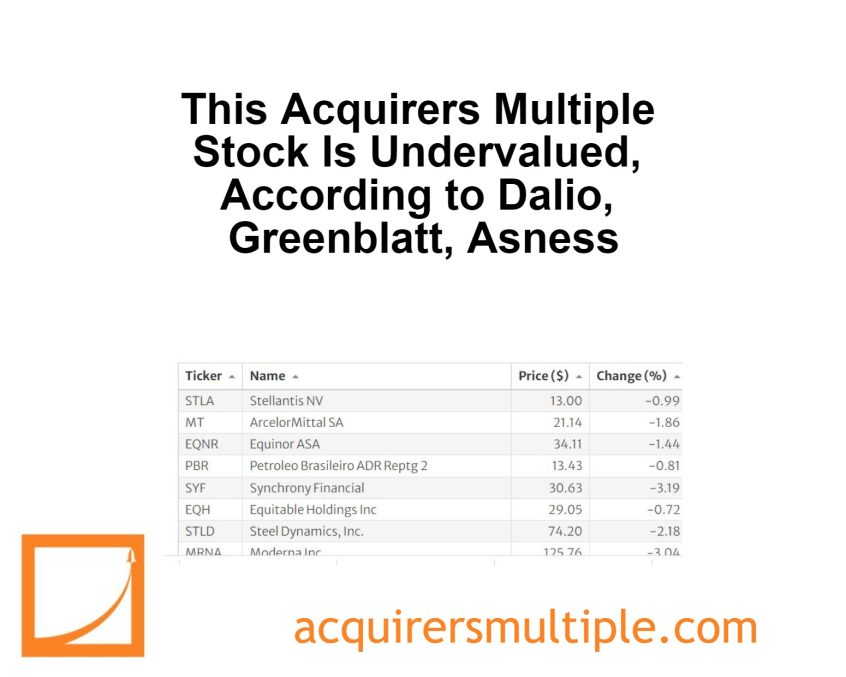

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

The Art of Identifying Leadership Qualities in Potential Investments

During their recent episode, Taylor, Carlisle, and Bares discussed The Art of Identifying Leadership Qualities in Potential Investments, here’s an excerpt from the episode: Brian: Yeah, very difficult, obviously. So, we do the table stakes work that everybody does in terms of analyzing alignment of incentives through– We prefer as … Read More

Howard Marks: Psychology-Induced Errors In Investor Behavior

In his book – Mastering The Market Cycle, Howard Marks explains the phenomenon of capitulation in financial markets. In the early stages of a bull or bear market, most investors refrain from joining the trend, lacking the insight or courage to act early. As the trend gains momentum, these investors … Read More

Mohnish Pabrai: Warren Buffett’s 4% Hit Rate

During this interview with My First Million, Mohnish Pabrai discusses Warren Buffett’s investment strategy and performance, particularly highlighting a key point from Buffett’s 2023 letter to shareholders. Buffett noted that over his 58-year tenure at Berkshire Hathaway, only 12 investment decisions significantly impacted the company’s success. Despite making hundreds of … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Maslow’s Eupsychia: Imagining the Potential of a Self-Actualized Society

During their recent episode, Taylor, Carlisle, and Bares discussed Maslow’s Eupsychia: Imagining the Potential of a Self-Actualized Society, here’s an excerpt from the episode: Jake: [chuckles] I’d be curious to hear your take on some of this stuff, Brian, because especially when we start talking about culture and what maybe … Read More

Warren Buffett: Identifying Leaders Who Love Their Business

During the 1998 Berkshire Hathaway Annual Meeting, Warren Buffett offered several insightful lessons on business management, particularly in the context of acquisitions and leadership, including why it’s crucial to discern whether a business leader is driven primarily by a passion for their business or by financial gain. This distinction helps … Read More

Nassim Nicholas Taleb: 5 Key Investing Lessons: Stay Within Your Expertise

In this interview at the AIM Summit, Nassim Nicholas Taleb provides 5 key investing lessons: Stay Within Your Expertise: Taleb emphasizes the importance of sticking to your professional expertise. If you are not a finance professional, avoid trying to make money through investments beyond your understanding. Instead, focus on excelling … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Gaining an Edge in Investing: Information, Analysis, and Behavioral Insight

During their recent episode, Taylor, Carlisle, and Bares discussed Gaining an Edge in Investing: Information, Analysis, and Behavioral Insight, here’s an excerpt from the episode: Brian: Sure. So, I should start by saying that, as an investor, you can have an edge in your information, the actual data that you’re … Read More

Ray Dalio: The Best Investment Hedge Right Now Is…

During his recent interview with WSJ, Ray Dalio explains why he sees gold as a great hedge right now. Gold is a reliable store of wealth when inflation erodes the purchasing power of fiat currencies. When central banks and governments monetize debt, leading to increased money supply and potential devaluation, … Read More

Mohnish Pabrai: What Happened When Charlie Munger Reviewed My Entire Portfolio?

During this Q&A session with Guy Spier at VALUEx BRK 2024, Mohnish Pabrai shared an anecdote about an intimidating experience with Charlie Munger. During their first meeting, set up by Warren Buffett, Charlie examined a printout of Pabrai’s entire portfolio. Despite not using computers, Charlie’s friend or assistant had prepared … Read More

Joel Greenblatt – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E21): Brian Bares on Moats, Analytical Edges, and the Importance of Growth

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Brian Bares discuss: Gaining an Edge in Investing: Information, Analysis, and Behavioral Insight Maslow’s Eupsychia: Imagining the Potential of a Self-Actualized Society The Art of Identifying Leadership Qualities in Potential Investments Investing as a Form … Read More

Tesla, Inc. (TSLA) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Tesla, Inc. (TSLA). Profile Tesla is a vertically integrated … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (05/24/2024)

This week’s best investing news: Terry Smith – Valuation Is Not as Important as Quality (The Market) The Gold Rally (Verdad) Stanley Druckenmiller Interview CNBC (CNBC) Quantitative Momentum Investing (Validea) Guy Spier – Outperforming The S&P 500 Index & The Dangers Of Long-Term Compounding (Guy Spier) Turning $1M Into $1B+: … Read More

Why Comcast Corp (CMCSA) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Comcast Corp (CMCSA) Comcast is made up of three parts. The … Read More

Finding Your Tribe Online: Navigating Digital Connection in a Disconnected World

During their recent episode, Taylor, Carlisle, and Morgan discussed Exploring Finding Your Tribe Online: Navigating Digital Connection in a Disconnected World, here’s an excerpt from the episode: Tom: Yes, exactly right. I think that all of this stuff is solved. It’s like a solved problem in many ways we just … Read More

Warren Buffett: Proven Techniques to Minimize Investment Risk

During the 1994 Berkshire Hathaway Annual Meeting, Warren Buffett discusses risk as the possibility of harm, which is tied to the time horizon for holding an asset. Short-term trades, like buying and selling within a day, are highly risky. In contrast, long-term investments, such as buying Coca-Cola shares for years, … Read More

Terry Smith: Stocks: The Only Asset Class That Truly Compounds Returns

In this interview with Algy’s Investment Podcast, Terry Smith discusses his investment philosophy which revolves around the power of compounding returns through investing in high-quality companies that retain and reinvest a significant portion of their profits back into the business. He believes stocks are the only asset class that can … Read More