This week’s best investing news:

Ray Dalio’s five megatrends help explain what comes next (AFR)

Legendary investor Peter Lynch on stock picking (CNBC)

Wise Words from Howard Marks (Novel)

A Conversation with Kenneth C. Griffin Founder, CEO Citadel (Yale)

Lauren Templeton – Her Path in Investing, Becoming Director of Fairfax India (Guy Spier)

Jeremy Grantham Interview Rosenberg Research (RR)

Chris Bloomstran – Ark Invest, the bucket shop EFT promotional “investor,” (Treadreader)

Guy Spier – 15 Genius Things I Learned at Lunch With Warren Buffett (Yahoo)

Aswath Damodaran – Mega-cap tech valuations are not expensive relative to the rest of the market (CNBC)

Swedish Fish (Verdad)

Mason Hawkins Investment Philosophy & Strategy (SPA)

The Most Unattractive Stocks Have Looked Since 2008 (Validea)

Sam Zell – Remote work is ‘bull***t’ (Fortune)

Unwinding insane monetary policy can be painful (Rudy Havenstein)

David Rolfe – Meta Q1 earnings were a ‘tour de force’ (CNBC)

Letter #76: Frederic Arnault (2022) (A Letter A Day)

What Beat the S&P 500 Over the Past Three Decades? Doing Nothing (Morningstar)

What if? Warren E. Buffett, An Alternate History (Neckar)

More Lessons From the Do Nothing Portfolio (Morningstar)

Some Things I Think (Collab Fund)

Transcript: Brian Hamburger (Big Picture)

This Misunderstood ‘Backdoor’ Can Lead to Windfall Profits in the Stock Market (Empire Financial)

Q1 2023 Letters – (Reddit)

Pzena – The Current Opportunity In Small Caps Globally (Pzena)

Giverny Capital Q1 2023 Letter (Giverny)

Weitz Value Fund Q1 2023 Commentary (Weitz)

Royce – Why the Time Looks Right for Quality (Royce)

FPA Queens Road Small Cap Value Fund Q1 2023 Commentary (FPA)

Polen Capital Management: Focus Growth Q1 2023 Commentary (Polen)

This week’s best value Investing news:

Value investors set for a ‘stupendous decade’: Rob Arnott (AFR)

Value investing may finally be emerging from its decade-long slump (Globe & Mail)

Value, Growth & Intrinsic Investing Revisited Part II (Intrinsic Investing)

Value Investor Insight interview with Matthew Fine of Third Avenue Management (VII)

The Cult of Warren Buffett (Behavioral Value Investor)

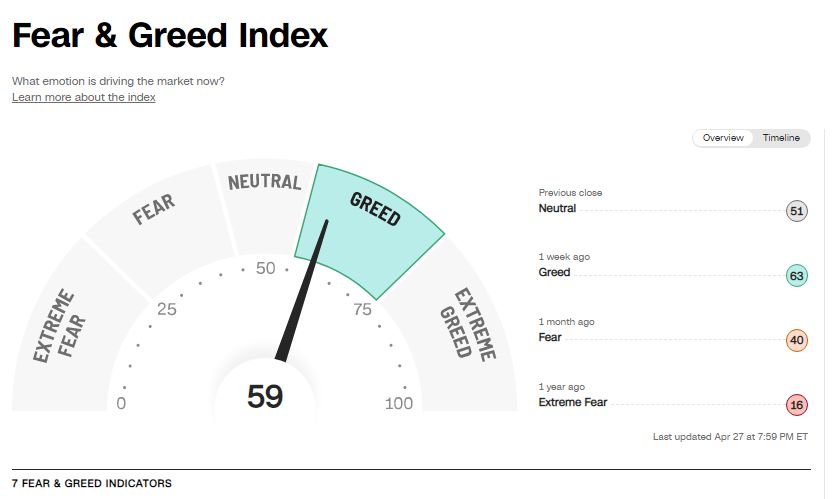

This week’s Fear & Greed Index:

This week’s best investing podcasts:

Investing Legend Peter Lynch & Media’s Talent Shakeup 04/25/23 (Squawk Pod)

TIP547: The Truth About Stock Market Forecasts (TIP)

Morris Chen on Opportunities in Commercial Real Estate Debt (Sherman)

Aaron Sack – Branded Middle Market Investing at Morgan Stanley (Capital Allocators)

Alexis Rivas – A New Blueprint for Homebuilding (ILTB)

David Rosenberg: The Bear Market Bottom Is Not In (Macro Voices)

Japanese Small Value: Opportunity Set, Constraints, Valuations (MOI)

Prof. John Y. Campbell: Financial Decisions for Long-term Investors (EP.250) (Rational Reminder)

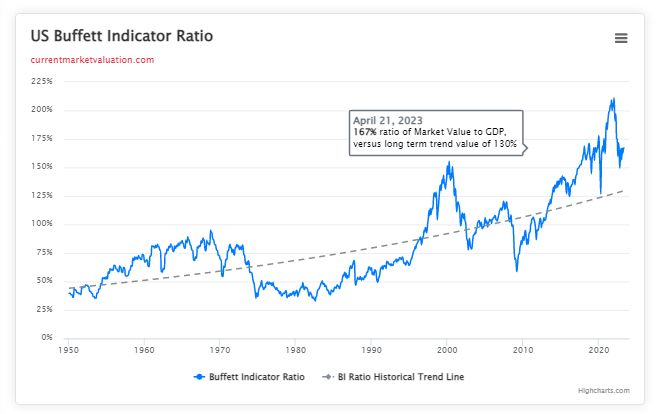

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Improving the Quality Factor by Incorporating Intangible Intensity (AlphaArchitect)

Alternative Investments: Loved, Hated, and Maybe Misunderstood. But Necessary (AllAboutAlpha)

This week’s best investing tweet:

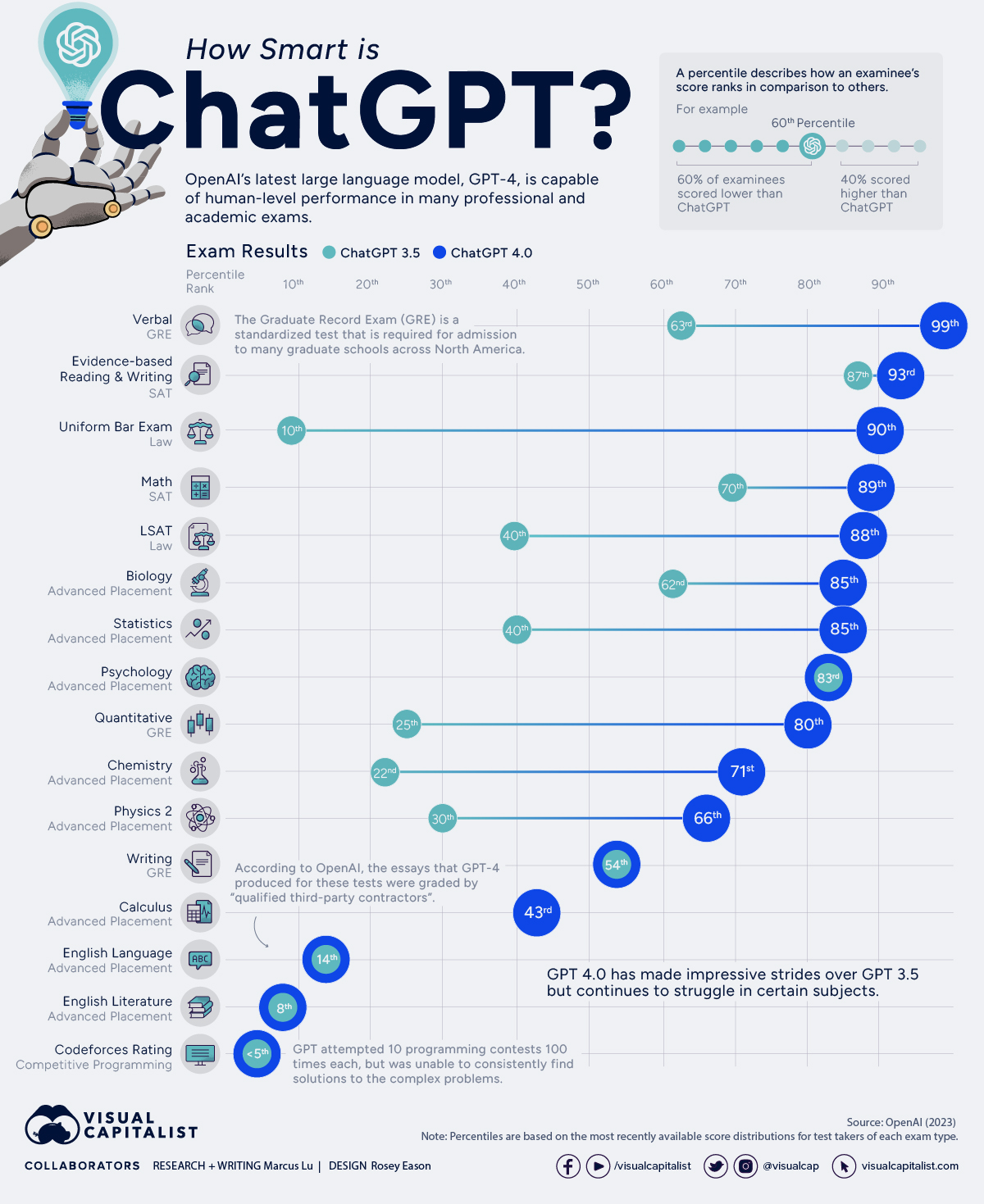

This week’s best investing graphic:

How Smart is ChatGPT? (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: