We’ve launched a new investment firm called Acquirers Funds® to help you put the acquirer’s multiple into action. Acquirers Funds® Our investment process begins with The Acquirer’s Multiple®, the measure used by activists and buyout firms to identify potential targets. We believe deeply undervalued, and out-of-favor stocks offer asymmetric returns, with … Read More

Procter & Gamble Co (PG) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Procter & Gamble Co (PG). Profile Since its founding … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (11/01/2024)

This week’s best investing news: Secrets of Legendary Investor Howard Marks (3 Takeaways) Jeremy Grantham – How to Spot a Market Bubble (Morningstar) Industry Is Not Destiny (Verdad) Joel Greenblatt: Legendary Investor & Author on Patience in the Investing Business (Money Maze) Finding Picassos: How Great Microcaps Become MultiBaggers (Validea) … Read More

Alpha Metallurgical Resources Inc (AMR): Is It a Buy? – Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: Alpha Metallurgical Resources Inc (AMR) Alpha Metallurgical Resources Inc is a … Read More

Finding Long-Term Winners in Packaging and Exchange Stocks

During their recent episode, Taylor, Carlisle, and George Livadis discussed Finding Long-Term Winners in Packaging and Exchange Stocks. Here’s an excerpt from the episode: Tobias: So, you don’t want to talk about individual names, but can you give us an idea of where you tend to look, what you tend … Read More

Joel Greenblatt: Great Businesses Expand Their Margin Of Safety

During his recent interview with the Money Maze Podcast, Joel Greenblatt discussed his approach to investing, emphasizing the importance of recognizing the potential for businesses to grow beyond their initial appearances. He uses Apple as an example, noting how its ecosystem added hidden value beyond hardware. Greenblatt contrasts short-term trades … Read More

Jeremy Grantham: The Paradox That Follows High P/E Markets

During his recent interview with Morningstar, Jeremy Grantham discussed the paradox of market euphoria and its aftermath. He observes that the most euphoric stock market periods—1929, 1972, the tech bubble of 2000, the 2008 financial crisis, and 2011—were followed not by strong economic growth but by some of the worst … Read More

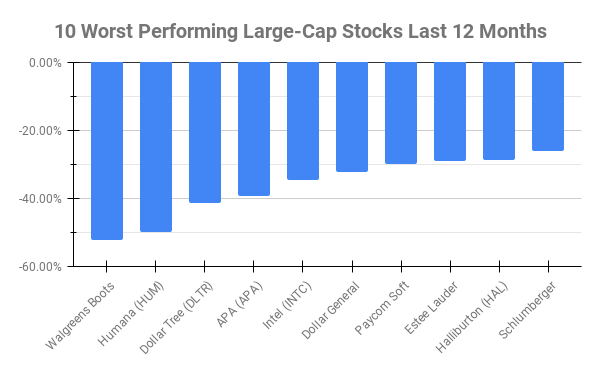

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Name 1 Year Price Returns (Daily) Walgreens Boots Alliance (WBA) -52.24% Humana (HUM) -50.00% Dollar Tree (DLTR) -41.32% APA (APA) -39.41% Intel (INTC) -34.71% Dollar … Read More

Which Superinvestors Hold Acquirer’s Multiple Stocks?

Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, … Read More

From Internet Backbone to Bankruptcy: The Cautionary Tale of Nortel

During their recent episode, Taylor, Carlisle, and George Livadis discussed From Internet Backbone to Bankruptcy: The Cautionary Tale of Nortel. Here’s an excerpt from the episode: Jake: [sighs] All right. Let’s do it. This one might actually fit in with some of the conversation about some of the bigger companies. … Read More

Dan Loeb: We See a Golden Age for Event-Driven Investing

In his recent Q3 2024 Letter, Dan Loeb discussed Third Point’s Q3 results which delivered a nearly 4% gain, achieving a 14% year-to-date return amid stronger market breadth. This was partly driven by rate-sensitive and cyclical stocks outperforming as markets anticipated the Fed’s easing cycle. Loeb notes the firm’s diversification … Read More

Bill Nygren: Value Investing In Companies Without Relying on Catalysts

During his recent interview with Behind The Balance Sheet, Bill Nygren reflects on his 40-year investment career, emphasizing the importance of both financials and management quality when selecting companies. Initially focused on buying undervalued companies with strong leadership, he later adopted a strategy aimed at finding firms that offer a … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Why Mid-Caps Offer the Sweet Spot for Investors

During their recent episode, Taylor, Carlisle, and George Livadis discussed Why Mid-Caps Offer the Sweet Spot for Investors. Here’s an excerpt from the episode: Tobias: I feel like no two periods are exactly the same. This is definitely not as memey and as bubbly as it was back then. But … Read More

Joel Greenblatt: Real Losses Are Key to Successful Investing

During his recent interview with The Money Maze Podcast, Joel Greenblatt explains that learning to invest requires real-life experience and, often, losing money. He shares that while investors sometimes profit unexpectedly due to luck, genuine lessons come from mistakes in analysis or unpredictable events, like the COVID-19 pandemic. Greenblatt advises … Read More

Howard Marks: Choosing the Right Risk Level in Investing

In his recent memo titled – Ruminating on Asset Allocation, Howard Marks argues that in an efficient market, the expected return rises proportionally with risk, meaning no position on the risk spectrum is inherently superior—all offer a similar risk-to-return ratio. This view assumes markets price assets fairly, negating the chance … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Nvidia: The Company That Sucked All the Oxygen Out of the Market

During their recent episode, Taylor, Carlisle, and George Livadis discussed Nvidia: The Company That Sucked All the Oxygen Out of the Market. Here’s an excerpt from the episode: Tobias: It must have been. Pretty clever. What about Nvidia? I don’t know much about Nvidia at all. It feels to me … Read More

David Einhorn: Warren Buffett’s Secret to Timing Markets

In his most recent Q3 2024 Letter, David Einhorn discusses Warren Buffett’s impressive ability to sidestep market downturns, a skill that has contributed significantly to his long-term success. Despite Buffett’s belief in the impossibility of timing markets, his actions—such as closing his fund in the 1960s, buying at the 1970s bottom, … Read More

Jeremy Grantham: How AI Mania Mirrors Past Market Bubbles

During his recent interview with Morningstar, Jeremy Grantham describes a unique market cycle where a classic 2021 bubble merged with the rapid rise of AI-related stocks in 2022-2023. Initially, a small group of AI-driven stocks, the “Magnificent Seven,” surged as the broader market declined, marking a concentrated gain. Grantham likens … Read More

Mohnish Pabrai – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More