As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Comcast Corp (CMCSA) Comcast is made up of three parts. The … Read More

Finding Your Tribe Online: Navigating Digital Connection in a Disconnected World

During their recent episode, Taylor, Carlisle, and Morgan discussed Exploring Finding Your Tribe Online: Navigating Digital Connection in a Disconnected World, here’s an excerpt from the episode: Tom: Yes, exactly right. I think that all of this stuff is solved. It’s like a solved problem in many ways we just … Read More

Warren Buffett: Proven Techniques to Minimize Investment Risk

During the 1994 Berkshire Hathaway Annual Meeting, Warren Buffett discusses risk as the possibility of harm, which is tied to the time horizon for holding an asset. Short-term trades, like buying and selling within a day, are highly risky. In contrast, long-term investments, such as buying Coca-Cola shares for years, … Read More

Terry Smith: Stocks: The Only Asset Class That Truly Compounds Returns

In this interview with Algy’s Investment Podcast, Terry Smith discusses his investment philosophy which revolves around the power of compounding returns through investing in high-quality companies that retain and reinvest a significant portion of their profits back into the business. He believes stocks are the only asset class that can … Read More

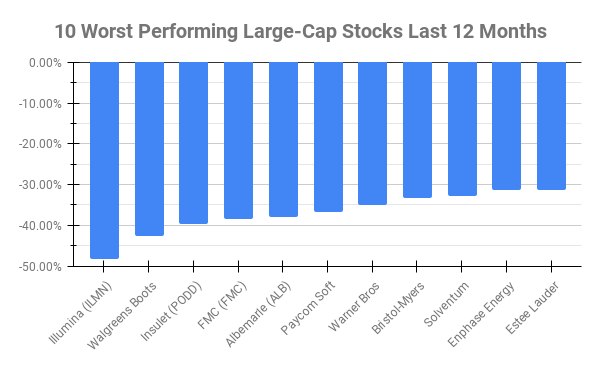

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Illumina (ILMN) -48.30% Walgreens Boots Alliance (WBA) -42.69% Insulet (PODD) -39.76% FMC (FMC) -38.52% Albemarle (ALB) -38.03% Paycom Soft … Read More

This Acquirers Multiple Stock Is Undervalued, According to Dalio, Pzena, Greenblatt

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

Beyond Logic: Exploring the Limits of Left-Brain Thinking

During their recent episode, Taylor, Carlisle, and Morgan discussed Beyond Logic: Exploring the Limits of Left-Brain Thinking, here’s an excerpt from the episode: Tom: It’s a conclusion of world changing importance for me, which is, essentially, we are imbalanced towards the brain’s left hemisphere. So, his first book, well, not … Read More

Guy Spier: The Importance of Process Over Outcomes in Investing

In this interview, Guy Spier discusses the importance of having a robust decision-making process when investing, as good processes can lead to bad results and vice versa due to uncontrollable external factors. He emphasizes structuring decisions to account for multiple possibilities and uncertainties, aiming for a good life regardless of … Read More

Stanley Druckenmiller: Using AI in Investing: A Game-Changer

During his recent interview with CNBC, Druckenmiller discusses his investment in Argentina, inspired by a Davos speech. He used Perplexity to identify the top five liquid Argentine ADRs and, following George Soros’ strategy of investing first and investigating later, bought them all. His positions have since grown, bolstered by positive … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

The Power of Weirdness: Embracing Your Unique Path

During their recent episode, Taylor, Carlisle, and Morgan discussed The Power of Weirdness: Embracing Your Unique Path, here’s an excerpt from the episode: Tom: A tropism is a direction, I think, and holism just means holism. So, it’s a directional force towards holism. So, it’s like, evolution is always acting … Read More

Warren Buffett: Don’t Underestimate The Role of Luck In My Investing Career

During the 2024 Berkshire Hathaway Annual Meeting, Warren Buffett discusses the significant role of luck in his success and life in general. He acknowledges that many fortunate circumstances, such as avoiding accidents, have contributed to his longevity and achievements. He admits that he would not have been the favorite to live … Read More

Mohnish Pabrai: The #1 Trait That Makes a Great Investor

In this interview with My First Million, Mohnish Pabrai emphasizes that patience is the key trait for successful investing. He illustrates this by referencing a Seinfeld episode where Elaine’s boyfriend is content staring at the seat back in front of him during a flight, leading to their breakup. Pabrai suggests … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Quantitative Finance and the Mantis Shrimp: Unlikely Connections

During their recent episode, Taylor, Carlisle, and Morgan discussed Quantitative Finance and the Mantis Shrimp: Unlikely Connections, here’s an excerpt from the episode: Tobias: Tom, usually, we do veggies at the top of the hour. JT, you want to serve up some–? It’s all veggies this episode. We’re just going … Read More

Terry Smith: How to Consistently Beat the Index

In his latest interview with The Market, Terry Smith explains why Investing in high-quality companies is more important than focusing on undervalued ones. Historical data shows that even high P/E ratios, such as 281 for L’Oréal, can lead to market outperformance over time. Warren Buffett advises that owning a great … Read More

Warren Buffett: The Key Metrics for Business Evaluation

In his 1979 Berkshire Hathaway Annual Letter, Warren Buffett discussed Berkshire Hathaway’s 1979 operating performance, which was strong but slightly less impressive than in 1978, with operating earnings at 18.6% of beginning net worth. Despite a 20% increase in earnings per share, Warren Buffett cautions against focusing on this metric. … Read More

Jeremy Grantham – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E20): Tom Morgan on McGilchrist’s Hemisphere Theory and the Hero’s Journey

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Tom Morgan discuss: Quantitative Finance and the Mantis Shrimp: Unlikely Connections The Power of Weirdness: Embracing Your Unique Path Beyond Logic: Exploring the Limits of Left-Brain Thinking Navigating Digital Connection in a Disconnected World Experience Matters: … Read More

Meta Platforms Inc (META) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Meta Platforms Inc (META). Profile Meta is the world’s … Read More