We’ve launched a new investment firm called Acquirers Funds® to help you put the acquirer’s multiple into action. Acquirers Funds® Our investment process begins with The Acquirer’s Multiple®, the measure used by activists and buyout firms to identify potential targets. We believe deeply undervalued, and out-of-favor stocks offer asymmetric returns, with … Read More

Cliff Asness: Staying the Course Through Adversity

In this interview with the Finserve Podcast, Cliff Asness reflects on the challenges of investment strategies. Initially, he believed the hard part was creating a profitable, diversified process. Back tests seemed promising but weren’t always reliable. Despite adjustments, real-life results were often less impressive. Over 30 years, they’ve used half … Read More

Stanley Druckenmiller: AI Could Be Bigger Than the Internet

During his recent interview with CNBC, Stanley Druckenmiller discussed his investment success with Nvidia, which began when his young partner predicted AI’s significance over blockchain in 2022. Initially skeptical, Druckenmiller bought Nvidia, which soared with the rise of AI. Despite the stock’s meteoric rise, he sold as it hit $900 … Read More

The One Stock That Superinvestors Are Dumping: Is It Time to Sell?

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth … Read More

Beyond the Knockout Punch: Why Microcaps Struggle with Business Diversification

During their recent episode, Taylor, Carlisle, and Claremon discussed Beyond the Knockout Punch: Why Microcaps Struggle with Business Diversification, here’s an excerpt from the episode: The other place where companies struggle is what I would call small company problems. What really hurts these companies is things that like single product, … Read More

Mohnish Pabrai: A Tale of Missed Chances in Investing

During his recent interview with The Investor’s Podcast, Mohnish Pabrai discusses his passion for bridge and shares a story about an investor who shorted Berkshire Hathaway, missing out on significant gains. The investor later regretted not investing in high-yield U.S. treasuries in the early ’80s. Pabrai reflects on missed opportunities … Read More

Howard Marks: The Danger of Certainty

During their latest discussion on The Insight, Howard Marks, Armen Panossian, and David Rosenberg discuss the current market environment. Here’s the main point from Howard Marks: Uncertainty in the Current Market: Marks highlights the numerous uncertainties in the current market environment, including geopolitical tensions, climate change, economic growth, inflation, and … Read More

The Undervalued Stock That Superinvestors Are Loading Up On

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in investing gurus who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, … Read More

Why Unsexy Industrial Businesses Are Ideal for Microcap Buyouts

During their recent episode, Taylor, Carlisle, and Claremon discussed Why Unsexy Industrial Businesses Are Ideal for Microcap Buyouts, here’s an excerpt from the episode: Tobias: We’ve got about three minutes left, Ben. If you had to look into your crystal ball, what do you think will be the industry that … Read More

Warren Buffett: Charlie Munger: The Architect of Berkshire Hathaway

During the recent 2024 Berkshire Hathaway Annual Meeting, Warren Buffett recounts meeting Charlie Munger in 1959, likening it to twins reunited. While both were curious, Buffett focused on whether things worked, while Munger delved into how they worked. Munger’s understanding of electricity rivalled Edison’s; he designed and built his home … Read More

Warren Buffett: Is AI The Nuclear Genie of Our Time?

During his latest 2024 Berkshire Hathaway Annual Meeting, Warren Buffett acknowledges his lack of understanding about AI but doesn’t dismiss its significance. He compares it to the nuclear genie, once out of the bottle, impossible to control. He recalls a disturbing experience where AI convincingly mimicked him, realizing its potential … Read More

Bill Ackman – Top 10 Holdings – Latest 13F

One of the best resources for investors are the publicly available 13F-HR documents that each fund is required to submit to the SEC. These documents allow investors to track their favorite superinvestors, their fund’s current holdings, plus their new buys and sold out positions. We spend a lot of time … Read More

VALUE: After Hours (S06 E18): Ben Claremon on Devonshire Partners’ Micro Public-to-Private Equity Strat

In their latest episode of the VALUE: After Hours Podcast, Tobias Carlisle, Jake Taylor, and Ben Claremon discuss: Why Unsexy Industrial Businesses Are Ideal for Microcap Buyouts Beyond the Knockout Punch: Why Microcaps Struggle with Business Diversification Microcap Investing: Finding Diamonds in the Rough Skin in the Game: Why Microcap Buyout Investors … Read More

Berkshire Hathaway Inc (BRK.B) DCF Valuation: Is The Stock Undervalued?

As part of a new series, each week we typically conduct a DCF on one of the companies in our screens. This week we thought we’d take a look at one of the stocks that is not currently in our screens, Berkshire Hathaway Inc (BRK.B). Profile Berkshire Hathaway is a … Read More

This Week’s Best Value Investing News, Podcasts, Interviews (05/03/2024)

This week’s best investing news: David Eihorn – Greenlight Capital Letter Q1 2024 (Greenlight) François Rochon – Intelligent & Rational Long-Term Investing (TIP) The Bull Case For Commodities Is As Strong As Ever (Validea) 10 Tough Questions for Warren Buffett at Berkshire’s Annual Meeting (Barron’s) Mohnish Pabrai’s Session with MIT’s … Read More

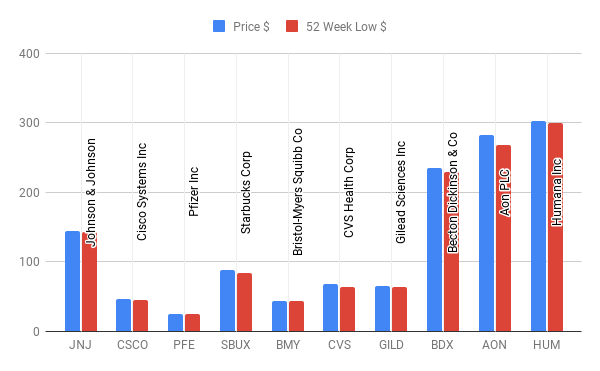

10 Big-Name Stocks Near 52-Week Lows: Are They A Buy?

Over the past twelve months a number of big named companies have been near or below their 52 week low price. Each week we’ll take a look at some of the biggest names currently close to their 52 week lows: Symbol Name Price $ 52 Week Low $ JNJ Johnson … Read More

Why TotalEnergies SE (TTE) Stock Is A Buy? Acquirer’s Multiple Stock Screener Analysis

As part of our ongoing series here at The Acquirer’s Multiple, each week we focus on one of the stocks from our Stock Screeners, and why it’s a ‘buy’ based on key fundamentals. One of the cheapest stocks in our Stock Screeners is: TotalEnergies SE (TTE) TotalEnergies is an integrated oil and gas company … Read More

The Cockroach Portfolio

During their recent episode, Taylor, Carlisle, and Buck discussed The Cockroach Portfolio, here’s an excerpt from the episode: Jason: Exactly. No lube. So, basically, my partner, Taylor Pearson and I built exactly what we wanted for ourselves and our families, and then we just opened it up to outside investors. … Read More

Terry Smith: Build a Concentrated Portfolio Or Buy The Index?

In his book Investing for Growth, Terry Smith discusses the general view that stocks outperform bonds, the reality is that most stocks do not, and the positive returns are largely concentrated in a select few. Active investors typically fail to beat both equity indices and bonds, hindered by fees, inadequate … Read More

Mohnish Pabrai: The Young Investors Edge: Spotting The Next 50 Bagger

In this interview with MIT’s Brass Rat Investments, Mohnish Pabrai explains why young people have a distinct advantage in identifying emerging trends and investment opportunities due to their proximity to cultural and technological shifts. He highlights historical examples, like the rapid decline of landlines first observed among college students and … Read More

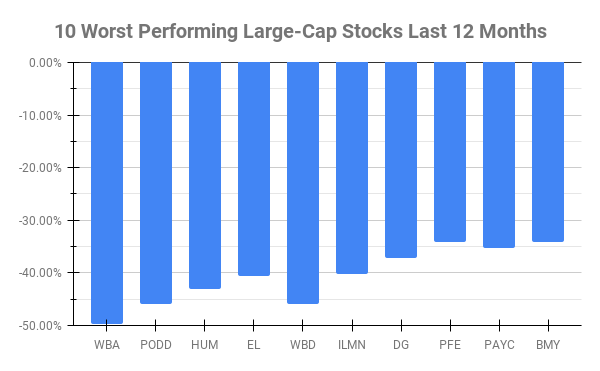

Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers Over The Past 12 Months

Over the past twelve months ten Large-Cap stocks have underperformed all others. Large-Caps are defined by $10 Billion Market Cap or more. Here’s this week’s top 10 worst performing Large-Caps in the last twelve months: Symbol Name 1 Year Price Returns (Daily) WBA Walgreens Boots Alliance Inc -49.70% PODD Insulet … Read More