This week’s best investing news:

The Future of the Free World with Jamie Dimon (Economic Club NY)

An Interview w/ Ariel Investments Founder John Rogers (Odd Lots)

Steve Cohen on How to Build Your Investing Career: Part Two (Point72)

A Conversation with Francois Rochon (Capital Compounders)

GMO Quarterly Letter | Bargain, Value Trap or Something in Between? (GMO)

‘The Mother Of All Bubbles’ Part Deux (Felder)

Christopher Bloomstran: Value, Patience, and Trust: Sharing Investment Wisdom (Talking Billions)

9 evergreen investor lessons from 2024 (TKer)

Don’t Expect a Repeat (Humble Dollar)

The Fed, the Middle Class, Bitcoin and Society with Cedric Youngelman (Havenstein)

Mall stocks are ripping right now. Here’s how nostalgia fuels our trading decisions (Sherwood)

You’re Invited to Wall Street’s Private Party. Say You’re Busy (Jason Zweig)

MiB: Dana Mattioli on Amazon’s Everything War (MiB)

No One To Blame (MicroCapClub)

The Most Hated Stocks in the World (Ben Carlson)

A critical driver of GameStop’s parabolic gains in 2021 and 2024 no longer exists (Sherwood)

This week’s best value investing news:

Investing is easy, but hard to implement? Sanjay Bakshi (ET)

Under the Radar: The Unseen Value of Price-to-Book Investing (Benzinga)

Christopher Bloomstran: Value, Patience (Talking Billions)

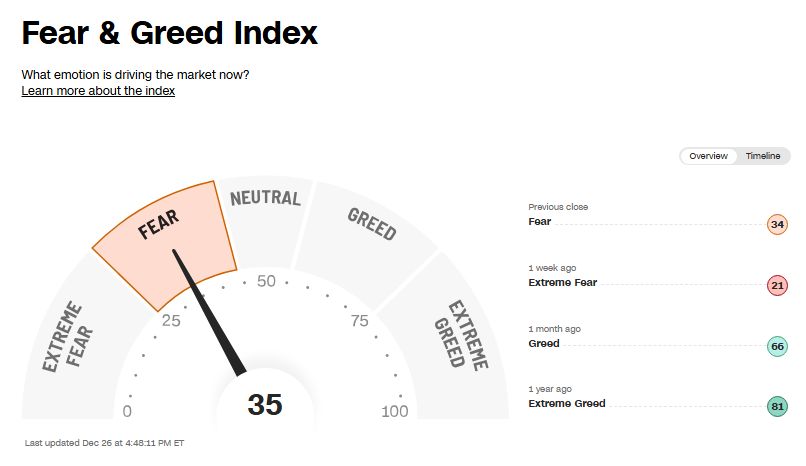

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Felix Zulauf – The Next Market Reversal Could Be Ugly! | #563 (Meb Faber)

GARRRP: Growth at a Reasonable Reasonable…Reasonable Price with Roger Fan (PlanetMicroCap)

Jared Kushner – The Mechanic (ILTB)

EP 184: The Biggest Investing Lessons Of 2024 To Take Into 2025 With Michael Batnick (Peter Lazaroff)

How the Fed’s Surprise Outlook Adds to Market Uncertainty for 2025 (Morningstar)

Elise Kennedy – Finding growth in all parts of the market (Equity Mates)

Tesla’s Next Act: Conquering AI Transport and AI Labor (Dave Lee)

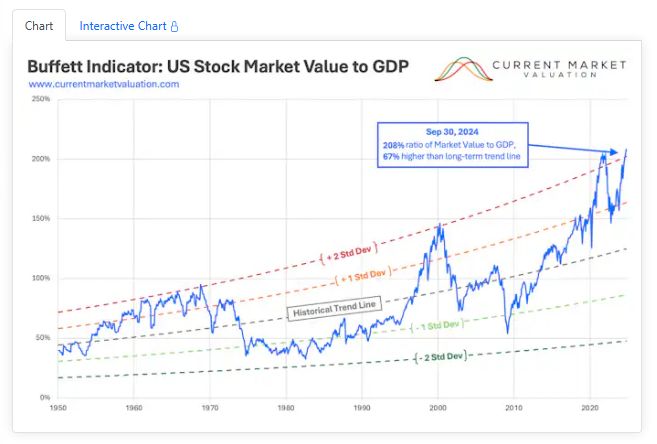

This week’s Buffett Indicator:

Strongly Overvalued

This week’s best investing research:

Do sell-side analysts say “buy” while whispering “sell”? (AlphaArchitect)

Top 10 Posts from 2024: Private Markets, Stocks for the Long Run, Cap Rates, and Howard Marks (CFA)

Market Forecasting: Chicken or the Egg? (PAL)

This week’s best investing tweet:

Apple closes at a new high and at $3.9 trillion approaches a $4 trillion market cap, 37.5x earnings. The Mag 7 are 6% LARGER than the entire S&P 500 one decade ago and equal to the entire index capitalization in March 2020. Price matters, just not today. Merry Christmas!🎄🎁…

— Christopher Bloomstran (@ChrisBloomstran) December 24, 2024

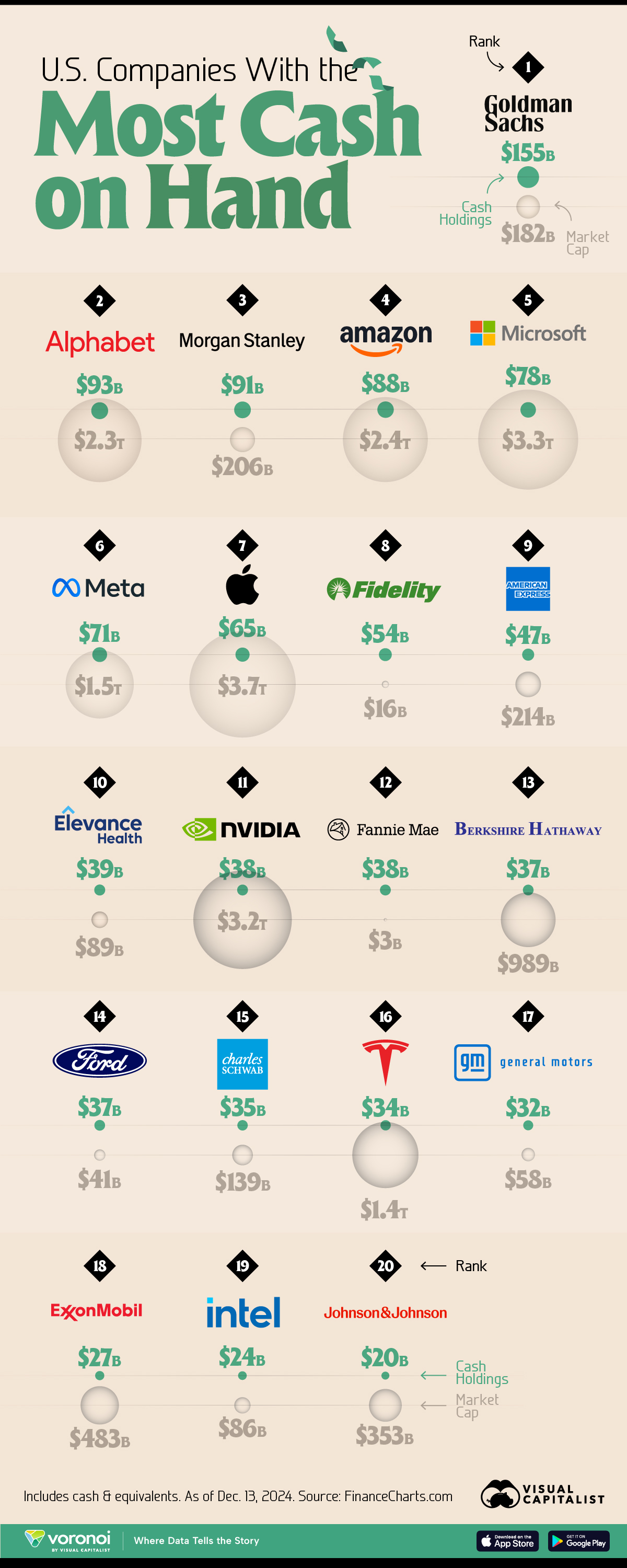

This week’s best investing graphic:

Ranked: The U.S. Companies With the Most Cash on Hand (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: