why it’s important to investors. Here’s an excerpt from the episode: Jake: Bill, focus right now. 18% of the matter based on mass in the universe is visible to us and the … Read More

Picking Winners From Losers Using The G-Score

During his recent interview with Tobias, Partha Mohanram, a Professor of Accounting and John H. Watson Chair in Value Investing at The University of Toronto discussed Picking Winners From Losers Using The G-Score. Here’s an excerpt from the interview: Tobias: Well, your name was brought to my attention by the Practical Quant, … Read More