This week’s best investing news:

Berkshire Hathaway 2022 Annual Report (BH)

Greenlight’s David Einhorn says there are two types of buybacks (CNBC)

Howard Marks – Global Investment: Are We Witnessing a Sea Change? (Asia Society)

A History of Market Panics (Jamie Catherwood)

Berkshire Hathaway Q4 2022 Earnings Report (BH)

Burry Sees ‘Terrible Consequences’ From Student Loan Forgiveness (Bloomberg)

Jeremy Grantham Calls For A Market Crash, Once More (SA)

Stock-Bond Correlations (Verdad)

Bill Nygren – We try to find things priced much more attractively than the market (CNBC)

Oaktree Capital moves into leveraged buyout lending with $10bn fund (FT)

What The Growth In ‘Financial Shenanigans’ Says About The Economy (Felder)

Ray Dalio-founded hedge fund Bridgewater to cut 100 jobs in push to develop AI: report (NY Post)

Aswath Damodaran – Session 9: More on cash flows (AD)

Tom Russo – Compounding ‘the most powerful force of nature’ (Yahoo)

GMO Insights: The Many Faces of Sovereign Default (GMO)

These debt numbers are shocking: Leon Cooperman (Fox)

What You Can Learn From Warren Buffett’s Mistakes (Bloomberg)

The inflation story is really very complicated, says Greenlight Capital’s David Einhorn (CNBC)

What the NBA Can Learn From Formula 1 (Stratechery)

Why Regret and Good Investing Don’t Mix (Intrinsic Investing)

Transcript: David Layton (Big Picture)

AI R Us (Epsilon Theory)

Welcome to the 5% World, Where Yield Chases You (WSJ)

How to Avoid Financial Disasters (Barry Ritholz)

How to Win Before You Even Start Investing (Onveston)

Pzena – Fourth Quarter 2022 Highlighted Holding: PVH Corp (Pzena)

Alibaba Q3: Big-Short Michael Burry’s Long Position (SA)

Rob Arnott on The Current State of Inflation & Fed Policy (ITTW)

If the Fed wants to cause a recession, it can, says Ariel’s Charlie Bobrinskoy (CNBC)

Small-Cap Stocks Shine in Market Reversal (WSJ)

All the recessions that didn’t happen (Yahoo)

Bridgewater – The Tightening Cycle Is Approaching Stage 3: Guideposts We’re Watching (Bridgewater)

February Views from First Eagle Global Value (FEIM)

Mairs & Power’s Inside Look – Managing a Tight Labor Market (M&P)

This week’s best value Investing news:

2023 Outlook for Value Webinar (Pzena)

Why Rob Arnott Likes International Value Stocks (Bloomberg)

Value Stocks Likely to Outperform Growth in New Macro Regime (Investing.com)

Value right now is overweight cyclical in banks and energy, says Ariel’s Charlie Bobrinskoy (CNBC)

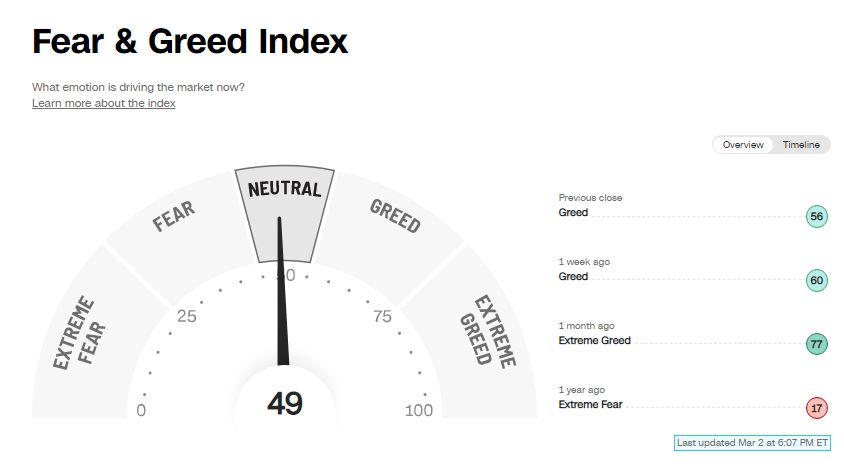

This week’s Fear & Greed Index:

This week’s best investing podcasts:

TIP528: Mastermind Q1 2023 w/ Tobias Carlisle and Hari Ramachandra (TIP)

Tom Gayer – A Discussion with Markel’s CEO (Business Brew)

Market Neutral Returns (Grant’s)

Doug Leone – Lessons from a Titan (ILTB)

#160 TKP Insights: Leadership (KP)

Show Us Your Portfolio: Corey Hoffstein (Excess Returns)

Paul Bloom on Psych, Psychology, and the Human Mind (EconTalk)

Machine learning isn’t the edge; it enhances the edge you’ve developed (FIM)

Mastering your trading psychology with Jason McIntosh (Equity Mates)

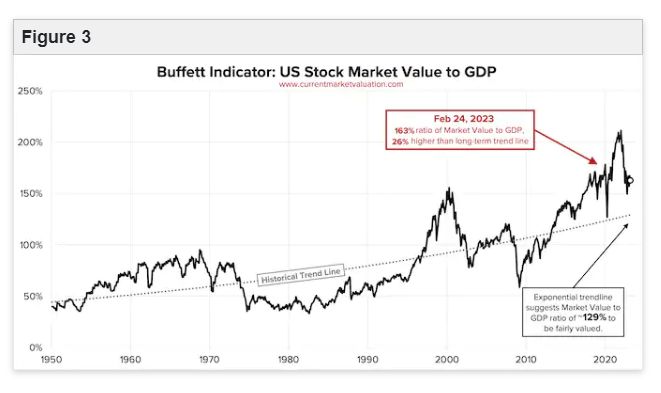

This week’s Buffett Indicator:

Fairly Valued.

This week’s best investing research:

Inside the Minds of Expected Stock Returns (Alpha Architect)

Shorting Lousy Stocks = Lousy Returns? (CFA)

Global Benchmarks Pave the Way for Rising US Yields (ASC)

ARKK vs. QQQ in the Dot.Com Bust (AAA)

This week’s best investing tweet:

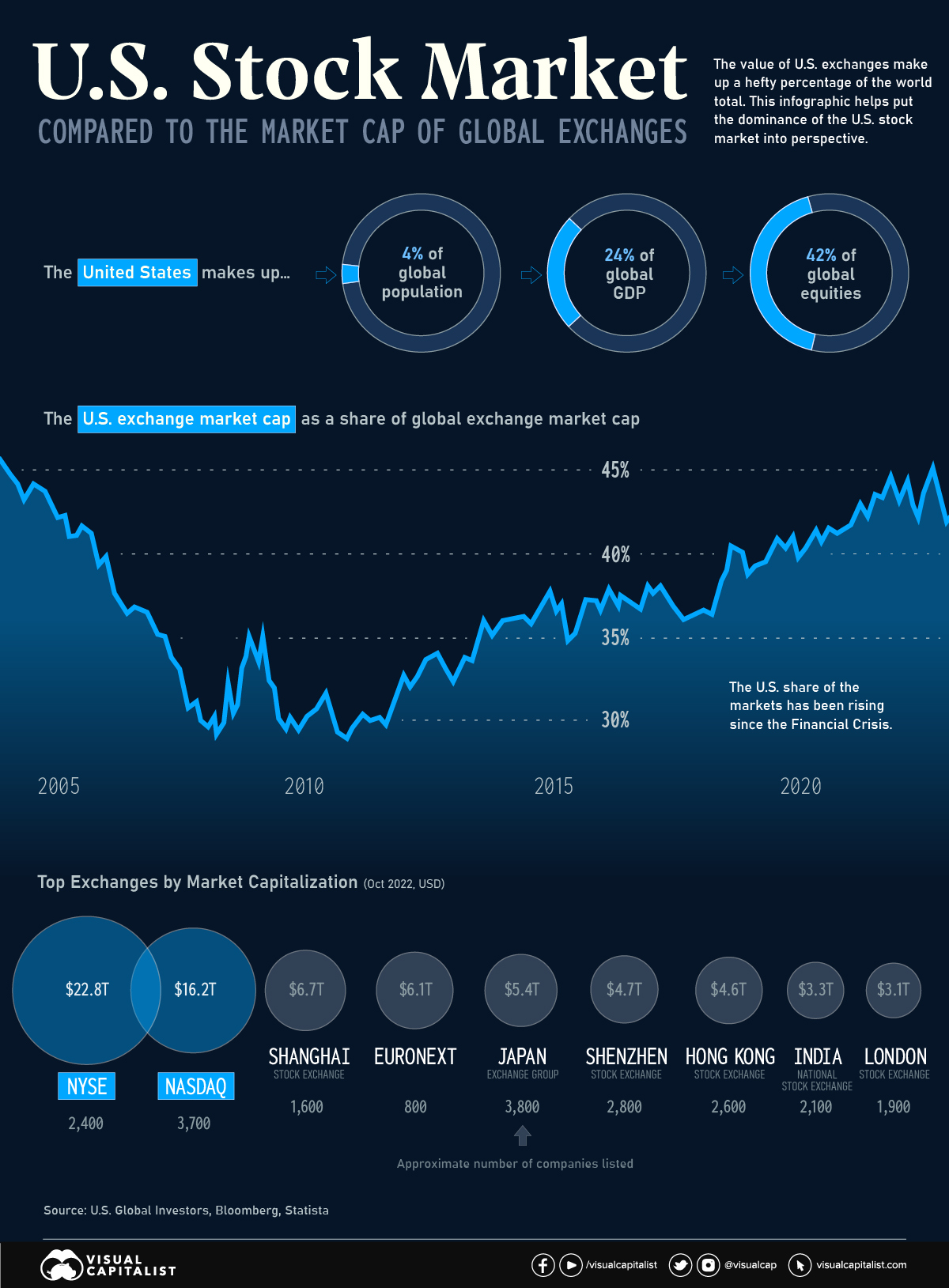

This week’s best investing graphic:

Visualizing the Global Share of U.S. Stock Markets (Visual Capitalist)

For all the latest news and podcasts, join our free newsletter here.

Don’t forget to check out our FREE Large Cap 1000 – Stock Screener, here at The Acquirer’s Multiple: