This week’s best investing news:

Equity Investing in Inflationary Environments (Verdad)

Low Demand, Low Supply, High Price Expectations (Epsilon Theory)

What Drives Bond Yields? (AQR)

Druckenmiller Warns Of ‘Dire Consequences’ Of More Government Spending (video) (MSNBC)

Prophets and Losses (Humble Dollar)

Why Investors Can’t Kick the ‘Past Performance’ Habit (WSJ)

Bill Miller: Insights from 2Q Market Letter (Validea)

This Fund Delivers Big Gains Without Big Tech (Barron’s)

Wise Words from Michael Price (Novel)

It’s Not Supposed to be Easy (Weitz)

GWS Interviews Professor Jeremy Siegel (video) (Gatewood)

John Rogers: Disrupting Wall Street (video) (Rob Richardson)

Avoid making these costly mistakes (CMQ)

Inflation: Long-Term, Transitory or Reset? (Barry Ritholz)

The Boring, But Timely, Case for Quality (Royce)

When Quality Companies Face a Reckoning (Intrinsic Investing)

Markel’s Tom Gayner explains the company’s acquisition philosophy (video) (Richmond Times)

David Booth on 50 years of indexing (EB Investor)

How dividends protect income from inflation (DGI)

Jeff Bezos Is Not My Astronaut (No Mercy)

When Valuation Matters (Compound Advisors)

What’s More Powerful Than Compound Interest? (DGS)

161: China Govt vs China Big Tech, Texas Instruments, WallStreetBets, (Liberty)

Submerging Emerging Markets (Howard Lindzon)

Is value dead and if so, since when? (Klement)

What Happens When Your Competitors Quit? (Mindset)

The Unique Risks of Chinese Stocks (Prdctnomics)

Fire and Ice (Woodlock House)

The National Bureau of Economic Research Makes it Official (Brinker)

H1-2021 Wexboy Portfolio Performance…Yeah, It’s a Biggie! (Wexboy)

Market Commentaries Q2 2021

First Eagle (Seeking Alpha)

This week’s best value Investing news:

Value Investing in the Energy Transition (Causeway)

The fundamentals of value investing – “Use knowledge to reduce uncertainty” (DSGMV)

When Value and Momentum Intersect (NASDAQ)

The Softer Side of Value Investing – Ep 134 (podcast) (Intellectual Investor)

This week’s Fear & Greed Index:

Fear.

This week’s best investing podcasts:

Jim Stack On Charting A Course Through Stock Market Rapids (Felder)

TIP363: The Game of Investing w/ Bing Gordon (TIP)

The Reopening U-Turn (What Goes Up)

#116 Jeff Immelt: Leadership In A Crisis (Knowledge Project)

Andrew Lapthorne – Thematic Baskets and Strong Balance Sheets (S4E13) (Flirting with Models)

Carl Kawaja – Wisdom from Decades of Investing (Invest Like The Best)

Unveiling Shorts & Digging (Zer0es TV)

Meet with Management, It HELPS with Chris Krug, President at Chatham Harbor Capital Management (Planet MicroCap)

Niall Ferguson on Why We Study History (Conversations with Tyler)

What to Make of the Bond Markets? (Take 15)

A Deep Dive into Sector Investing with State Street’s Matt Bartolini (Excess Returns)

Private Equity Masters 6 – Doug Ostrover – Blue Owl Capital (Capital Allocators)

The Customer Isn’t Always Right (Barron’s)

Savita Subramanian (Behind The Markets)

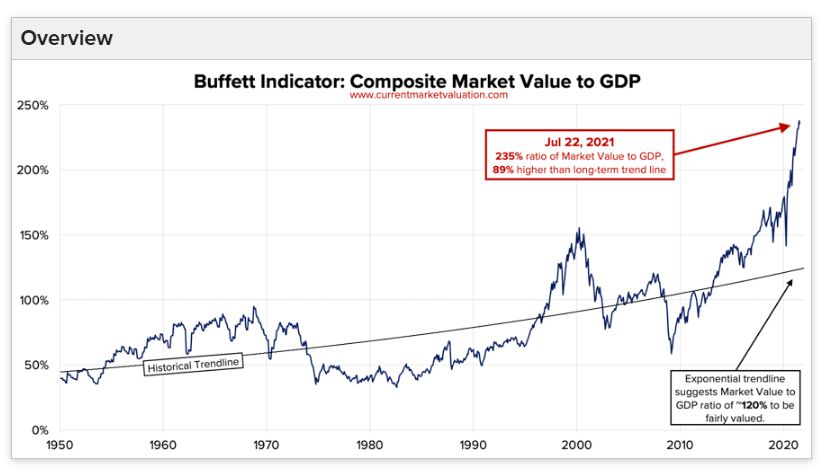

This week’s Buffett Indicator:

Strongly Overvalued.

This week’s best investing research:

The Benefits of Sin Stocks (Alpha Architect)

The Future of AI and Big Data: Three Concepts (CFA)

Technical Analysis for IPOs (All Star Charts)

What About Beta? | SPAC-a-Mole (All About Alpha)

Chart of the Month: S&P 500 Vs. GDP (PAL)

Hood Meme Stock Top (Macro Tourist)

This week’s best investing tweet:

This week’s best investing graphic:

Ranked: The Reputation of 100 Major Brands in the U.S. (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: