During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed how Warren Buffett Pulled Off The Greatest Trade Ever. Here’s an excerpt from the episode: Tobias: Well, I’m going to be talking about something good. I tweeted this out on Friday. I truly believe it– … Read More

This Week’s Best Investing Articles, Research, Podcasts 7/24/2020

Here’s a list of this week’s best investing reads: The Bubble 500 (Verdad) The Greatest Danger Investors Face (A Wealth of Common Sense) Securitization & Markets (Jamie Catherwood) Jim Chanos – We Are In The Golden Age of Fraud (FT) A Viral Market Update XII: The Resilience of Private Risk Capital (Aswath Damodaran) … Read More

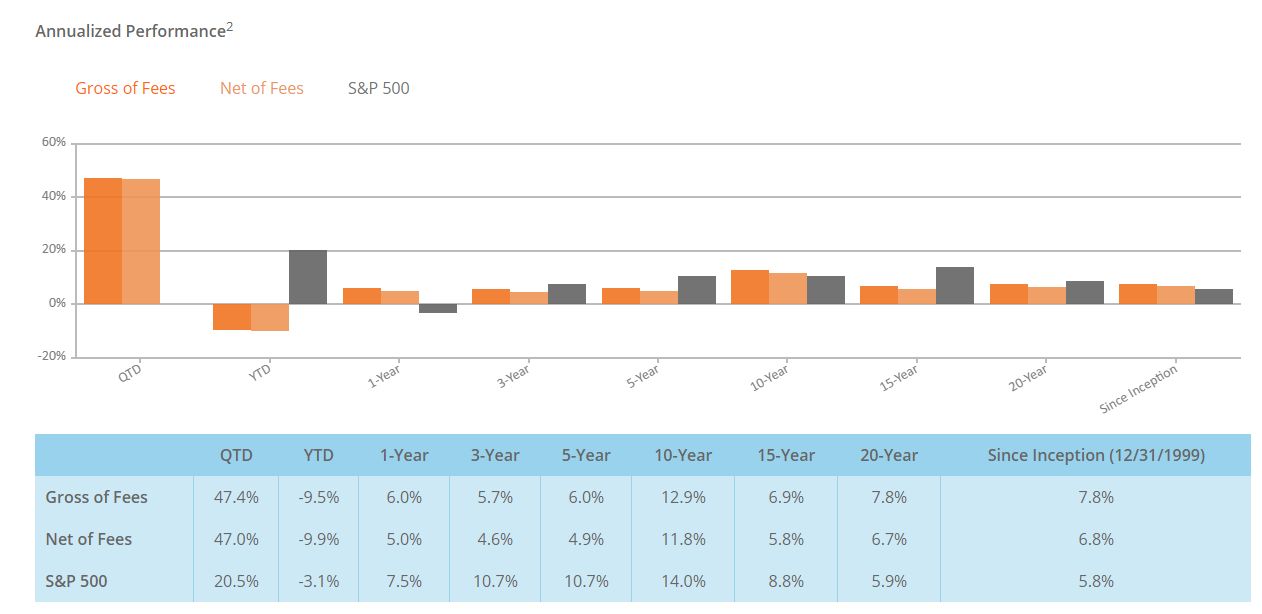

Bill Miller: Opportunity Equity Portfolio – Best Quarter Ever – Up 47% (Net of Fees)

This week Miller Value reported in their Q2 2020 Letter that the Miller Opportunity Equity Portfolio returned +47.0% (net of fees) saying: “It was the best of times, it was the worst of times…” I’m pleased to report we just had our very best quarter of performance in the history … Read More

VALUE: After Hours (S02 E29): Buffett’s Got The Greatest Trade Ever, $WFC WTF, Investor Personalities

In this episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle chat about: Warren Buffett Pulled Of The Greatest Trade Ever $WFC WTF Finding Your Fundamental Investing Blindspot Bill Miller Credits His Success To Learning Philosophy David Einhorn: Before and After Bill Ackman And Mature Unicorns The Problem … Read More

Sexing Chicks And World War 2 Spotting

During his recent interview with Tobias, Mike Puangmalai, owner of The NonGaap Newsletter discussed Sexing Chicks And World War 2 Spotting. Here’s an excerpt from the interview: Tobias: It’s just that it’s too subtle to articulate. With sexing chicks, you can’t tell somebody what to look for. They just have to guess on … Read More

One Stock Superinvestors Are Buying Or Holding (22)

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Sequoia Fund: Top 10 Holdings (Q2 2020)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Rich Pzena: The True Performance Of Value Investing Should Be Measured Over A Variety Of Endpoints

In his latest Q2 2020 Market Commentary Rich Pzena urges investors to consider the performance of value investing over a variety of endpoints, rather than just the recent past, as a better representation of the strategy’s efficacy. Here’s some excerpts from his commentary: The extreme volatility in the first quarter … Read More

Tweedy Browne: Value Investing Will Continue To Thrive

In a recent interview with Advisor Perspectives the team at Tweedy Browne discussed why they believe value investing will continue to thrive. Here’s some excerpts from the interview: It’s been a tough stretch for value investing, particularly for those who take a statistical or a factor-based approach. The value factor … Read More

TAM Stocks Included In Greenblatt, Dalio, Rogers Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Wide Value Spread

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed The Wide Value Spread. Here’s an excerpt from the episode: Tobias: All right, good stuff. Shall we move on to mine? Not really a huge topic this time around. I’m just noticing value getting absolutely … Read More

Companies Will “Spring Load” And “Bullet Dodge” Equity Grants To Benefit Insiders

During his recent interview with Tobias, Mike Puangmalai, owner of The NonGaap Newsletter discussed how Companies Will “Spring Load” And “Bullet Dodge” Equity Grants To Benefit Insiders. Here’s an excerpt from the interview: Tobias: You talk about using compensation. The two mechanisms are spring-loading options and bullet dodging. There’s this great part in … Read More

The Dark Arts Of Corporate Governance

During his recent interview with Tobias, Mike Puangmalai, owner of The NonGaap Newsletter discussed The Dark Arts Of Corporate Governance. Here’s an excerpt from the interview: Tobias: You’ve got this great series, which we’re going to go through in a moment, on your blog about corporate governance and the dark arts of … Read More

Cheap Bank Stocks

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Cheap Bank Stocks. Here’s an excerpt from the episode: Bill: I don’t know. I’ve been on this financials deep dive because I just look at where they’re all trading and this is– I feel I’m … Read More

John Huber: Coffee Can Investing – So Easy, Yet So Hard

Earlier this month John Huber, Managing Partner at Saber Capital, wrote a great piece on the merits of ‘coffee can’ investing. The strategy, which appears to work very well, is rarely used by investors. Huber provides some great insights on why. Here’s an excerpt from the piece: The coffee can … Read More

Michael Mauboussin: Ben Graham’s Mr Market Behavior Will Be Around For A Long Time

In his recent interview with Sean Delaney on the What Got You There podcast, Michael Mauboussin discusses behavioral economics and makes the point that human nature, as it relates to investing, is unlikely to change anytime soon. Here’s an excerpt from the interview: If you go back and circle around … Read More

(Ep.76) The Acquirers Podcast: Mike Puangmalai – Dark Arts, Corporate Governance, Activism, And Tech With NonGAAP

In this episode of The Acquirers Podcast Tobias chats with Mike Puangmalai, owner of The NonGaap Newsletter, and master in the dark arts of corporate governance. During the interview Mike provided some great insights into: The Dark Arts Of Corporate Governance Ben Horowitz Avoided An Options Backdating Scandal Corporate Governance … Read More

Stock In Focus – TAM Stock Screener – Matrix Service Co (NASDAQ: MTRX)

As part of a new series here at The Acquirer’s Multiple, we’re providing a new feature called ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Matrix Service Co (NASDAQ: MTRX). Matrix Service Co is an … Read More

Howard Marks: The Reason Stocks Are Absurdly Expensive Is Due To ‘Freeloading’ Passive Investing Strategies

In his recent interview with CFA Chile Howard Marks highlighted the impact that passive investing strategies are having on driving stock prices to absurdly expensive levels while also driving out active investors, which keep prices fair. Here’s an excerpt from the interview: When you see the way the markets have … Read More

Christensen’s How To Measure Your Life

During their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Christensen’s How To Measure Your Life. Here’s an excerpt from the episode: Jake: [laughs] That’s right. So, the first thing is, how this came up was– I’ll give you guys a little hack that I … Read More