In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed The El Farol Bar Problem. Here’s an excerpt from the episode: Jake: This is the kind of famous at this point, El Farol problem. E-L-F-A-R-O-L. If in case, you want to look it up yourself … Read More

One Stock Superinvestors Are Selling

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

GMO: Japan Value And Small Cap Value Stocks Are Cheap

In their latest paper titled – JAPAN VALUE An Island of Potential in a Sea of Expensive Assets, GMO explain why Japanese value and small cap value stocks are cheap. Here’s an excerpt from the paper: Japan Small Value Stocks Present a Robust Opportunity Set for Alpha Seekers Successful cost … Read More

Joel Greenblatt: Forget All The Verbiage Around Value Investing

In his latest interview on the Finance Simplified Podcast, Joel Greenblatt discusses how he simplifies his valuation process, despite all the verbiage around value investing. Here’s an excerpt from the interview: The way I look at it is… a private equity investor. Private equity firms buy entire businesses. And that’s … Read More

Investing Lessons From Scott, Scurvy & Vitamin C

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Investing Lessons From Scott, Scurvy & Vitamin C. Here’s an excerpt from the episode: Tobias: I got some veggies. So, I’m going to take away with some veggies. I think there’s an interesting lesson on … Read More

Michael Burry: Special-Issue Intelligent Investing

In his 2001 Shareholder Letter, Michael Burry discussed his “special-issue intelligent investing” strategy. Here’s an excerpt from the letter: When I stand on my special-issue “Intelligent Investor” ladder and peer out over the frenzied crowd, I see very few others doing the same. Many stocks remain overvalued, and speculative excess … Read More

Alta Fox: Creating A “Wall Of Fame” Of Ultra Successful Value Creators

In his latest Q2 2021 Market Commentary, Connor Haley explains why Alta Fox is creating a “Wall of Fame” that will include ultra-successful value creators. Here’s an excerpt from the commentary: Another common theme among our less successful investments to date has been investing alongside management teams that lacked sound … Read More

Howard Marks: Why Follow Macro Forecasters Who Don’t Disclose Their Track Records?

In his latest memo titled – Thinking About Macro, Howard Marks provides his thoughts on macro-investing, inflation, the Fed, and gold. On the subject of macro forecasters he says: That brings me to the subject of forecasters’ track records, or rather the lack thereof. Back in the 1970s, an elder … Read More

Ken Fisher Top 10 Holdings (Q2 2021)

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

Popular Factors Underperform

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Popular Factors Underperform. Here’s an excerpt from the episode: Jake: The forward PE has been the number one model for 14 years in a row as of 2019. By the way, it’s underperformed by … Read More

David Herro: Increased Volatility Is Great For Long-Term Value Investors

In his recent interview with Morningstar, David Herro discussed why increased volatility and price dislocation is great for long-term value investors. Here’s an excerpt from the interview: Herro: The competitive landscape sure has changed. Because when I look… when I first got into this business in 1986, it was mostly … Read More

Stock In Focus – TAM Stock Screener – Dicks Sporting Goods Inc (NYSE: DKS)

As part of our ongoing series here at The Acquirer’s Multiple, we provide this feature article titled ‘Stock in Focus‘ where we focus on one of the stocks from our Stock Screeners. One of the cheapest stocks in our Stock Screeners is Dicks Sporting Goods Inc (NYSE: DKS). Dick’s Sporting Goods retails … Read More

Value Investors Misunderstand Leverage

In their recent episode of the VALUE: After Hours Podcast, Taylor, Brewster, and Carlisle discussed Value Investors Misunderstand Leverage. Here’s an excerpt from the episode: Bill: I will go to my grave saying that, for now, value investors misunderstand leverage. That is one place that I think that value investors … Read More

This Week’s Best Value Investing News, Research, Podcasts 7/30/2021

This week’s best investing news: Equity Investing in Inflationary Environments (Verdad) Low Demand, Low Supply, High Price Expectations (Epsilon Theory) What Drives Bond Yields? (AQR) Druckenmiller Warns Of ‘Dire Consequences’ Of More Government Spending (video) (MSNBC) Prophets and Losses (Humble Dollar) Why Investors Can’t Kick the ‘Past Performance’ Habit (WSJ) Bill Miller: Insights from … Read More

Royce: Small Cap Quality Continues To Outperform

In his latest commentary titled – The Boring, But Timely, Case for Quality, Steve Lipper at Royce explains why small cap quality continues to outperform. Here’s an excerpt from the commentary: Encouraging investors to “buy high quality” might seem a tired, and not very useful cliché. It often carries the … Read More

Wally Weitz: It’s Not Supposed To Be Easy

In his latest commentary titled – It’s Not Supposed To Be Easy, Wally Weitz uses one of Charlie Munger’s age-old quotes to explain the current investing environment. Here’s an excerpt from the commentary: In our combined 70+ years of investing, there’s a lesson about investing that seems to repeat itself … Read More

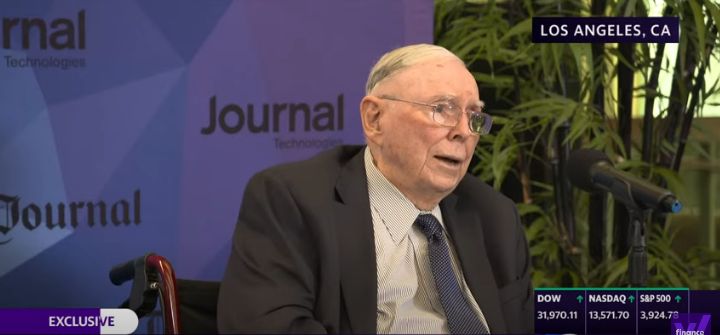

Charles Munger: The Chinese Economy Will Continue To Dominate The U.S

Earlier this year during the Daily Journal Annual Meeting, Charles Munger explained why the Chinese economy will continue to dominate the U.S economy. Here’s an excerpt from the meeting: I think the Chinese have behaved very very shrewdly in managing their economy, and they’ve gotten better results than we have … Read More

This Acquirers Multiple Stock Is Appearing In Dalio, Simons, Ainslie, Portfolios

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

VALUE: After Hours (S03 E28): Scott, Scurvy And The South Pole; El Farol Bar Problem; Misunderstood Leverage

In this episode of the VALUE: After Hours Podcast, Jake Taylor, Bill Brewster, and Tobias Carlisle chat about: Value Investors Misunderstand Leverage Investing Lessons From Scott, Scurvy & Vitamin C The El Farol Bar Problem Are You A Good Investor Because You’re Getting Results? Forward P/E Underperforms Rising Short Interest … Read More

Why Foreign Investors Perform Well In China

During his recent interview on The Acquirers Podcast with Tobias, Vivek Viswanathan, portfolio manager of the Rayliant Quantamental China Fund discussed Why Foreign Investors Perform Well In China. Here’s an excerpt from the interview: Vivek: There’s also another beautiful aspect of China which is, they have reams of data. So, regulators … Read More